Features Articles

Just like housing, a little extra size can cost a lot more.

Printed circuit boards in panel or array format increase the efficiency of the assembly operation, especially in volume applications. Takt time is greatly reduced, and handling of product is easier. However, rising material prices are cutting into that advantage because more material is required to produce those arrays.

PCB costs are based on the amount of raw material required to make a particular board. The metal finish, like ENIG or silver, plays a part in pricing, but it is the amount of fiberglass and copper needed that really determines the final cost.

The quoted price for most boards in panel or array format is based on a fabricator's desired panel price for a particular technology or quantity, divided by the number of arrays (or pieces) that fit on a standard 18 x 24" manufacturing panel. The more arrays or pieces that fit on the panel, the lower the cost.

Whether that price is dictated by the number of boards (arrays) that can fit on the standard manufacturing panel, or by the total square inches of the finished array, a quarter or half-inch too long in one direction may mean a double-digit price difference.

The PCB East keynoter gives a roundup of innovative technologies to come out of the pandemic.

The PCB East keynoter gives a roundup of innovative technologies to come out of the pandemic.

We have gone where no mask has gone before! The Printed Circuit Engineering Association (PCEA) held its first regional conference and exhibition in Marlborough, MA, in April.

A resurrected PCB East drew attendees from as far as the West Coast and Florida. There is nothing like in-person contact. The social aspect of networking has been missing for far too long. The enthusiasm of the attendees bodes well for future face-to-face regional gatherings.

It was great to see so many old friends in the real world, while meeting new young engineers and entrepreneurs such as Yitzi Ehrenberg and David Kanarfogel of Conformant, who have developed a new additive circuit process based on an innovative CVD system.

IPC and retired industry legend Dr. Laura Turbini joined many notable attendees, including Dr. Hayao Nakahara, Anaya Vardya, John Vaughan, Chrys Shea and Peter Bigelow, president of the SMTA Boston Chapter.

The many design and engineering programs conducted during the three-day meeting and exhibition by such experts as Susy Webb, Rick Hartley and Steph Chavez brought attendees up to date.

In step with the expanding revolution of 3-D printing offering the ability to create previously unimaginable structures by the precision dispensing of a variety of conducting and insulating materials, Dr. Jaim Nulman of the AME Academy stirred our imaginations with a two-hour introduction to 3-D additive manufactured electronics.

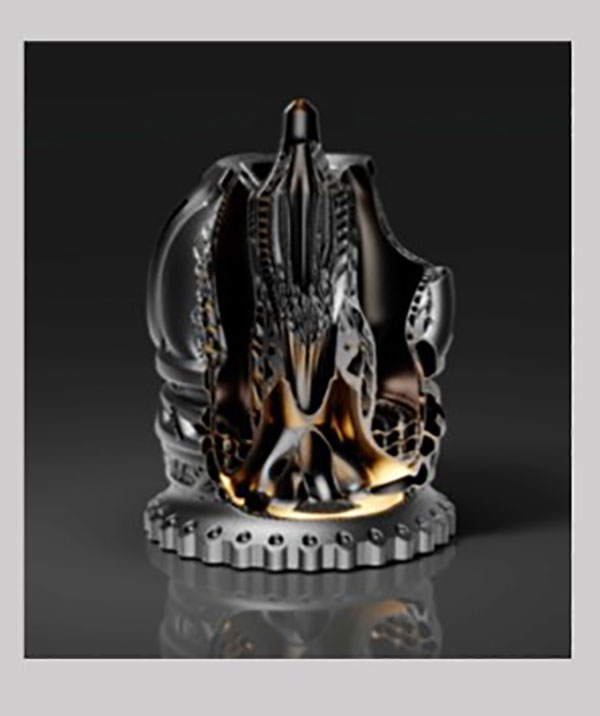

During my keynote “From Possibility to Reality,” I discussed new and emerging technologies from Israel, Germany, the US and Japan. The image of a rocket spike created by Hyperganics’ algorithmic engineering platform that used AI to design and print the complex part amazed a full lecture hall. The detailed combustion chambers, which can only be created by software, ensure it doesn’t overheat.

The theme was Covid Class Creations: products and processes developed, improved, modified and introduced during the pandemic. A number of new products under advanced development or on the verge of commercialization not yet seen in the marketplace were presented.

This aerospike rocket engine was engineered in Hyperganic Core using advanced software algorithms and has never seen a single piece of manual CAD. It’s likely the most complex additive manufactured part ever produced; it broke all conventional workflows. The part could not previously be designed, let alone built. It is said to be about 20% more efficient than previous bell-shaped parts.

Luminovo’s rapidly growing software suite for PCB design and manufacture, not yet available in the US, drew a lot of attention. Among its features is one that can calculate and predict design violations. It also calculates supply chain risk assessments.

