The Rising Tide of the OEM Market

As influential as EMS and ODMs have become, the customer still drives the ship.

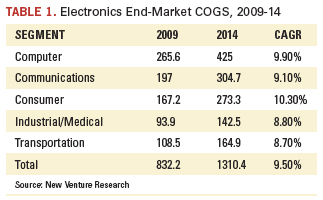

Those who follow our research know that we keep a close watch on the worldwide OEM electronics manufacturing market: in other words, the computer, communications, consumer, industrial/medical and transportation sectors. It is an enormous market in terms of revenue, reaching nearly $1 trillion in cost of goods sold (COGS) in 2008, before slipping to $832 billion in 2009. The recovery is expected to exceed $1.3 trillion by 2014 (Table 1).

What is remarkable about this market is its robustness. It is difficult to find markets of this scale expanding at the current compounded growth rate. Even more amazing, this growth rate has increased over the past few years with the explosion of notebook computer and mobile phones. Over the next five years, taking the lead will be consumer products: flat and 3D TVs, video game consoles, navigation systems and IP set-top boxes.

By comparison, the medical market always has exhibited solid growth, mainly in the areas of diagnostics and imaging systems, as well as surgical and monitoring equipment. Until last year, industrial product industries such as semiconductor capital equipment, process control, test and measurement steadily expanded. Yet with the downturn in 2009, capital spending went into a deep freeze and these markets contracted considerably. The same was true for automotive, although aerospace/defense and “other transportation” (off-road, trains, marine, etc.) remained relatively strong.

Nearly two-thirds of the OEM market today is comprised of computer and communications equipment, and this percentage is growing. A large part of these markets is commodity in nature, and once OEMs engage in the Asian business model of margin depletion, little money will be made from these sectors. Oddly, ODMs – e.g., Compal, Asus, Quanta, Wistron – (discussed later) last year were some of the most profitable in the industry. While EMS companies collectively lost $7 billion, ODM firms made more than $2 billion.

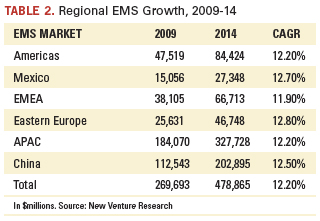

The real story behind the growth of the OEM market lies in where the assembly of electronics products is taking place. In this regard, we must look to EMS suppliers (including ODMs) and the growth rates associated with production taking place in low-cost countries. Today, EMS assembly accounts for around 32% of the total electronics assembly market. Yet, the growth of these suppliers in the three general low-cost regions (Mexico, Eastern Europe and China) account for the highest growth rates. Assembly value in these regions is approximately 50% higher than in high-cost regions (Table 2).

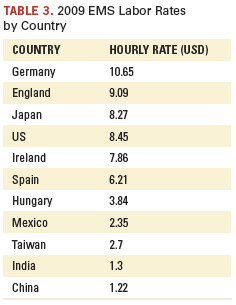

The reason behind this disruption can be understood when comparing the average base (unburdened) labor rates throughout the world. Essentially, an order of magnitude of difference exists between low-cost regions when compared to the base wage rate of high-cost regions. Making matters more difficult, once a competitor makes the move to migrate to a low-cost region, frequently others must follow to remain viable. (As the saying goes, “Once one cow crosses the rivers, so will the others.”)

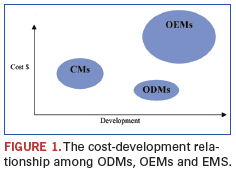

ODMs have disrupted the EMS industry the way EMS suppliers once disrupted the OEM electronics industry. ODMs typically have a lower cost of operation due to their focus on a select few commodity products and Asian (read: low cost) operations base. Moreover, they can discount assembly prices by raising design and component prices, which are often bundled into their service offering. As a result, EMS suppliers find it difficult to compete head-on with ODMs in the product sectors they excel in. Figure 1 highlights the supplier differences in value-add and cost.

OEMs like to work with ODMs because they lower risk by not having to invest in design, materials or inventory. (EMS companies frequently burden the OEM customer with inventory liability.) ODMs are attractive because they offer advanced designs, fresh IP and the ability to bring a new product to market very quickly. Where ODMs add risk is they may become a competitor once they gain the product design knowledge, as has happened in the past. Moreover, ODMs have a tendency to tolerate unhealthy profit margins just to gain a contract, and this can be risky for the OEM should the market soften or they go out of business. (Oddly Foxconn, officially an EMS company, succeeds by modeling an ODM business.)

With the EMS industry only accounting for 32% of the total available market, one might ask where is the other 68% of OEMs’ product assembly? The answer can be found in the geography and business philosophy of leading electronics companies. By a wide margin, Asian (Chinese, Taiwanese, Korean and Japanese) OEMs prefer to manufacture in-house, while North American and increasingly European OEMs are looking to outsource as their business model. Further, a high percentage of OEM products simply are not able to be outsourced (aerospace, defense, medical, industrial, etc.) and are often produced in such low volumes that subcontracting is not profitable. As a result, EMS penetration is not expected to exceed more than 37% of the entire OEM industry by 2014.

NVR has analyzed the opportunity for outsourcing by market industry and leading OEM company in excruciating detail through its recent report, The Worldwide OEM Electronics Assembly Market – A Unique Database Providing Global Electronics Assembly Data on Nearly 300 of the World’s Leading Outsourcing Companies, published in August 2010. For more information, see newventureresearch.com.

Randall Sherman is president and CEO of New Venture Research Corp. (newventureresearch.com); rsherman@newventureresearch.com. His column runs bimonthly.