A Bright Future for Worldwide Merchant Embedded Computing Markets

The five-year forecast calls for 38% growth, driven by the industrial and communications sectors.

The electronics manufacturing market is big; global assembly of printed circuit boards exceeded $1 trillion last year. Given such a vast marketplace, there are numerous opportunities for companies to specialize in one or another technology. Embedded computing is one such technology with a great deal of promise.

The merchant embedded computing (MEC) market is a specialized market within electronics assembly. It is a dynamic industry, with advances occurring continuously, thanks to an energetic standards development effort. MEC modules and components are board-level computing systems and solutions, based on specifications controlled by a dozen or so standards organizations that have grown up along with the industry. Literally hundreds of standards – adopted or still under development – are controlling the design and manufacture of embedded applications. Also, more than 200 companies worldwide are developing and manufacturing products, with an additional 100 to 200 participating in the distribution and assembly of embedded computing boards and their components.

New Venture Research has been tracking the merchant embedding computing market for over 15 years. In our latest report, the Merchant Embedded Computing Market – 2013 Edition, we provide a historical analysis and forecasts of the embedded computing market, as well as our observations of market trends for the coming five years. Data are based on field-user surveys and interviews by industry participants, as well as our other reports related to electronics assembly. We analyze the overall market from three separate, but interrelated, perspectives:

- Applications: five application segments targeted by MEC companies.

- Bus architectures: nine categories, based on the bus architecture and form factors of embedded boards and modules.

- Board function: four functional design categories of board-level products.

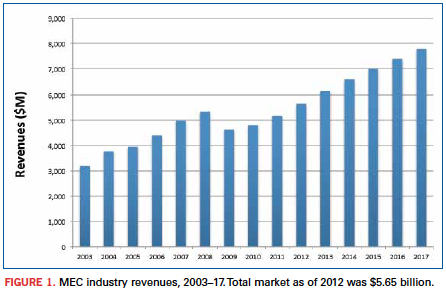

Sadly, any current analysis of today’s electronics marketplace must start with the recession of 2009 – a near-economic calamity often compared to the Great Depression of the 1930s. The recession left an indelible mark on virtually every aspect of the global economy, not least the electronics assembly markets, including the market for embedded computing. Figure 1 shows the impact of the economic downturn on the MEC industry. In 2009, there was an abrupt and significant reversal in the growth rate, as well as total revenues of the MEC market. The pain was felt in virtually every segment of the MEC market. Yet, seen from a wider perspective, the “Great Recession” was little more than a blip in a history of consistent growth by the industry. Despite the severity of the downturn, by 2012 the market had fully recovered in terms of total market size, and seemingly in momentum. Moreover, the MEC market is projected to continue growing well into the future, according to our research.

One reason for our optimism is based on the nature of the MEC industry. Thanks to the evolution of old standards into new, and more advanced ones, the manufacturers of embedded computing modules and components are constantly working at the leading-edge of technology, providing products that ultimately save customers money. Ivan Straznicky, a technical fellow at Curtiss-Wright Controls Defense Systems, a long-time player in the merchant embedded computing market, points out that today’s merchant vendors can take advantage of the opportunity of “relieving the pain of our customers.” According to Straznicky, “Whereas in the past, they would have been tempted to build these components themselves, they now come to us because we have ready-made solutions that have been developed across multiple customers and been field-proven.” This is both the benefit and the promise of embedded computing.

Positive trends. A number of market trends point toward a growing MEC market, including:

- Purchasing by large sectors of the economy has picked up for MEC products, as telecommunications companies, industrial automation companies and government (particularly in the defense industry) are spending on repairing and replacing equipment that depend on embedded computing devices. Such maintenance work all but stopped during the recession, so pent-up demand is helping drive the market.

- The transition toward digital communications, as well as skyrocketing traffic, is driving telecommunications carriers to rapidly upgrade their networks and private enterprise to increasingly move toward IP and data communications products. The MEC industry is well placed to take advantage of this transition.

- Next-generation, high-integration silicon is enabling manufacturers to design board-level systems with capabilities not possible even five or six years ago. Improvements include lower energy consumption and very high-speed serial bus interconnects, all within small form factors. Embedded computing vendors are tightly focused on leading-edge technologies and board architectures, which will place them at the forefront of emerging markets in the coming years.

