Features Articles

Using Lean Six Sigma to balance the increasing cost of solder.

While the death of through-hole technology has been predicted for decades, the reality is some applications have components that require a level of solder joint robustness that only through-hole technology can deliver. In low- and medium-volume operations, the cost-effectiveness of soldering those mixed-technology printed circuit board assemblies using a selective solder machine is an easy calculation because it may eliminate the cost of operating a wave solder machine. However, operations doing high-volume assembly of predominantly through-hole PCBAs may find determining the cost-effectiveness of selective solder is more challenging since their wave solder machines operate continuously. In those cases, the question becomes: What is the point at which use of wave soldering becomes inefficient when the percentage of through-hole components on printed circuit board assemblies drops?

The cost of solder, along with other material and production costs, is increasing globally. While these cost increases are unavoidable, implementing efficiency improvements can help balance these costs by reducing the amount of solder needed and eliminating solder dross.

Industry colleagues reunite after two years for in-person lunches with a side of unrestrained conversation.

I meet a certain friend periodically for lunch. I value his company and conversation. Time with him is never dull. He runs an EMS firm, also never dull. His work provides daily material for stories. He tells those stories well. Sometimes I’m privileged to hear them at our lunches. Talk flows with an easy and relaxed familiarity, a kind of relief. Sometimes the food gets cold. No matter.

Our discussions are more urgent now because the pandemic preempted our lunches for two years. We have a lot of pent-up opinions to catalogue and classify. Add to that winter’s natural chill, which enforces a certain introspection. Two years is a long time to accumulate vent-worthy prejudices. Like a trusted confidante, our resumed midday dialogue is most welcome – and good therapy.

These exchanges with my friend take place in a bullshit-free zone. No topic is sacred. No opinion is off-limits. Salesmanship and posturing are implicitly discouraged. Aside from the standard business-related talk, we risk diverting into politics, history, science, philosophy, religion, child-raising, youthful folly, renewed inflation, government, taxes, hiring difficulties – whatever suits us at that moment.

He has many opinions, as you would expect of an EMS CEO. Sometimes I don’t agree with them, but that’s okay because sometimes he doesn’t agree with me. Those sincere, but always respectful, differences are what make our luncheons so refreshing, interesting and educational. And now, long anticipated. There are no hidden agendas. It’s amazing what one can learn when keeping an open mind and not trying to pitch something. Perhaps an unheralded benefit of the pandemic is the stripping away of many pretensions. Life’s too short, as has been made crystal clear these past 24 months.

So many things have changed. We compare notes in our customary judgmental way. Items that may have seemed important only two short years ago no longer seem to matter. So many things have also stayed the same. People can still be obtuse, stupid, unthinking and intolerant. Colleagues can still be greedy, controlling, inconsiderate and intimidating. All this can be accomplished while social distancing and being fully vaccinated and boosted. Some use the pandemic as cover for bad behavior, masking moves they intended to make anyway. Covid simply furnished a readymade pretext.

Our discussions make use of a newly expanded vocabulary. Think of the neologisms we’ve learned: supply chain; spike protein; herd immunity; viral load; mRNA vaccines. We’re all amateur epidemiologists now with an expanded lexicon of excuses when things don’t go to plan: Los Angeles Harbor; Donbas/Ukraine; Xinjiang; reshoring.

We’ve aged at an accelerated rate. Commitments are now hedged. Everything is qualified and tentative. My friend and I note the prevalence of more nuanced language – after normal was redefined.

“If all goes well…”

“If everything arrives on time…”

“If everybody stays healthy…”

“If nobody gets sick…”

“If the flight isn’t cancelled…”

“If the shipment isn’t held up…”

“If the test is negative…”

If.

Many might add, “God willing.”

Most understand the qualifiers. Understanding is often a function of age, although it is risky to generalize. We all know wise millennials and aged fools. The minute you generalize is the instant you are proved wrong, and you have the lesson of oversimplification and snap judgment thrown back in your face. The story of my life. (It keeps me humble.) But the fact remains, in my experience – and that of my lunch companion – most opt to muddle through rather than make a scene of futile protest. Mercifully, neither of us has experienced debates about masking adjudicated with fistfights yet.

