PARDUBICE, CZECH REPUBLIC -- Automotive LED assembler APAG Elektronik has opened a 3,300 sq. m site here, where it can place up to 33 million SMT components per month.

Samples subjected to typical end-use qualification testing revealed the importance of the application technique on the performance of certain coatings.

At the annual IPC trade show, everything was headed up. Except, perhaps, the perception.

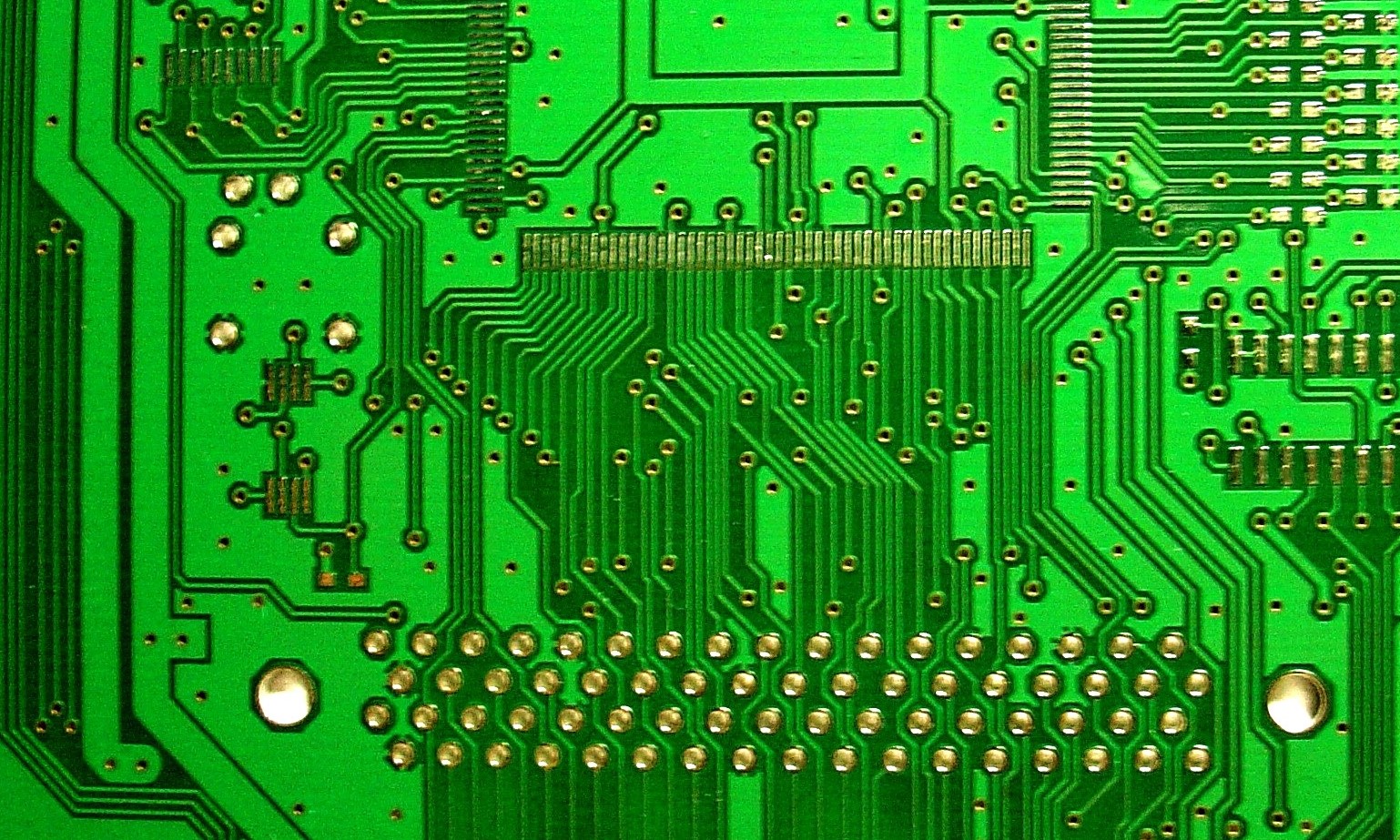

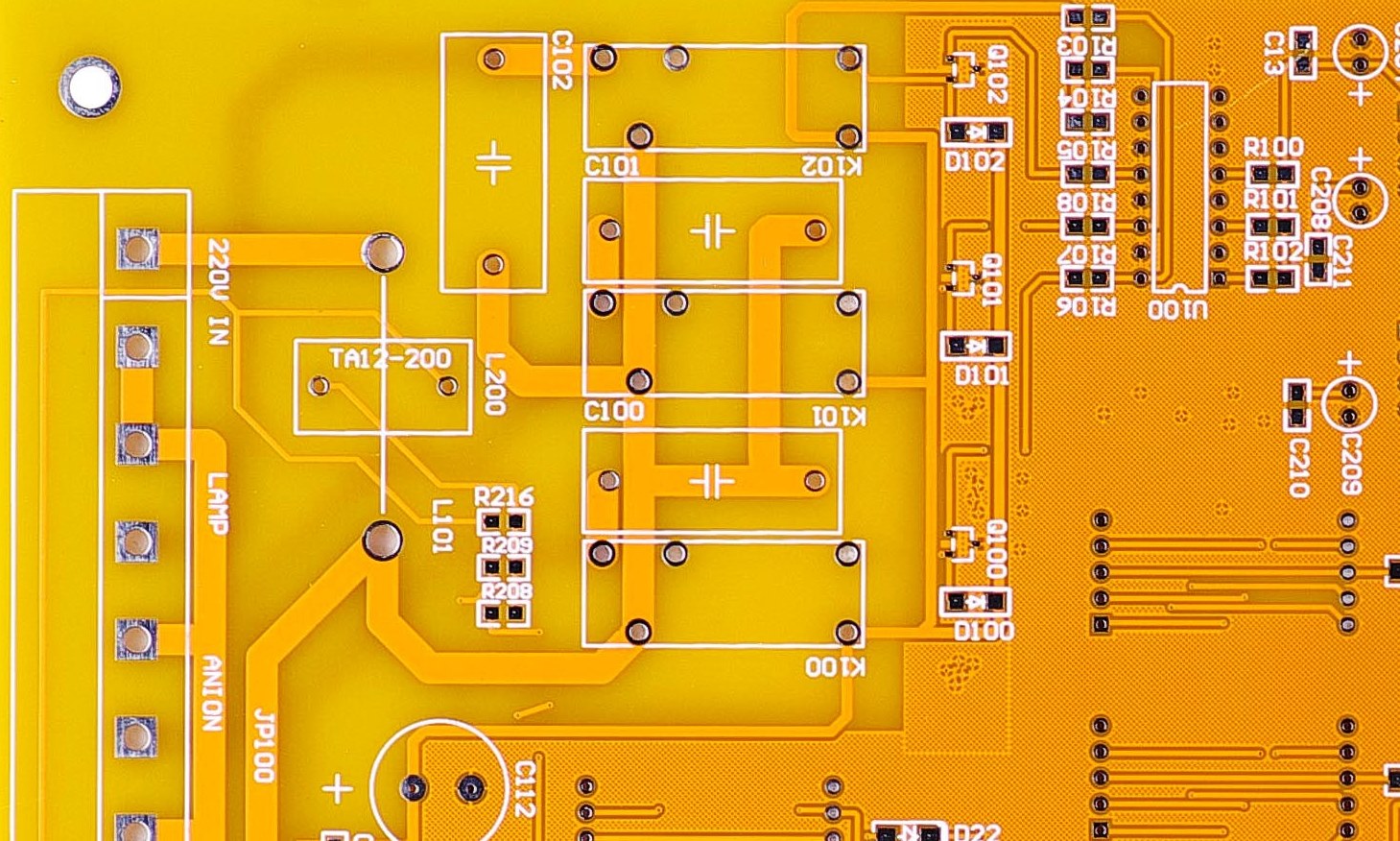

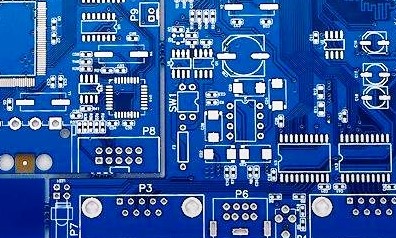

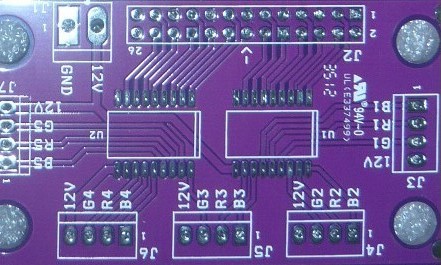

Here’s a Lean hint: Add a tint for distinguishing boards.

Some colors are so standardized that changing them serves no purpose and could indeed be counterproductive or even dangerous. Change the

stop/caution/go lights from red/amber/green to blue/pink/yellow and you’ll have mass confusion and injury. If invited to a black tie event, you would know what

In the kaizen process to improve manufacturing quality and reduce cost, one of the five S’s is seiketsu, or maintaining high standards of housekeeping and workplace organization at all times. This can be accomplished by devising color schemes so distinct that one knows at a glance an object’s nature or purpose. This could be applied to printed circuit boards by using a colored solder mask to shout out its nature. to wear, but an event called “paisley tie” . . . maybe not. Printed circuit boards are always green – except when they’re not.