Microprocessor manufacturers, particularly Intel, continue to raise the bar with ever greater integration and more powerful chips, and as Jim Renehan, director of marketing at Gainesville, GA-based Trenton Systems points out, there is a need among standards to move up the “food-chain” to provide more capability for boards and plug-in cards.

MEC vendors face competition from other electronics sectors, as well, including the electronics manufacturing services industry. (NVR tracks the EMS market in a companion report, The Worldwide Electronics Manufacturing Services Market.) Both industries depend on sales to OEMs and to government prime contractors. EMS vendors have an advantage in selling products in large numbers at low cost. Many MEC vendors, on the other hand, are small and specialized in niche markets. Their products are, by nature, customized and sold in small quantities. But the rewards in such a business model can be high, as the vendors can act quickly and build to specifications not possible by EMS competitors.

Some segments of the MEC industry have fared better than others as the market has emerged from the downturn, and in the following sections, we analyze the issues and opportunities for each of the major market sectors covered by our report.

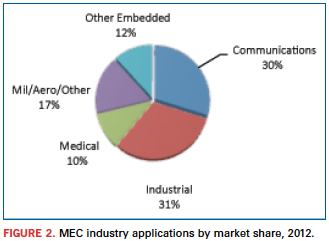

Application markets. The MEC market consists of four leading application markets – communications, industrial automation, medical, and military/aerospace – and an “other” category that includes a number of vertical markets, such as transportation, security, surveillance, point-of-sale/kiosk applications, etc.

These application markets tend to have very specific product requirements that differentiate them from one another, as well as from other electronics assembly market segments such as PCs and the general purpose embedded electronics markets. Requirements include operating in harsh environmental conditions of temperature, humidity or vibration; greater reliability and security; and specific real-time computing functionality. Hence, the market leaders, competitive forces, growth rates and size of the different application segments vary widely.

Figure 2 presents a top-level analysis of the MEC market from the point of view of the five application market segments for 2012. Prior to the industry downturn, the communications application market was the largest single market segment. However, general industrial automation applications have made a stronger comeback than has been seen in the telecommunications sector and, by 2012, had become the largest and fastest growing MEC market.

The growth of the industrial automation application market – “Big Data,” as Renehan refers to it – is at least partially a function of corporations around the world upgrading their circa-2007 systems with new energy-efficient systems. It is claimed that these new technologies can enable users to replace 10 servers with one new multicore server and permit an energy payback in fewer than 18 months. Other advances include large increases in the ability to move massive amounts of data in and out of systems, requiring interconnect speeds to grow from 1Gbps today to 10 and 40Gbps. This is good news for MEC communication suppliers, as well as industrial manufacturers.

Over the next five years, we expect this trend to continue. While the communications application market will grow at a pace equal with the overall market, industrial automation products will outpace communications, and will account for more than one-third of the total market by 2017.

Medical applications was also hit hard by the financial crisis, which slowed MEC-based purchases of large equipment considerably. Unlike other manufacturing sectors, which have begun to replace and upgrade equipment, new spending in the medical segment is still depressed, in part due to uncertainty in the US about forthcoming changes in the national healthcare system. Consequently, we do not expect this market to grow as quickly as other segments.

Military and aerospace applications suffered in much the same way as industrial automation. And it has rebounded for much the same reason. NVR expects that various challenges of providing to the mil/aero market will slow its growth rate, somewhat. Growth in this market is closely tied to politics and to the security issues facing all defense-related markets, and these challenges will impact short-term growth rates.

Even so, Michael Macpherson, vice president of strategic planning at Curtiss-Wright, points out that, overall, the global picture for this market segment looks quite healthy. Curtiss-Wright is a leading competitor in the military and aerospace market segment. From Macpherson’s point of view, the market constraints have been primarily in the US. He specifically points to the debates over the budget and sequestration as having put pressure on the “topline of the defense market.” As a consequence, there may not be quite as many of the multi-billion-dollar programs. “But we do the electronics,” Macpherson notes. “And while there may not be as many new, big programs, the fact that they are still upgrading and doing service life extension for existing platforms means they are still upgrading the electronics, and that is good for us.”