Averatek’s A-SAP process (semi-subtractive process, or SSP, by some) allows the design and fabrication of 25µm lines and spaces, illustrated by a part produced at American Standard Circuits, as was Rogers’ new resin for 3-D additive manufacturing (by spray) that resulted in printable and plateable parts.

Atotech’s new electroless – yes, I said electroless, not immersion – tin process was intriguing! The process did not dissolve copper from the base plated, is not dependent on its position in the periodic table in reference to the metal(s) – usually copper – and did not stop depositing when the base was sealed. Therefore, no dissolved copper contaminates the solution. The company also introduced a new oxide replacement for MLB manufacture, which left a smoother surface for HF and VHF needs.

As we contemplate new materials for 5G and 6G applications, Isola introduced hybrid laminates, combining PPE with outer layers on FR-4, as well as other combinations. The company also provided data on its new green materials.

Nano Dimension provided information on the progress of its activities to make 3-D ink-jetted printed circuit structures containing passive components, 75µm lines and spaces, and 45° pad-less interconnects between levels with its most recent DragonFly IV system.

PulseForge’s use of photonics to replace IR or laser for soldering permits soldering to curved or flexible surfaces, soldering to PET or paper (e.g., LEDs to flexible substrates), reel-to-reel and soldering batteries to substrates for single-use medical devices. The use of photonics can be used to cure protective coatings or sinter metallic pastes – all in seconds with 75% less power than IR. The company illustrated its activities to develop cycles for BGA assembly. The photonic soldering process reportedly provides fewer voids in SAC alloy joints than conventional thermal processes.

The author (right) greets attendees following his keynote at PCB East in April.

IO-Tech, winner of recent innovation awards at Productronica and Lopec, introduced its unique patented laser system for application of precisely and rapidly depositing type 6 solder spots with resolution of 100µm in diameter and 25µm (or finer) pitch – faster than dispensing 2,000 droplets. I predict fabricators will be challenged to make substrates that take full advantage of this system’s capabilities! Die bonding is another potential application for this system, as deposits are extremely flat. (Roughness is <5µm.) It can print on components for multiple chip stack applications. And, for this application, the system is said to be faster than dispensing 10,000 droplets.

This is only the beginning of a new age in the design and manufacture of electronic packages. It’s difficult to see how the chip shortage problem will be resolved in the near future, as the world’s supply chains are experiencing new disruptions due to the conflicts in Europe. It is also too soon to know how or if active components will be part of the future of additively built constructions.

In the interim, we’ll continue to see more consolidation. There will be more vertical integration. Partnering and cooperation, perhaps even system or facility sharing, will increase.

Even when supply chain issues are resolved, we still need to build new infrastructures for the new designs promulgated by so many new innovations. Then we will need new standards and new tests to determine quality.

Stay tuned! Better yet, join the parade and march forward with your contributions to the developing world of electronic design, manufacture and packaging.

is a business and technical consultant dba Weiner International Associates, serving the specialty chemical and electronics industries. His clients have included several Fortune 100 companies. His executive experience includes president of New England Laminates; vice president of sales and marketing of Dynachem, and director at Wong’s Kong King International; gene@weiner-intl.com.

Firstronic and Lacroix took a long-term approach to joining forces, eliminating the usual learning curve.

As a 40-year veteran of the electronics manufacturing services industry, I’ve seen my share of EMS mergers and acquisitions from both sides of the equation. The basic EMS industry business model adds complexity to that equation not found in most industries because EMS companies are an extension of their customers’ manufacturing operations or, in some cases, their entire manufacturing operation. If a larger conglomerate acquires the company that manufactures your dish soap, you won’t notice unless the product’s effectiveness or branding changes dramatically. If your EMS provider is acquired, it’s obvious on day one.

In many transactions, the only consideration of impact to an EMS company’s customer base is visits to key customers during the due diligence phase to enable the acquiring entity to assess whether the business levels they anticipate are likely to continue in the new entity. The alignment of EMS brand/differentiating processes and facility redundancy are often minor considerations.

Shipping, Covid-19 and inflation challenges rival supply chain issues when securing capital equipment.

When I made my 2022 capital investment plan, I never thought it would be my 2023 capital investment plan. However, with a couple minor exceptions, equipment will be put in service during 2023, not this year as originally planned.

I thought I was the exception, but in conversations with colleagues, I realize I am the current norm. A trio of events had the combined impact of making what should be simple investments in machinery and equipment anything but.

The most talked about, problematic event has been the strained supply chain. I am not sure exactly how much of the problem getting machinery and equipment is directly attributable to the supply chain, but it has indeed had an impact. When obtaining lead-time quotations, availability of parts, chips, etc., are always the culprit cited for the long length of time to build the equipment, whether a complex custom-built item or simply a copier for the office.