Internally one could use green to represent “lead solder boards – do not run on the RoHS line.” Blue, then, could mean “RoHS – set the temperature profile accordingly.” Red could be used for “Prototypes – do not ship to customers without engineering approval.” And black could mean commercial avionics, while gold represents DoD equipment requiring special documentation.

Marketing could color code the boards based on market segment, allowing them to trace returns from one country, to sales made to other territories or gray markets.

Three really nice features of solder mask color coding are 1) the color could be seen from a distance without having to search for and read a small label; 2) the

color remains for the life of the board and could not be removed, and 3) there is no cost. Virtually all PCB vendors already stock a variety of colors, and to get your business, many would color match anything for free, even your boss’s red Ferrari.

ROBERT SIMON is a veteran of technology development and marketing, having worked R&D and marketing for electronics, polymer, and metal companies, including Bayer AG and Battelle Memorial Institute, before founding USTEK Inc.; r.simon@ustek.com.

Choosing the right magazine handlers can significantly improve throughput and accuracy in the processing of microelectronic components.

Press Releases

- New SASinno Ultra-i1 Gives K&F Electronics Added Flexibility in Selective Soldering

- Smartsol and Koh Young Technology Announce Strategic Partnership for the Mexican Market

- RBB Systems Boosts Manufacturing Capabilities with Equipment Upgrades for 2026

- 11th Class of Engineering Interns Begins Forging Success at Hyrel