What exactly have we learned? Are we smarter and wiser, or warier from the experience? My friend and I wrestle with that one. Lunch does indeed grow cold. The conversation gets hot.

Our discussion turns to communication skills among colleagues and coworkers. One unsung skill that pays dividends is the ability to ascertain and describe a situation, so it is comprehensible to a third party. That seems obvious enough. The surprising truth is many can’t do it, or do it badly, resulting in much time expended, reexplaining the original problem to the intended recipient. We lament the hours lost rectifying misunderstandings that never should have happened, due to a basic lack of clarity in stating the issue.

Breaking down problems into easily digestible bites (or bytes) is a gift, a real advantage for those who have it. Communicating those bites (or bytes) to interested laypersons so they understand and can act on them is a sublime gift. An articulate engineer who can distill a technical challenge to its simplest terms for nontechnical laypersons, such as buyers or managers, who can effortlessly switch between those laypersons and technical peers, is golden. And almost impossible to find.

Equally scarce are those whose radiological skills can clearly describe the content of an x-ray image to an engineer. The recipient doesn’t always know – or admit to knowing – what it is they are looking at.

The same goes elsewhere in companies for HR or accounting problems. Misinformation about 401(k) policies or charts of accounts can drive comprehension off the rails, leading to more time wasted. Once derailed, it’s hard for the recipient to mentally regain proper course. Just as with articulate engineers, plain-speaking HR specialists and literarily astute bookkeepers and accountants are in short supply, and doubtless not floating off the California coast waiting to be unloaded in bulk. Plug-and-play candidates to fill open positions are becoming an endangered species. We both agree we need to devote more time to training our own.

Communicating problems in easily digestible bites is a gift.

Our discussion turns to the private equity boom. My friend tested positive for private equity, as his firm has been acquired twice in the past four years. No known cure. He hopes the side effects are long-term, and he can cash out at an opportune time and move on to the next challenge, or maybe no challenge at all. (Ain’t capitalism grand?) Whether his company is more competitive as a result is an open question that only time will answer. Whether his employees will remain employed as the debts mount and the spreadsheets are deployed to justify the metrics is another. (Their feelings about the transactions were not available at press time.) One senses a reaction akin to a Russian conscript confronted with the imminent prospect of a Ukrainian winter sightseeing tour: high risk, abundant stress, with plenty of question marks about the future.

My turn. I describe with some exasperation the junior investment bankers and family office acquisition companies that leave friendly voicemails or emails about twice monthly, reminding me of my actuarial status through their queries about our company’s future ownership. So solicitous. A favorite approach comes from ex-military officers. Like this:

I’m a West Point graduate and former Blackhawk helicopter pilot interested in buying a business in the PCBA testing and inspection services industry with $5 million to $20 million in annual sales. The other day, I came across your company and am reaching out to learn more.

I can offer a distinct transition opportunity for you as someone who will appreciate the hard work you've put into the business, take care of the valued members of your team, and build upon what you've established. As a company commander in the Army, I always placed the mission and my people first – and that’s exactly what I’d do with your company.

Hmm. A Blackhawk raid on a delinquent account for past-due receivables would leave an indelible impression. Distinct transition opportunity indeed.

Or this:

I hope December is off to a great start for you and the team at Dataset (sic). I'm reaching out today because I’m an experienced operations leader looking to acquire and grow a (sic) electrical and electronic manufacturing company. If you’ve ever considered handing over the reins and taking some chips off the table (i.e., selling some or all of Dataset), I would love to discuss the opportunity to carry on your legacy.

As a prior naval officer with years of operational leadership experience, I have a commitment to service and am passionate about a company’s mission and employees. I work with a core group of investors experienced in acquiring and growing high-performing companies like Dataset, and I am committed to working with the experienced management team you have put in place.

If you're interested in discussing your options, please let me know some times over the next week that work for a quick call. I understand this can be a sensitive topic, so please know I will maintain strict confidentiality in our discussions.

Lieutenant, now hear this! December was off to a great start until we received your email.

“Operational Leadership Experience” begins with knowing the correct spelling of the target company. It’s D-A-T-E-S-T. Please direct your service and commitment to doing your homework. Speling is @ sensitif topik.

For those who embrace pacifism, or at least a less “regimented” approach, there’s this:

I'm following up on a letter I sent you last week that discussed my serious interest in your business and whether you've considered transitioning ownership of your company. If so, I would very much appreciate the opportunity to further discuss a potential option with you.

