Applying Lean Philosophies to Supply Chain Management in EMS

How a mid-tier EMS company used technology, philosophy and partnerships to optimize its systems while facilitating rapid growth.

The current management team took control of Firstronic in 2011. The company’s business base was primarily automotive-related. The majority of manufacturing was printed circuit board assembly-related. At the time of the acquisition, there was a single US facility with about $7 million in annual revenue.

The first step in optimizing the supply chain strategy was Leaning the customer base. Like many automotive suppliers, the company had struggled through the down cycle in 2007-2010 and in the process broadened its business focus to the point where there were nonviable accounts.

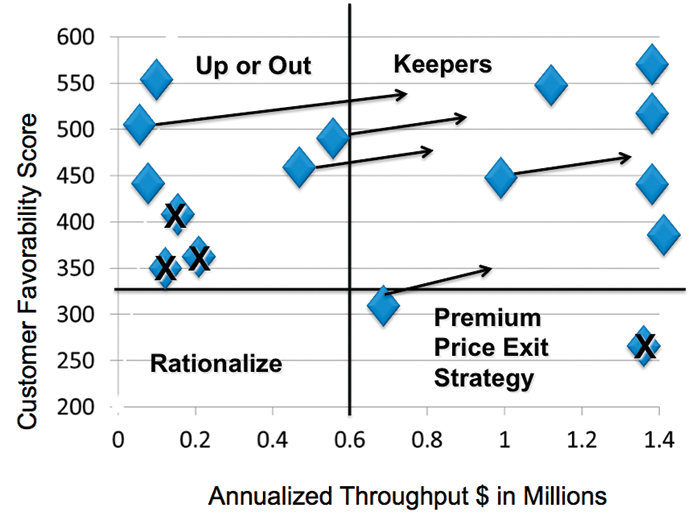

In conducting a customer rationalization strategy, the management team utilized the Boston Consulting Group matrix. Each customer was analyzed and assigned a favorability score based on the following criteria:

- Volume (500,000 units per year)

- Mix (no. of assemblies)

- Complexity (BoM line items)

- Auto placements

- Procurement challenge (end-of-life, sole source, allocation issues, etc.)

- Product lifecycle (yrs.)

- Customer’s internal PCBA capability

- TAM (revenue potential)

- Manageability (documentation, systems, logistics, internal support, etc.)

- Margin potential (throughput %).

Once scored, a Customer Rationalization Matrix (FIGURE 1) based on the BCG matrix was used to visually illustrate the rationalization strategy.

Figure 1. Customer rationalization matrix.

Customers with low revenue and a low favorability score were encouraged to transition to other suppliers. Customers with low revenue but a high favorability score were classified as “up or out.” Customers with high revenue potentials and a high favorability score were classified as keepers, and customers with high revenue and a low favorability score saw an increase in pricing as a motivation to exit.

As a result of the rationalization process, the business base went from over 20 customers and over 5,000 unique part numbers to fewer than 10 customers and fewer than 1,000 unique part numbers. This significantly reduced the complexity of the business and enabled more focus on the needs of preferred customers and targeted customers with high favorability scores.

The Supply Chain Element

The next step was rationalizing the supply base to a core of suppliers willing to align their systems to the EMS provider’s model. It should be noted customer rationalization was an important part of this. The EMS industry has a certain amount of controlled chaos. The customer favorability scoring process looks closely at the factors that can generate non-value-added activity and transactions which consume resources at both the EMS provider and suppliers. The customer rationalization process had the net effect of minimizing variability and muda (waste) from a supply chain perspective. This enabled the EMS provider to position itself as a higher value customer within its supply chain.

In terms of supply chain strategy, there was strong preference for engagements with suppliers with the same Lean mentality. The goal was to concentrate the business with a few good partners willing to work within the EMS provider’s model. The concept of being a high-value customer was important to those negotiations. In any customer-supplier relationship there is a certain amount of hidden cost associated with unnecessary activity due to poor planning. The Lean Synchronous Flow system used by the EMS provider eliminated much of that risk. Additionally, the EMS provider’s supply chain management team was willing to support each supplier’s business model by working with their sales representatives to ensure they received appropriate credit for the design wins associated with the parts that were being purchased. A strong systems alignment strategy also minimized the amount of human interaction required. In short, the supply chain management approach was to develop strong partnerships with suppliers that could see value in the well-organized approach to material sourcing, which a holistic approach to Lean generates.

Where possible, local suppliers were selected. There were several advantages to this strategy:

- Minimized transport and concomitant freight cost

- Faster response time

- Elimination of trips overseas

- Elimination of language differences and large time differences

- Ability to maintain lower inventory, which translates to higher turns and increased working capital

- Elimination of delays associated with customs and shipping

- Elimination of currency exchange fluctuation risks

- Faster project launches

- Reduced time to market

- Freeing of space for production (product transformation) activities.

Master agreements were set up to support a bonding strategy. Green, Yellow, Red (GYR) reports were set up to identify issues far enough in advance to enable resolution prior to a line-down situation. Within the GYR framework, green indicates the order is on plan; yellow indicates the order is trending out of plan and needs help, and red is an out-of-control limits situation requiring immediate attention. The GYR review causes more resources to be spent in a proactive mode, which virtually eliminates upstream surprises from causing last-minute chaos. Vendors that supply dozens or even hundreds of parts are able to pick out the handful that need to be expedited. Suppliers are expected to deliver the exact quantity, exactly when the materials organization asks for it. A red card log tracks supplier compliance and flags potential supply issues within the Kanban system. Non-cancellable/nonreturnable (NC/NR) commitments are based on component lead-time rather than the full annual quantity.

Balancing Forecast With Demand

The EMS provider’s previous materials management system focused on utilizing MRP Share with suppliers’ auto-releasing orders based on the MRP Share file. MRP represented a best guess at customer demand. When suppliers shipped in material based on that, it was not unusual to get parts that weren’t needed because something changed.

By switching to a Kanban system, material is brought in to replace material that has been consumed. As a result, working capital isn’t being wasted on parts that are either not needed or inactive.

To support this Lean approach, program management generates forecasts based on analysis of customer orders and annualized projections, plus historical demand, when available.

The EMS provider uses a two-bin Kanban system. The standard process for setting bond size is to determine part type and lead time and then calculate the average usage over the current lead-time. If the part is common bond or stock, the minimum targeted bond is four weeks. If the part is NC/2NR or unique (sole-sourced), the minimum required bond is four weeks plus one additional week for every four additional weeks of lead-time. For example, for an NC/NR part with a 12-week lead-time, the minimum bond = 4+(12-4)/4= 6 weeks. A visual card system is utilized in Materials and Production to indicate materials availability. This Available to Promise (ATP) report color codes (grades) parts as follows:

- Red = If the ATP balance is equal to zero anywhere in the lead-time window

- Yellow = if the ATP balance is less than the minimum bond within the lead-time window

- Green = if the ATP balance is within bond within the lead-time window.

Synchronous Flow Manufacturing

The EMS provider uses a synchronous flow manufacturing system, which changes from order-based on a projection (push) to order on physical action (pull). Both raw material and finished goods are driven by demand pulls. Zones and bins are sized to support downstream material flows, while upstream systems produce and deliver replenishments. There is 100% visual management of real-time status.

Under this system, when a customer order is received, parts are pulled from finished goods zones in an order that maintains first in, first out (FIFO) status. ATP GYR color codes are used in finished goods Kanban as well to trigger appropriate replenishment priority. Once the shipment is completed, the card is delivered to the master rack in front of SMT to trigger replenishment.

From a raw materials standpoint, suppliers are focused on ensuring component availability to agreed-upon bond size. If a demand variation begins to deplete the buffer faster than anticipated, suppliers have adequate lead-time to address the issue. In short, they are focused on managing exceptions versus constantly addressing expedites.

One other variation of note in the EMS provider’s approach to Lean supply chain management is that vendor-managed inventory (VMI) in in-house stores is limited. The rationale: As much floor space as possible should be dedicated to product in transformation rather than product or inventory-in-wait state. The EMS provider also has a strong preference for EDI versus forcing the supplier to use a portal. The advantage is it connects two different systems together instead of forcing the EMS provider’s system on a supplier.

The EMS provider originally developed its own integrated MRP/shop floor control system, when a previous divestiture from its parent company resulted in loss of the existing MRP system. Known as ProManage, this software automated many elements of project launch, plus material status and work-in-process tracking. At the time, there were virtually no off-the-shelf systems capable of providing the level of proactive program management support found in ProManage. In 2014, the company migrated to a service as a software (SaaS) system known as Plex Online. That system was implemented in fewer than four months, in part because the team had become “systems experts” in the process of developing ProManage. Because Plex is cloud-based, information is easily accessible by both the management team and customers 24/7 anywhere in the world.

In terms of Lean materials management support, the system is robust enough to enable only two buyers to manage more than 400 parts. It supports management visibility with a dashboard that measures:

- Revenue

- Inventory levels/turns: by customer and by program

- Warranty returns

- Labor to plan

- Purchase price variance

- On-time delivery by customer and by program

- Backlog.

Results

The EMS provider takes a holistic approach to Lean, adopting core concepts and problem-solving tools. Lean is a culture rather than a continuous improvement program, and the measure of success isn’t based on the results of continuous improvement projects presented by Lean champion. Instead, success is measured by the impact Lean practices have on overall operational results.

The management team meets monthly to review the P&L statement, balance sheet, cash flow and a list of key metrics that include material cost of sales, labor/efficiency, gross margin, purchase price variances (PPV), inventory turns, cash conversion cycle, net margin and EBITDA % on sales. The dashboard of these metrics is fully integrated within the ERP system. Goals and targets for these key metrics are based on comparisons with publicly-traded EMS providers.

From the management team’s perspective, flawless performance on metrics that customers value, such as on-time delivery, quality, efficiency and yield, should translate to strong financial performance and increases in enterprise value. Areas in which the company has achieved top performance include:

- On-time delivery: 99.6%

- Inventory turns: 12 to 14

- Gross margin: >21%

- Compound annual revenue growth rate: >50%.

From a revenue growth standpoint, the company grew from $7 million in revenue in 2011 to nearly $50 million in revenue in 2015 out of its facility in Grand Rapids.

During the same period of time, employment has increased to 180 from 45. Facilities have expanded from a single site to a wholly owned facility in Mexico and joint ventures in China, India and the Czech Republic and a global workforce exceeding 750 employees. The Lean supply chain management practices outlined above have supported these expansion efforts.

Conclusion

In the EMS industry, particularly in the sub-$50 million annualized revenue range, resources and borrowing power are limited. Materials typically represent more than 70% of unit cost. Excess inventory, unnecessary transactions and a lengthy supply chain pipeline can limit a company’s ability to invest in the technology or increased capacity needed to grow the business.

Conversely, taking a Lean approach to supply chain management reduces inventory and enables fewer workers to support a growing enterprise. Less floor space is required. Financial resources can be focused on investments, which attract additional business. Highly visible kanbans ensure the impact of demand variations on available raw material is quickly addressed.

An additional benefit of this Lean approach is the development of true supplier partners. The level of organization present in an enterprise that is holistically Lean makes a strong business case for extending those practices within the supply chain. Suppliers aren’t asked to make changes that are bad for business. Instead they are asked to support a system that is inherently more efficient. As the EMS provider they support grows, so does their business.

In this EMS provider’s case, the journey began with customer rationalization. A motto in this industry is “you can’t do good business with a bad customer.” It speaks to the point that customers that don’t fit the business model often drive consumption of non-value-added time and resources. The lesson to be learned from both a customer and EMS provider perspective is EMS providers have a difficult time being all things to all customers. The broader the business focus, the more difficult it can be to implement Lean systems. While a more focused approach may seem exclusionary, the reality is it frees “bad fit” customers to find a contractor whose model is a good fit, and it provides “good fit” customers with the responsiveness and quality that come with an efficient business model.

Embracing a holistic approach to Lean saves money, reduces overhead personnel, frees floor space, enhances throughput and improves financial metrics. The example illustrated above demonstrates how that savings can be refocused into growth momentum.

Ed.: This article was originally published in the SMTAI Proceedings, October 2015 and is reprinted here with the author’s permission.

is vice president of supply chain at Firstronic (firstronic.com); wjohnson@firstronic.com.

Press Releases

- PulseForge Makes Major Breakthrough Which Allows Flux-less Soldering in an Ambient Environment

- Panasonic Connect publishes case study on delivery of its surface mount technology (SMT) equipment to Dixon Technologies, one of India’s largest EMS companies

- CE3S and Desco Industries Announce May 2026 ANSI/ESD S20.20-2021 Certification Webinar Series

- Kurtz Ersa Goes Semiconductor: Expanding Competence in Microelectronics & Advanced Packaging