Rodger Hosking, a vice president and cofounder of Pentek, a New Jersey-based merchant embedded computing vendor that also focuses on government and military markets, agrees. One of the drivers of this market, he points out, is that government organizations are faced with maintenance costs of older systems that can be replaced by newer systems with “one tenth of the cost, one tenth the power dissipation and one hundred times the performance. So, you look at the economics, as well as the strategic advantages of some new technology, and it’s quite a simple equation for a government electronics customer to justify upgrading or replacing older equipment.”

Bus architecture markets. Market penetration by the various embedded computing bus architectures is driven as much by technology as it is by market forces. The nine bus architecture categories defined in our report are as follows:

- PCI.

- CompactPCI.

- AdvancedTCA (ATCA).

- VMEbus.

- PMC.

- AdvancedMC (AMC) and MicroTCA.

- PC/104 and its variants, plus EPIC, EBX and motherboards (ATX and ITX).

- COM and COM Express.

- Other.

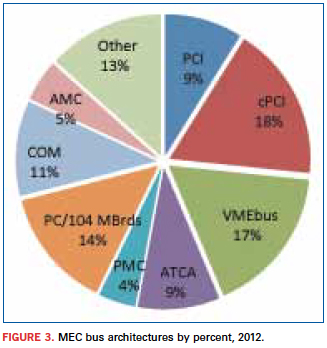

Each MEC bus architecture has a different rate of adoption depending on the needs of individual application segments. Some are older parallel-bus technologies and nearing their end-of-life, as is the case for PCI-based buses, specifically the PCI and CompactPCI architectures. CompactPCI (cPCI) has historically captured the largest share of the MEC market, but this is changing, as PCI architecture market shares are rapidly shrinking. Figure 3 shows that cPCI was the largest single bus architecture segment in 2012. NVR expects that within two years, its market share will drop below that of VMEbus – however, not necessarily owing to any great growth by the latter segment. Also, an “old” bus architecture, VMEbus standards and products have changed and adapted to the advances in technology and consequently will remain a significant product segment. Helping VMEbus products stay competitive is the fact that this architecture is specifically designed for extreme environments, a design feature that makes this an ideal product for many industrial automation applications, especially for mil/aero applications.

Yet, VMEbus will grow only more or less equally to the overall market, while the big winners for the future are products driving the industry toward higher integration in smaller form factors. This trend is reflected in the growth rates of the computer-on-module (COM) bus architecture. This technology will grow at double-digit rates between 2012 and 2017, largely because it is enabling vendors to create complete systems on a highly integrated single board. PC/104 and its variants are also small form factor architectures, but are not as trendy as COM.

Looking to the future, though, if you had to describe the most significant trend in the evolution of MEC architectures, it can be pared down to a single word: “Faster,” says Todd Wynia, VP of planning and development at Emerson Network Power Embedded Computing. “The industry has shifted from bus-based architectures to a fabric-based industry,” he says. “Instead of being the VMEbus or compactPCI of the past, it’s now Ethernet-based backplanes for architectures like ATCA or the evolution of compactPCI or VPX – all fabric-based interfaces. And the evolution of those interfaces is ever-faster.”

In keeping with that evolution, we expect to see a rapid expansion of AdvancedTCA, as well as AdvancedMC bus architectures. Both of these form factors were originally developed for telecommunications, but they have since expanded into industrial automation markets and are consequently experiencing high growth rates. AdvancedMC is particularly worth watching. The AMC specification was only adopted in 2005, yet we expect that it will capture nearly 8% of the total MEC market by 2017.

New bus structures are continuously being developed by merchant vendors. Basing their design and manufacturing on existing standards and on new specifications being developed by the standards organizations, the vendors sell a bewildering array of off-the-shelf embedded board designs to OEMs and even end-users. Moreover, most companies are willing to develop custom architectures based on existing product lines. This constant innovation serves to strengthen the MEC industry and at the same time fend off competition from EMS vendors. High volume is not necessarily the name of this game; rather it is innovation, customization and optimization that will drive the MEC market through the next decade.