As I mentioned in my letter, I founded my company with the intention of acquiring and operating a business in the testing and inspection industry, and I'm particularly interested in your company. If this sounds like an option you're interested in discussing, and you (generally) meet the criteria listed in my previous email and attachment, please contact me using this email address or the phone number below. I've also attached a brochure that further explains my background.

As with many, this pitch reads like a rich kid with family money looking to either fill his idle time or fulfill the thesis requirement for his MBA graduation project.

The pickup line is often some variation of the same theme: I’ve often wanted to get into the testing business and run a testing company on my own... Like they’ve been lying awake at night all their life, harboring this elusive Test Engineering Dream, and now it’s within their third-party-funded grasp.

Interestingly, the prospective acquirers are all male. In all the years of receiving such inquiries, I have yet to receive a single proposal from a female aspirant. Take from that what you will. As my companion does.

We part ways, content in being back together, sharing knowledge and swapping stories about our dysfunctional, yet thriving, industry, and reimagining the New Normal. The more things change....

is president of Datest Corp. (datest.com); rboguski@datest.com. His column runs bimonthly.

Register now for PCB East, the largest electronics technical conference and exhibition on the East Coast. Coming in April to Marlboro, MA.

The metaverse offers opportunity for escapism and empowerment.

Market research published last summer suggests the total AR/VR market will top $700 billion by 2025, suggesting a compound annual growth rate close to 75%. Those are amazing statistics, although we know investment in virtual and augmented reality has surged during the pandemic. Spending on VR has increased, particularly among consumers constrained to stay at home for extended periods. They have time, and they’re bored. But professional applications are also expanding quickly in marketing, retail, healthcare and manufacturing.

As a concept, AR/VR is closely connected with another emerging phenomenon: the metaverse. The distinction between the two is quite blurred. The metaverse is perhaps best envisioned as an alternative reality whose scope extends throughout the entire internet and into the real world. Although there will be elements of virtual reality, and a VR headset will provide one means of entering the metaverse, the big tech giants are thinking much bigger. Facebook’s parent company has even changed its name to Meta, a clear expression of its ambitions.

We can expect this alternative reality to start becoming accessible through gaming and entertainment applications. People will exist and move around as avatars, go to shops, attend concerts. The chance to style our appearance and create our own reality is a fantastic opportunity for escapism. And who could blame anyone seeking an escape from the real real world?

Important opportunities exist to improve our working lives, however, as well as the quality of services such as healthcare and emergency first response. With the benefit of instant access to building records through the internet, police or firefighters can capture information about the layout, occupants and fire-escape routes within their field of view to preserve their own safety and provide more effective support to those inside.

FIGURE 1. Expect VR headsets to use flex circuits and IMS to reduce size and improve thermal management.

The opportunities to enhance mental well-being are perhaps even more profound, particularly in the aftermath of the pandemic. The numbers of people suffering from anxiety-related disorders such as agoraphobia are expected to have increased. Those already suffering, having been compelled to stay indoors for extended periods, will likely have experienced setbacks in their battle. The metaverse could greatly expand the prospects for treatment by providing a controlled environment for a patient to enter, move around in, and deal with challenges that are carefully designed to help build confidence.

In a similar vein, metaverse technology can have a democratizing effect on formerly specialized areas of research, like sports performance. Elite sportspeople are known to employ visualization to prepare mentally for high-pressure events. Rehearsing their responses helps fine-tune performance and strengthen the self-control to achieve their ultimate goal. The desire for outstanding achievement is common, yet few can get the right help to use visualization effectively. The metaverse can provide a suitable environment to try it out, with the aid of online courses delivered by your own personal coaching avatar.

Of course, much depends on the availability of suitable software to create these environments and challenges. The scale of the internet can come to the rescue here, enabling facilities to be made available on a similar basis to today’s mobile apps: Visit your metaverse store for low-cost or even free apps, possibly monetized on a subscription basis or through in-app purchases.

Then there is the question of hardware. Apple is reportedly working on a VR headset that is expected to be extremely lightweight – less than one pound, with later models weighing even less. Of course, headset weight is a key metric for any VR application to avoid discomfort. Weight is even more important in the metaverse, however, where users will expect to be comfortable for extended periods.

