The Contracting Contract Electronics Market

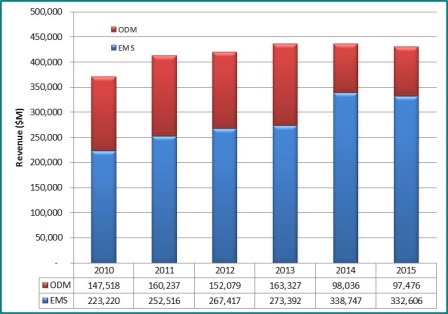

NEVADA CITY, CA – The worldwide market for contract electronics manufacturing services declined 1.5% in total revenue to $430 billion in 2015, a new report asserts.

Overall revenue for the segment, which includes ODM and EMS companies, has been in decline since 2013, but over the past five years the EMS market has grown at a 3% CAGR, says New Ventures Research, a data collection group that focuses on the sector.

The results are part of a new 600-page report called "The Worldwide Electronic Manufacturing Service Market – 2016 Edition" that examines some 100 EMS and ODM suppliers across 52 countries.

Figure 1 summarizes the CM market growth from 2010 to 2015 in terms of US revenue.

The market was sustained by the strong demand for smartphones, which resulted in an increase in assembly revenue of $14 billion in 2015. Orders for tablets once were strong but declining, while notebooks shipments were weak, albeit still growing, and growth in desktops has been negative for the last couple of years. Overall, the computer industry lost nearly $19 billion in assembly revenue in 2015 (includes servers and workstations). Nearly all high-mix/high‐complexity products (medical, industrial, transportation) experienced positive growth, although defense/military suffered a decline resulting from budget constraints.

Figure 1. The worldwide CM market ($M), 2010-2015.

For the sixth year in a row, the industry was profitable at $10.3 billion for public companies, an all‐time high for the industry. Foxconn accounted for nearly half of all the money made by the EMS industry in 2015, and EMS companies accounted for approximately 78% of the $10.3 billion. Five EMS companies and three ODM firms lost money in 2015 — a cumulative total of $142 million. Pegatron ranked second in total earnings ($867 million) for EMS companies followed by Flex, while Delta Electronics and Quanta ranked highest in earnings for the ODMs (all three achieving around $600+ million in profit).

Plant closures and openings were insignificant in 2015, as companies appear to have right‐sized their operations or closed facilities due to acquisition. The openings are clearly related to new business opportunities, while the closures are being driven by negative economic decisions.

Because of the change in business model whereby certain ODMs in 2015 were reclassified as EMS companies, it has appeared that the ODM market is shrinking, but this is essentially due to ODMs embracing the EMS manufacturing model and spinning off their manufacturing operations for the benefit of their customers.

Worldwide OEM Electronics Market

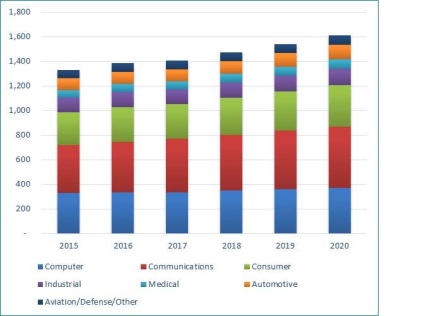

Figure 2 presents the worldwide electronics assembly forecast for 2015 to 2020 by market segment. The overall market demand for electronic products should resume growth throughout the five‐year forecast period after three years (2013‐2015) of highly unusual zero growth in the industry. NVR expects overall market growth to return to a CAGR of 5.4 percent over the next five years, barring a possible downturn in this election year that often declines in the following year.

Figure 2. The worldwide market for electronics product by market segment, 2015 ($B).

Communications and computer products will continue to be the segments driving the largest growth in the electronics industry. In 2020, the total industry is expected to reach $1.6 trillion in annual assembly value (COGS), as consumption and replacement of electronic products continue and new products fuel demand. Outsourcing has become a critical element in keeping the electronics assembly industry expanding and driving costs to the margin each year—a leading factor in stimulating continuous consumer and industrial demand. The trend to move price‐sensitive manufacturing to low‐cost regions (usually regional – no longer just to Asia) will impact the industry for all suppliers in the foreseeable future.

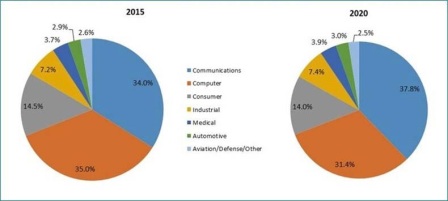

CM Application Market Share

Figure 3 compares the worldwide CM market by market segment for 2015 and 2020. Both EMS firms and ODMs will experience the strongest growth from production in the communications and computer market segments (assuming the latter recovers). Specifically, EMS companies will find good growth in notebooks, e‐readers, cellular handsets, monitors, console video games, and set‐top boxes, while ODMs are projected to experience good growth in tablets, e‐readers, cellular handsets, monitors, and class‐carrier equipment. In general, EMS firms will tend to excel in technology‐intensive product areas and in complex, low‐volume board assemblies. ODMs excel in manufacturing commodity/high‐volume products such as motherboards, monitors, handhelds, and consumer electronics.

Figure 3. Worldwide CM market by industry segment, 2015 and 2020.

Table 1 ranks the top ten overall CM companies by revenue for 2015. Foxconn continued its extraordinary dominance as the leading EMS firm in the industry, outdistancing its closest contender by almost four times. Flex was displaced from the number‐two position by Pegatron starting in 2014, dropping into third place. The leaders are comprised of three ODMs and seven EMS firms*.

Table 1. Top 10 CM Companies’ Market Share, 2015 Market

Company Rev. ($M) Share

Foxconn 141,197 32.8%

Pegatron 34,655 8.1%

Flex 24,595 5.7%

Jabil 18,557 4.3%

Quanta 15,865 3.7%

Compal 13,346 3.1%

Sanmina 6,576 1.5%

Inventec 6,229 1.4%

TPV Technology 5,907 1.4%

Celestica 5,639 1.3%

Others 157,515 36.6%

World total 430,082 100%

* ODM revenue shown is EMS only. Branded product sales are excluded.

Although a simple ranking of CM companies by revenue is informative, says NVR, there are many other meaningful financial measures of CM performance. To summarize, the report uses a total performance rating based on a weighting of these other measures. The CM companies having the highest total scores were deemed the best performing companies in the industry; conversely, those companies having the lowest total scores were viewed as the worst performing CM companies for 2015.

In 2015, SVI Public Co., Ltd. emerged as the EMS company with the highest total score, outdistancing Foxconn, which ranked number one but did not place in the top ten in 2015. VTech CMS ranked second, while Flex, Supermicro (a new ODM), Pegatron, and Delta Electronics all ranked with similar scores for positions 3–6. Bringing up the end were Valuetronics, Sanmina, PCI and EliteGroup Computers.

Press Releases

- SMarTsol America Expands Partnership with ASMPT and Strengthens Regional Coverage in the United States

- Absolute EMS Appoints Mark Sika as President to Lead Next Phase of Growth

- Beyond Torque: New Seika Machinery Webinar Reveals How Strain Gage Technology Exposes Hidden Bolt Axial Force Risks in Battery and PCB Assemblies

- New SASinno Ultra-i1 Gives K&F Electronics Added Flexibility in Selective Soldering