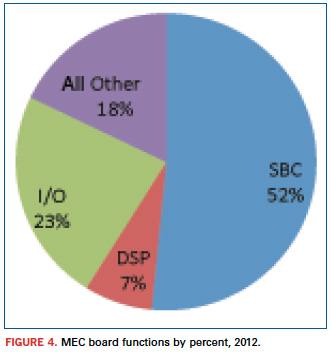

Board function markets. The MEC industry can also be categorized according to the functional design of embedded boards. NVR identifies four board function categories: single-board computers (SBCs), digital signal processor boards (DSPs), I/O boards, and other board functions. The last category incorporates a huge number of diverse and specific functions, many of which are custom designs, including switchboards, chassis, backplanes, and system integration devices. The MEC board function markets are presented in Figure 4, providing market share of each functional category for 2012.

In some applications, I/O boards are proliferating and are customized to the wide spectrum of I/O functions that different applications use. Other board functions are also proliferating, mostly owing to a growing demand for custom products. But the real story for MEC board functions is a persistent shift toward single board computers. MEC vendors are more and more integrating all of the electronic components and functionality into SBCs, creating complete systems. (This trend goes hand in hand with the growth of COM bus architecture, which is, by definition, a SBC board function.) Leading manufacturers like GE Intelligent Platforms exemplify this trend. GE considers single board computers as increasingly significant for its product line. According to Ian McMurray, speaking for the embedded computing group, SBCs are at the heart of its military/aerospace business, incorporating an extensive range of component products, including microprocessors, sensor processing systems, video processing platforms, image processing technology and highly rugged routers and switches.

Increasing integration onto the SBC platform has always been a characteristic of this market segment, and it goes hand-in-hand with the evolution of bus architecture technology. The key elements driving this trend – processors, fabrics and integration – are leading increasingly toward advanced fabric-centric architectures, such as VPX, which McMurray notes has become the architecture of choice for new military programs at GE Intelligent Platforms. Moreover, as SBCs integrate and incorporate ever more of digital signal processing, graphics and I/O functionality, the need for separate DSPs and I/O boards decreases, and leads to growing demand for single board products like the COM Express form factor. Thus, already accounting for more than half the total MEC market in 2012, NVR projects that the SBC market segment will continue to expand its market share of the total MEC market over the next five years and beyond.

Conclusions

Throughout this discussion, we have touched only lightly on the thing that gives meaning to the merchant embedded computing market: the active, dynamic standards process. Despite a bewildering array of products and designs, the products that drive the MEC market are themselves driven by relatively few organizations that bring together (sometimes fierce) competitors to work collectively to develop open specifications that help everyone – manufacturers and customers alike. From the earliest consortia – such as VITA, PCI-SIG and PICMG – to the most recent – SFF-SIG and SGeT – these organizations empower manufacturers to concentrate, not on basic form factors and connectors, but on building the best mousetrap for the application.

Significant changes are happening in the MEC marketplace and in the electronics industry in general. Along with the evolution of technologies, such as the shift from parallel to serial and from simple buses to fabric-based architectures, the standards organizations are constantly evolving their standards to keep pace. As Moore’s Law continues to be demonstrated by ever more powerful chips, applications once needing discrete chips for separate tasks are being integrated into single, more densely packed chips, and new standards specifications will make it possible to integrate those chips into embedded designs. The challenges raised by decreasing size and increasing performance cannot effectively be addressed by individual companies. It is the PICMGs, VITAs and SFF-SIGs that will help speed these trends. It is these organizations that are helping define the future of embedded computing by advancing the technologies incorporated in standards specifications.

These trends are altering the MEC board market at an accelerated pace. Not only will much of today’s separate chip functionality get subsumed into a single chip design, but also the computational power and functionality of single-board computers will skyrocket. “There are always challenges to overcome,” concludes Rodger Hosking of Pentek. “That’s what keeps us in business, and it’s what keeps the industry going. The big driver is the silicon and component technology. Everything that we are surrounded by – the electronics in our cars, mobile electronics, everything – is getting more powerful, smaller, less expensive.”

Jerry Watkins is a senior analyst with New Venture Research and author of numerous syndicated reports in the telecommunications sector and more recently in the computing and merchant embedded computing industry; info@newventureresearch.com.