Numerous challenges must be overcome when packaging high-computing performance into a wearable form factor. Effective thermal management, of course, is extremely important and a huge challenge. In addition to lightweight for comfort, designers will be under pressure to create attractive designs people will want to wear. We can expect creative solutions, particularly using shaped, insulated metal substrates.

On the other hand, the supply of space-saving technologies like flexible printed circuit (FPC) will experience increased pressure. The automotive sector is already placing a huge demand for FPCs, as vehicle electrification continues to rise. It is reckoned future electric vehicles could contain more than 100 circuits on FPCs.

We can also look forward to exciting developments in sensors for contextual awareness. Leading MEMS sensors are already integrating small, embedded machine-learning cores that enable smarter functionality and faster response than their predecessors. Sensing techniques also are undergoing a significant change with the advent of sophisticated depth-sensing based on infrared time-of-flight measurements. These enable much faster and more energy-efficient 3-D perception than conventional imaging techniques. The sum of all these parts could deliver compact, stylish, low-power and comfortable wearables that enable us to exist quite naturally in the metaverse.

As this concept evolves, I am sure the most successful applications will be those that enhance our connections with each other. I would compare it with the original Facebook, which overpowered competitors and predecessors simply by offering more and better ways for people to interact, in real-time and through various groups, to share as many aspects of their lives and interests as they wish.

No doubt escapism and entertainment will be the main priorities for a sizeable number of metaverse users, but I see many opportunities to help people improve their well-being, achieve ambitious personal goals, and enhance working experiences. It does have great potential to make the real world a better place.

is technology ambassador at Ventec International Group (ventec-group.com); alun.morgan@ventec-europe.com.

The primary purpose of surface finishes is to prevent oxidation of the copper prior to soldering components.

Back when I held a soldering iron, we used a mixture of tin (63%) and lead (37%) for the solder (Sn63). The boards had the same coating on the plated holes and surface-mount pads. The application for surface mount is referred to as hot air solder leveling (HASL) and applies to any of the available solder types. The beauty of Sn63 is it has a lower melting point and is eutectic. “Eutectic” means the metal solidifies rapidly over a short temperature range. The benefit is fewer disturbed solder joints and good “wetting,” where the surface finish and the solder form a cohesive bond for a reliable connection. You can still buy Sn63 off the shelf at the local electronics store.

On the other hand, lead is a dangerous metal that can cause birth defects and other health issues. The Europeans took the vanguard with the RoHS initiative. If you want to sell electronics products to consumers, the lead content must be the minimum possible – not eliminated entirely but found primarily as a trace element within chips.

SAC (Sn-Ag-Cu): a heroic alloy. Metallurgists all over the world looked for replacement formulas. Tin is still viable and is generally mixed with small amounts of silver and other elements such as antimony, copper or bismuth. Tin makes up the bulk of the alloy, typically around 95% to 99.3%. If pure tin was used, the results could be problematic. Tin whiskers from dendritic growth present a shorting risk.

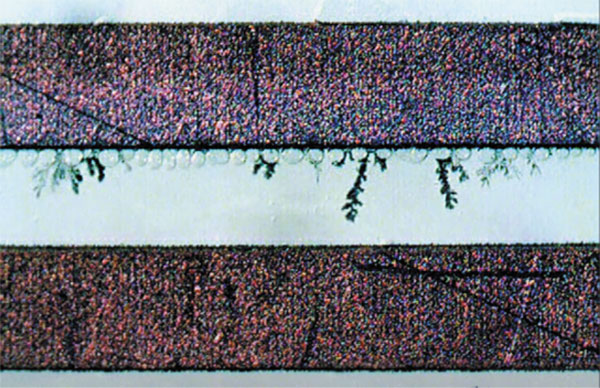

FIGURE 1. Pure, non-alloyed metals exhibit crystalline growth as the metal forms branches over time. Environmental conditions can aggravate the process. (Source: NTS Corp.)

Without lead, tin has a much higher melting point and does not solidify as quickly. The double-complication requires a dielectric material that can withstand the higher temperatures without breaking down.