That is only half the story, however. Shipping times to get equipment from location of origin to your facility are also taking significantly longer than before. It doesn’t matter if the machine is shipped from Asia, Europe or North America, or if the delivery is foreign or domestic; availability of planes, trains or container ships is as stretched as the supply chain of parts. Events taking place in Ukraine are exacerbating availability of raw materials, parts and shipping options.

Navigating the Covid world has also had its impact on the ability – and especially speed – to select what machinery and capital equipment to purchase. When compiling a capital budget, it is easy to say you need a drill, image, press or pick-and-place machine, but doing the due diligence to select the correct machine is something quite different. Historically one could attend trade shows, visit sites, see the equipment in action and run test jobs to see the results – all activities most efficiently handled by in-person visits to possibly multiple locations. In the Covid world of Zoom, WebEx, etc., doing the necessary due diligence required to select the best piece of equipment and then get approval to invest considerable sums in capital equipment has become much more challenging and a far lengthier process.

In particular, a process to select, prove out, and negotiate the purchase of a piece of equipment that in the past might have taken weeks now takes up to a year – and that is before pulling the trigger to commence the order. Companies that once let an equipment supplier and potential customer in to see a piece of equipment and run samples now may not allow visitors. Capital equipment manufacturers may have sold the demo equipment normally available for running tests. Equipment manufacturers’ sales and demo staffs may be working remotely – with no equipment available – and limited access to their factory to conduct sales demonstrations. Altogether, unless you are buying a duplicate of what you already have, the selection and due-diligence process rivals the supply chain issues, consuming valuable time in the equipment selection and procurement process.

The final challenge is inflation, which is relatively new but may become significant. With demand so high for all sorts of industrial and consumer items, and with the supply chain in such a strained state, the cost of components, raw materials and, therefore, the finished product is escalating at rates not seen for decades. When budgeting a capital expenditure, and completing the (long) process of selection and due diligence, finding out the cost is five to 10% or more higher may necessitate rethinking the equipment or timing of the investment. For any purchased capital investment via a loan, lease or line of credit, rising interest rates inflate the total cost of investment.

As much as inflation has impacted prices of new equipment, it pales in comparison to the impact inflation has had on the used equipment market. With lead times for new equipment stretched so far, a premium is now paid for readily available used equipment in good condition. In fact, it has been reported some used equipment is selling for more than it costs new. The lack of availability of new equipment, coupled with long lead times for new machines, is compounding the effect of inflation. As supply chain difficulties continue, inflation may become the biggest challenge in planning specific capital investments and preparing a capital budget.

So, regrettably, I am looking good for putting 2023 capital investments in service, but not so for 2022. I guess it’s time to plan for 2024 … or maybe even 2025.

The time to squeeze out more efficiency is when everything is in spec.

What kind of approach do you generally take? Do you follow the “if it ain’t broke, don’t fix it” mantra, or are you more the “it’s good, but it could be better” type? In electronics manufacturing, continuous improvement is often discussed, but how much does your organization adhere to this philosophy when the shop floor is humming and everything is within spec? This is when process engineers should try to squeeze out even more efficiency.

Certainly, there is urgency around a process that is not running as it should. However, when all the lights on the line are green, there is likely opportunity for more improvement than you realize. Consider challenging the process through the lenses of incremental cost reduction and quality enhancement.

In the stencil printing process, there are several possible avenues for lowering cost and raising quality, even when everything is within spec:

Cost down. The first and most obvious area for resource optimization is understencil cleaning. This sub-process of stencil printing has several costs associated with its operation, including time (output reduction) and a fixed cost (fabric and solvent consumables) for every clean. A majority of print platform suppliers ship equipment with relatively liberal default settings for fabric advance (how much is used for each clean) and solvent volume. This is based on assumptions a manufacturer may be cleaning a very dirty stencil with numerous apertures across the entire length of the fabric, so high debris removal must be accommodated. In essence, the defaults are set for worst-case scenarios, as is fairly standard practice. Optimizing these settings based on specific process conditions has the potential to reduce waste through streamlined consumables delivery.

A self-proclaimed “visionary” doesn’t always understand the true meaning of partnership.

In a perfect world, there would be truth in advertising.

It would be jaw-dropping to hear a politician say:

“My statements yesterday regarding the ignorance of voters on the issues of the day were not taken out of context. I meant every word I said, down to the last comma, semicolon and exclamation point, and I stand by them. Many of you don’t even know what a semicolon is, much less how to use it. What’s more, exploiting that gift of voters’ ignorance has propelled my political career and enhanced my electoral viability. Systems are meant for gaming, and I’m seizing the moment my schooling and ambition has set for me. Here in the land where preparation meets opportunity, mine eyes have seen the glory. God Bless America!”

Or to hear a certain classism laid bare with this frank preschool prospectus: