Sales, Orders and Production Growth Drive Continuing Industry Health and Optimism

Since IPC launched the quarterly Pulse of the Electronics Industry survey in mid-2017, respondents’ quarterly sales growth has been positive in each of the past eight quarters.

The 145 respondents to the second-quarter 2019 survey projected average sales growth of 7.4% this quarter.

The current state of the industry is solidly positive on balance. Of the key factors that are measured to assess the current state, sales and order growth are the strongest positive drivers of the current business environment in all regions, industry segments and company size tiers. Labor and material costs and recruiting challenges have been the primary negative influences on the business environment.

In the regional segmentation of responses on the current state, global businesses report the strongest current-state indicators in aggregate, followed by businesses in the Americas and then in Europe. Only the Asia Pacific region averaged a negative current-state score this quarter, which was heavily driven by rising labor costs.

Profit margins are a positive influence on the current environment this quarter for all industry segments except materials suppliers. Margins are moving in a positive direction for all company size tiers, especially those representing companies with annual sales of more than $100 million. A regional segmentation shows, however, that weakening profit margins are among the factors negatively affecting the current business environment for the reporting companies in Asia and Europe.

The industry’s outlook for the next six months is solidly positive overall, driven primarily by expected growth in sales, production, markets and capital investment. All indicators factored into the six-month business outlook are positive drivers in all regions, with the exception of exports. Exports this quarter were rated as moving in a negative direction in Asia and neutral in Europe, reflecting the current trade disputes and new tariffs. The export rating was strongest for the global businesses. Overall this quarter, global businesses gave the strongest ratings to the factors affecting the outlook for the next six months.

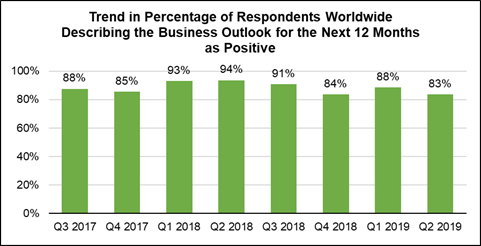

The industry’s outlook for the next 12 months is equally robust overall, with 83 percent of second-quarter 2019 survey respondents describing the 12-month business outlook as positive. The outlook is solidly positive in all regions, although for the past two quarters the outlook of respondents in Asia has been the weakest of the regions. The outlook is strong in all industry segments, most particularly for OEMs.

Sharon Starr is director, market research at IPC.

Register now for PCB West, the leading conference and exhibition for printed circuit board design! Coming Sept. 9-12 to the Santa Clara Convention Center. pcbwest.com

Press Releases

- 11th Class of Engineering Interns Begins Forging Success at Hyrel

- Rocka Solutions Announces 2026 Rockin’ Roundtable: An Interactive Discussion on What Really Drives SMT Printing Performance

- SEHO Visits CERN: Working Together for Fundamental Research

- ViTrox Appoints Juan Alfaro as Mexico Sales and Support Manager