The maximum working temperature of the material is one of the primary selling points. It is known as the glass transition (Tg) temperature. The materials we used in the old days did not stand up to the process, so the entire PCB material set had to be seriously upgraded. Going lead-free raised the reflow temperatures considerably. Boards and components alike have gone green since then.

Exemptions exist where tin-lead is still allowed. Spacecrafts that will eventually burn up on reentry are one such exemption. The goal of RoHS is to reduce the amount of lead that goes into the landfill. Provided the company can certify all its products will be returned to the factory for proper disposal, Sn63 coatings on the PCB are permissible. Obviously, consumer products do not get such an exemption.

ENIG: the gold standard. While tin-silver plating is still viable, the “gold standard” is gold. The mainstream alloy is immersion gold over electroless nickel over copper, or ENIG for short. The reason this is a preferred plating is the downstream process of assembly is more boring without the likelihood of tin whiskers. We like it to be boring when it comes to making goods. Those who study S-parameters also have a fondness for the consistency of ENIG finishes.

This plating is primarily aimed at high-density interconnect fabricators. The process can yield a solderable footprint with via-in-pad situations. Fine-pitch BGAs and other shrunken circuits require microvias. Plating with ENIG will likely improve yields due to the land patterns coming out flatter than with other types of plating. It’s also a go-to finish for flex circuits. It plays well with solder mask, making a good base for the following layer.

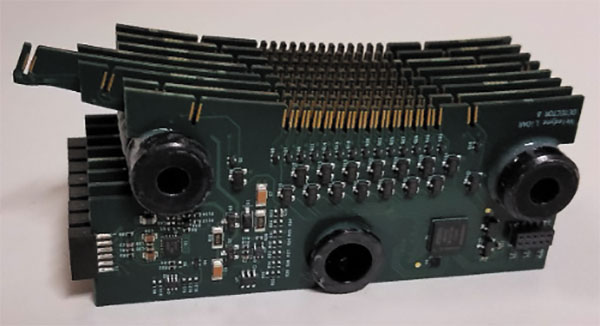

FIGURE 2. ENIG finish with through-hole vias and surface-mount components.

A note on “black pad”: This process defect was a hot topic for a few years. That time has passed. The fabricators worked out the right amount of phosphorus in the nickel to prevent the defect that was more than a cosmetic issue. That concern was laid to rest.

ENIPIG: not too hard, not too soft. Electroless nickel, immersion palladium, immersion gold adds palladium as a physical barrier between nickel and gold. That opens up the process. The main benefit to ENIPIG is the outer layer of gold is soft enough to be a good candidate for wire bonding, while still working well for soldering. The alternative for chip-on-board is a selective soft gold finish: the do-everything finish.

When selecting the correct finish, know the constraints. While ENIPIG has an upcharge, it’s not as expensive as soft gold or hard gold when used in combination with medium gold. Note medium hardness is geared for solderability, while hard gold creates a more durable contact surface for “gold finger” edge connectors. To meet the specification for HDMI, the gold fingers must withstand 10,000 insertion/extraction cycles.

OSP: a minimalist approach. Organic solderability protectant is a very thin coating consumed by the reflow process. In the factory, we had to be aware of the date codes on boards with OSP. You don’t want old boards with this coating.

During design, when reaching back to padstack definitions, the designer must coordinate something extra when using OSP. We had to include a paste stencil opening on our test points when the boards had OSP, or the test points would end up with bare copper. The exposed copper will tarnish over time. None of the other finishes have this requirement.

An IPC specification for OSP (IPC-4555) is on the horizon. Per a report on this publication’s website in August 2020, “The goal is to develop performance specifications for high-temperature OSPs, defined as capable of withstanding up to two IR reflows in conjunction with tin-silver-copper (SAC) or tin-bismuth (SnBi) alloys at a peak temperature of 245°-250°C and showing the same wetting balance results at three reflows as zero, with a maximum 20% drop.”

This is good news since OSP is well-suited to mass production runs. The micro-thin coating does not hinder solderability. The cost is low, along with the shelf-life. Organic solderability protectant has been around for quite some time with proprietary processes, so it will be beneficial to have a performance standard across the board.

is a career PCB designer experienced in military, telecom, consumer hardware and, lately, the automotive industry. Originally, he was an RF specialist but is compelled to flip the bit now and then to fill the need for high-speed digital design. He enjoys playing bass and racing bikes when he's not writing about or performing PCB layout. His column is produced by Cadence Design Systems and runs monthly.

A board’s level of technology should dictate how often to expect imperfections.

One of the most common questions I get from PCB buyers is, “How many X-outs are acceptable?” Some might say receipt of a PCB manufacturing panel or array with any X-outs indicates the supplier cannot maintain a high level of quality.

This is not necessarily the case.

An X-out occurs when a defective board in an array or manufacturing panel of like PCBs has been shipped. The board is literally marked with an X in permanent marker to signify it is flawed.

While a panel or array with zero X-outs is ideal, the board’s level of technology should dictate how often to expect this kind of perfection. If the board is a single-, double- or easy four-layer item, then a PCB buyer should expect – in fact, should demand – the manufacturer deliver panels free of defective boards.

However, if it is a higher technology – such as an HDI design – scrap will happen in every manufacturing lot. To expect otherwise is not realistic.

Any experienced PCB supplier knows this custom-made item – requiring more than 100 different manufacturing processes – will have a board (or boards) with some sort of rejectable imperfection in every manufacturing lot released to the floor. To address this issue, before the board order hits the production floor, the fabricator will release an overage, depending on the board’s technology, to ensure its manufacturing processes yield the number of boards required to fulfill an order.

The more high-tech the board is, the more overage may be necessary to account for any fallout.

For example, let’s say 1,050 pieces are released to meet an order requiring 1,000 individual boards. In this case, the manufacturer decides a board’s technology will require only an additional 5% in materials overage.

At final QC, the vendor then finds 32 pieces (or about 3%) did not make it through the manufacturing process for various reasons. Those bad boards are scrapped.

Because a 5% overage was produced, 1,018 pieces are good. So, the 1,000-piece order is shipped as promised, and the additional 18 pieces are put into finished spares. Everyone is happy, with most customers not paying any attention to the fallout that occurred within that overage amount.

Sometimes, though, having PCBs delivered in an array or panel format might highlight manufacturing challenges, especially when a customer has a “No X-out” policy.

If you put that same order in a four-up array, then 250 arrays would need to be perfect to meet the 1,000-piece requirement. Based on those numbers for that technology, the manufacturer could expect the same percentage of fallout. But boards found at final QC that don’t pass muster are “connected” to three pieces that passed with flying colors. This means 32 arrays with an X-out or 128 pieces total (32 x four-up) are not allowed to ship, regardless of their quality.

The vendor must release more overage (about 15%, or 152 pieces, because it’s a four-up array) to accommodate the normal fallout that occurs during the manufacturing process for arrays that can’t have any X-outs.

Whether your company accepts X-outs or not should be detailed in your firm’s PCB fabrication specifications. This information will guide your board suppliers on how much material (overage) they must release – based on their technical capabilities – to fulfill an order.

Here is an example of an EMS company’s X-out policy that is clearly spelled out:

“X-outs are allowed. However, not more than 20% of the PCBs in the array can be X’d-out, and no more than 10% of the arrays to be shipped may contain an X-out.”

This means if you have, say, a 2,000-piece order manufactured in a 10-up panel requiring 200 arrays to be received, the most you should receive is 20 panels that contain no more than two X-outs each.

Your fabrication specs should also state how X’d-out panels are to be received to avoid causing headaches for both receiving and production departments. A statement like this works:

“X’d-out arrays are to be segregated and identified accordingly at time of shipment.”

PCB buyers should keep in mind the amount of real estate needed for perfect arrays (no X-outs) means the overall cost of the board will be higher. The adage about not allowing the perfect to become the enemy of the good is applicable here.

Before your company sets its X-out policy, sit down with your manufacturing department. There are ways for an assembler to handle manufacturing panels with X-outs, but the department responsible for shipping quality, finished assemblies should have final say on X-outs.

A rigid “No X-out” policy will likely cost you more without improving the PCB manufacturing process. In most cases, a more flexible approach is warranted.

has more than 25 years’ experience selling PCBs directly for various fabricators and as founder of a leading distributor. He is cofounder of Better Board Buying (boardbuying.com); greg@boardbuying.com.

Register now for PCB East, the largest electronics technical conference and exhibition on the East Coast. Coming in April to Marlboro, MA.

