Trading Up

Could a show full of new products and a rising sun be a good omen for the industry?

We saw the sun in Munich.

For the first time in 10 years, I saw the distinct yellow rays of that giant orb in the sky break through the ubiquitous gray of the November German sky. Was it a sign? An omen? Global warming?

No, it was just good timing. But for once, scheduling the world’s largest electronics manufacturing trade show in a cold climate and on the cusp of the holiday season turned out to be a wise move.

Amid tepid expectations, Productronica turned out stronger than expected, with attendance lower than past years, but solid nonetheless. And while it clearly has become a regional (read: European) event, and several big-name suppliers opted out, and the fab side is a shell of its former self, Productronica defied gravity and the pundits to remain the mother of all trade shows.

In general, almost all the 80-plus companies we spoke to during the Nov. 10-13 show felt the corner has been turned. The capital equipment companies generally felt the bottom was last January, and reported September and October were to that point the strongest months of the year.

Across the board, the sentiment is that this year will be financially better, though there is disagreement on just how much so. Few companies reported equipment buys for capacity outside China. Perhaps more important, after a year of malaise, there is a noticeable improvement in the general outlook for 2010. The optimists far outnumbered the pessimists.

What follows are comments beyond what could be found in the company press releases leading up to the show. To review the product releases – and there were many – please visit our special web sections at http://www.circuitsassembly.com/productronica2009 and http://www.pcdandf.com/productronica2009.

Time was, Productronica was equal parts assembly and fabrication. No more. While assembly commands four-plus halls, the fab side has been reduced to a single hall. Laminate makers Isola, Arlon, Kingboard, Ventec and others were on hand, many in booths more in tune with the current market conditions and expectations for the show. Precious few machines were shown. Gone are the days when visitors could see 40 to 60 ft. plating lines in action.

David Rund, president of Taiyo America, called the show “excellent,” adding that with 80% market share in the US, Europe was the next big market for the soldermask supplier to target. He added that many attendees appeared concerned about the supply chain, and were attempting to assess their supplier’s financial viability before ordering product.

We did see a few sales made. Teknek sold a CM8 clean machine to Graphic. David Westwood will become GM of Teknek US and, with marketing manager (and wife) Jenni Westwood, will be moving to Charlotte, NC, to launch the company’s operations.

LPKF was drawing a crowd to gawk at the sharp BMW motorcycle on display, a vehicle (get it?) to highlight LPKF’s micromachining and LDS laser process that the automaker uses in a number of its products, mostly for steering control boards.

Holmüller is quickly coalescing with parent company Rena. It was a little odd not seeing Joe Kresky there, however.

Kodak rolled out Accumax, a new red-sensitive film. The company agreed that not many visitors were from outside Europe.

Staff I spoke with at Ventec, Isola and others remarked the show was smaller than in the past. Rogers added that the show was “smaller than usual, but not too bad,” estimating perhaps 20% of the attendees were from outside Europe. Interestingly, the attendees were almost all PCB manufacturers, not the OEM designers the company typically targets. John Hendricks says it could be because the visitors want to see the company’s tech support staff, and because they are now offering more high temperature products that would appeal to fabricators. The company is ending its polyimide lines because, as Hendricks said, that is “a dogfight we don’t want to be in.”

Meanwhile, Arlon was showing EP-2, its enhanced polyimide for high-speed digital applications, which features a Tg of 250°C, lower moisture absorption and lower electrical loss.

Productronica today is primarily an assembly show. The large placement companies continue to one-up each other with booths that, although toned down from previous years, still dazzled.

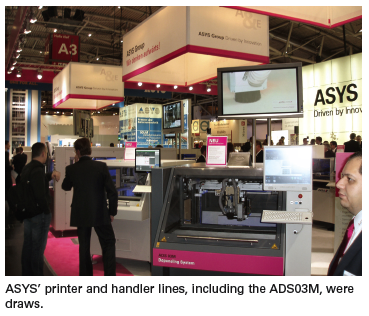

ASYS’s Markus Wilkens was among the many who observed the lack of attendees from Asia, although he saw several buyers from Brazil and a few from US and Mexico. The company showed the upgraded ADS automated depaneling system. It also increased the speed on its X3 printer.

Henkel Electronics global marketing manager Doug Dixon noted plenty of industry blowback to proposed legislation over so-called conflict metals (tin and other ores mined in the Congo). The industry, under the auspices of the IPC Solder Products Value Council, is readying a response. Henkel was showing a series of new die attach and Pb-free pastes.

Balver-Zinn launched the Aquasol water-soluble flux paste. Aimed at US market, it is in beta and is said to handle all alloys. Also new: a VOC flux (3960RX). The company also is working on a new no-clean paste, which will come in SnPb and Pb-free versions for pin-in-paste applications. Conductive adhesives remain on the company’s roadmap, but next up are low-VOC fluxes for Asia.

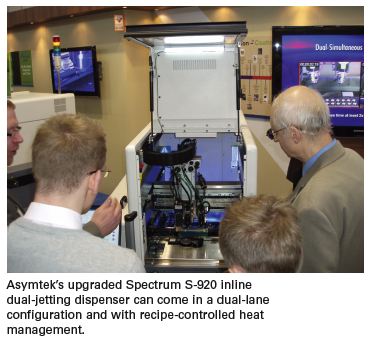

Asymtek typically has several new offerings and this year did not disappoint. The firm has upgraded the Spectrum S-920, an inline dual-jetting dispenser aimed at cellphone boards; the SC400, for jetting conformal coating; and the DispenseMate, a batch-style tabletop dispenser for UV-curable materials.

Vice president of sales Greg Wood noted business is improving and the company “can see the ice starting to melt.” Meanwhile, Asymtek parent

Nordson has hit $1 billion in overall sales and now is pushing its corporate identity on top of all the brands, a move that is being met with mixed reviews among the show attendees we spoke with.

Juki’s Heinz Schlup showed the KE-3020RL flexible mounter now in beta and due out this year. The dual head machine uses 25% less power than previous models and is rated at 17,100 cph per IPC-9850. “While the placement equipment market fell by 80% in 2009, it looks like the worst is behind us,” said Jurg Schuepbach, president of Juki Europe. However, he cautioned, large companies are not yet investing, and most won’t do so for another 12 months.

Fuji’s Scott Wischhoffer proudly displayed the NXTII placement machine, which comes with dual placement heads, one of which can be replaced with an inspection head. That head holds a single camera with three light systems, and is for higher reliability product, like pacemakers, where traceability is desired. The company will have two new machines at Apex.

Assembléon announced the integration of its pick-and-place machine interfaces into Valor’s software products. The enhanced machine interfaces now are available for Valor’s process engineering tool vPlan on Assembléon’s A-, M- and X-Series machines. The firms expect to expand the relationship to Valor’s MES tools. The company also said its rep deal with Yamaha remains intact.

Separately, Valor also exhibited DynaMix, its fully integrated MES software. The company reiterated that it will maintain its distribution and rep channel after the company’s acquisition by Mentor goes through.

Siemens’ CEO Guenter Lauber noted that business picked up in the June and July timeframe, primarily in China. Most sales are for replacement machines, although some orders have been for increased capacity, he said.

Europlacer displayed its xpii placement machine. The single- or dual-head machine features linear motors, front and rear feeders, and trolley-style or fixed bases. It can handle up to 92 feeders and places part sizes of 01005 to 50 x 50 mm.

Rehm said vapor phase machines have been outselling the general reflow market. With automotive still lead-heavy, the company feels there is plenty of room to grow. COO Marc Dalderup cited a slow improvement in business, adding 2010 could be up 10-30% from 2009.

Seho showed the PowerSelective selective soldering machine, with dual pots to facilitate changeover time. Christian Ott said the company is “completely loaded” through year-end and called the business outlook good.

KIC is pushing solutions to reduce energy use in ovens. The company has a new shield for real-time profiling of inline vapor phase machines.

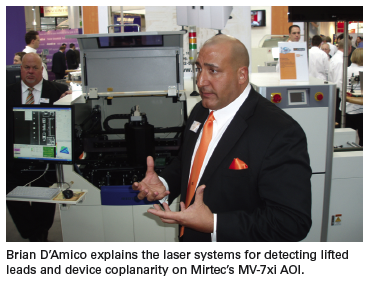

Mirtec is adding laser systems to its AOI line to enhance coplanarity and improve paste measurement capability. The company reported 100% growth in 2009.

Koh Young is growing. It has added two engineers in Ireland and now claims a 35% market share in SPI worldwide. It sold its first Aspire 3-D AOI to a consumer electronics OEM in Europe, and reported a second sale was about to close with a US customer.

A somewhat new face in the field was Opro Vision, which took over Orbotech’s assembly inspection business in 2009. With the machines, it brought on several ex Orbotech staffers, including Arnon Tuval as president. It now has 19 staff, half in development, half in support. Production takes place in Italy, some by third parties. Since the buyout, Opro Vision has developed a new tabletop AOI.

Viscom was among those noting a “big” increase in sales in October. Visitors were most interested in the company’s X7056 combination AOI/AXI.

TechCon Systems’ global sales and marketing manager Brian Glass held modest expectations for the show, but said the traffic and quality of leads matched those of two years ago.

Electrolube introduced some 13 products, most of which were non-VOC flavors of conformal coatings. Customer demand is driving its push into that technology, marketing manager Karen Harrison said.

Humiseal now offers gel versions of all its coatings. It has opened a manufacturing 100,000 sq. ft., fully automated facility in Pittsburgh, PA, and noted business has been picking up since May.

Overheard

We encountered several familiar faces on the show floor. One was Keith Favre, the former Electrovert, Speedline and PhotoStencil executive, who has launched his own rep business, FHP LLC (fhpreps.com).

Ovation Products founder (and Grid-Lok inventor) Charlie Moncavage supposedly is working on a new, cheaper board support system.

R&D Technical Services sold a third vapor phase rework machine to IBM.

Mike Buetow is editor-in-chief of Circuits Assembly (circuitsassembly.com); mbuetow@upmediagroup.com.