As governments realize the importance of investing in domestic manufacturing, opportunities are coming for EMS firms and PCB fabricators.

It takes time to gain perspective, especially perspective on the industry you are immersed in. In my case, it’s been 30 years since I entered the printed circuit board market. During the first six or seven years, it was heady, upbeat times in North America. Growth was a bounty supporting hundreds of domestic fabricators. Materials, supplies and capital equipment were made “locally” in North America. Then, around the new millennium, everything changed.

Suddenly, work headed to Asia, and fabricators contracted at an unprecedented scale to fewer than 200 within a few short years. The collateral damage was a collapse of materials, supplies and capital equipment companies that supported the industry. Even worse was the exodus of skilled talent who sought careers in more promising industries and never looked back. The relatively few companies that survived did so by hunkering down, focusing on a niche, and investing in only the equipment they needed to support their business base, in some cases taking draconian steps that worked short term but eventually led to their demise. Over the first decade-plus of the new millennium, it was depressing to be a North American circuit board fabricator.

However, times change, and with that change, opportunities emerge – finally!

After decades of ignoring reality – and for a variety of reasons and events, many of which have nothing to do with printed circuit boards, or even electronics – government and industry leaders are “shocked” to learn so much of North America’s manufacturers are no longer globally competitive and how much more capability and capacity is required for economic and military security. Now that they understand the need to invest in manufacturing, more specifically in electronics manufacturing – everything from chips to bare circuit boards and substrates – opportunities for the North American PCB industry finally may be knocking.

Do we open the door and take full advantage, or ignore it and squander our chance?

To take advantage of the current momentum to expand and enhance North American capabilities and manufacturing capacity may require a radical rethinking, or at least retraining, in how we as an industry operate. The entire risk/reward equation in particular needs to be revisited. After nearly 20 years of operating in a hunkered-down mode to mitigate risk and maximize reward, many in our industry may need to be retrained to break old habits and embrace a paradigm shift the opportunities of the future offer.

The first step toward taking advantage of new opportunities may be a brutally honest self-evaluation of what your company does, for whom, and with what resources. Most important is understanding what government or “C-suite” investment in electronics technology may look like and how that will impact your customers. As an example, if chip plants are built in North America, what other electronics manufacturing may now become more cost-effective if done closer to those plants vs. overseas. And, what printed circuit board technology will that increased demand for capacity impact?

With investment in more advanced technology, will new materials and the processing knowhow and equipment be outside current capabilities or comfort zones? Discussions with material suppliers should include a dialogue on what to be aware of; begin experimenting to be better prepared.

If the gap in North American electronics capability points to a specific type of printed circuit board technology that will be in especially high demand, that may be the place to consider increasing capital investment to either add capacity, enhance capability or broaden product offerings to include the growth opportunity. This review should include an estimated capital equipment budget and supporting cash flow, as well as a reality check with current customers to understand if their products and purchasing demands may also be impacted and shifting.

When demand increases, what type of employees will your company need to hire? This leads to workforce development opportunities that currently exist, and in the next few years will expand with an increase in qualified people seeking jobs in electronics. More important, with the emphasis on investing in new capabilities, what talent gap might you have that would prevent being able to produce a new technology? Getting involved now may be the best way to ensure having qualified talent when needed.

To take advantage of any opportunity that a reinterest in North American electronics manufacturing may present, it is essential to stay informed and get your team ready. Nothing will happen overnight, but it will happen more quickly than anyone who has become comfortable in the current industry paradigm imagines. We all need to be aware significant new opportunities are finally on the horizon.

After so long operating in a contracting industry segment, we in North America cannot afford to let the coming opportunities be squandered. Opportunity for growth is knocking for us all.

is president and CEO of IMI Inc.; pbigelow@imipcb.com. His column appears monthly.

Press Releases

- AIM Solder Hires Francisco Rodriguez as Regional Sales Manager for Northeast Mexico

- The Test Connection, Inc. Adds Creative Electron Prime TruVision™ X-ray and CT System for Deeper Failure Analysis

- Kurtz Ersa Goes Semiconductor: Expanding Competence in Microelectronics & Advanced Packaging

- ECIA’s February and Q1 Industry Pulse Surveys Show Positive Sales Confidence Dominating Every Sector of the Electronic Components Industry