Properly interpreting the pin one location can be the difference in placing the part.

You would think that in this day and age, all our machine friends would be smart enough to just know what we're thinking. Unfortunately, that's still not the case. There are some instances when we have to put in extra effort to make our intentions clear. Locations and polarities on your printed circuit board are a particularly good example. Ambiguous polarity markings and pin one markings printed on your PCB can wreak havoc on your prototype. In theory, for SMT parts, it really shouldn’t matter; the centroid would take care of the placement orientation. But, you may have noticed that it’s not a perfect world. It took me awhile to figure that out, but I have finally concluded as much.

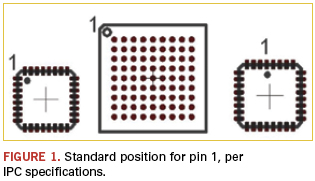

It’s not uncommon for the CAD library part to have the wrong zero degree rotation orientation. The IPC specified location for pin one orientation for square chips like QFPs, QFNs and BGAs is either the upper left or middle top (Figure 1). (Check out our centroid guide at http://i.screamingcircuits.com/docs/understanding-the-centroid-file-r2-2.pdf for more detail.) If it’s wrong in CAD, the centroid will be wrong, as will everything downstream. That’s why markings on the board are still important. Sometimes human intervention still comes through in the end.

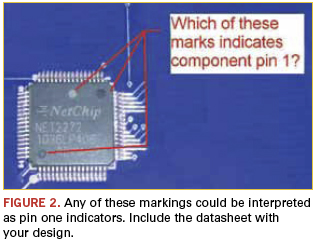

What do you do if your part is ambiguous, though? This particular chip (Figure 2) has three markings that could be interpreted as pin one indicators. At first glance, I’d assume it’s the dot in the center top. It would match with the text. However, there is a white dot in the lower left that could be pin one indicator, which would mean, in this case, the CAD library component had the incorrect zero rotation orientation.

Datasheets aren’t always easy to find. The one for the part shown is behind a registration wall. If you have a part like this, it’s really helpful if you include some documentation when you send your files to your assembly house. I found the datasheet for this particular part and was able to confirm that it is correct as placed with pin one down in the lower left (90⁰).

Ed.: Read Duane’s blog each week at circuitsassembly.com/blog/.

Duane Benson is marketing manager at Screaming Circuits (screamingcircuits.com); dbenson@screamingcircuits.com. His column appears bimonthly.

Test, clean energy and process control represent huge potential for EMS.

The industrial products industry for electronics assemblies is large and diverse. It is very attractive and profitable for many EMS suppliers because of the wide range of complex and high mix of electronics product assemblies. But it is also mysterious and vague, unless one understands the specific application for electronic content embedded within each product. OEMs and EMS seek participation of the other, because cost reductions of these assemblies are mandatory, so good partnerships are essential for staying competitive in this evolving industry.

We have segmented the industrial product market into four categories for easy understanding. These categories include process control, test & measurement, “other” industrial, and clean energy. Table 1 summarizes the total available market for electronic cost of goods sold (E-COGS) of industrial assembly products by market segment and geographic region for 2012.

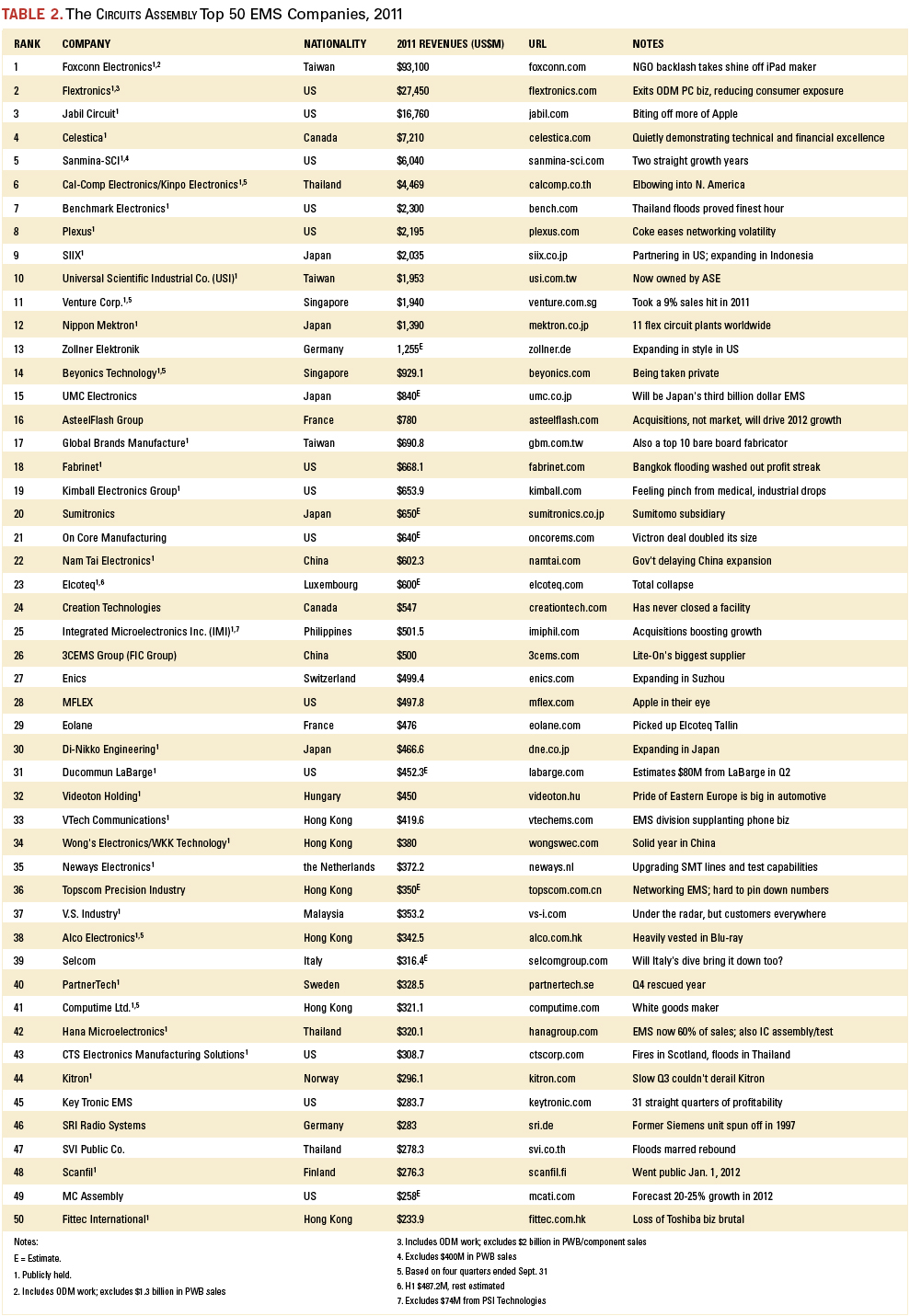

While the market for industrial product assembly has been growing at approximately 5 to 7% annually, the EMS product assembly market has been growing at a much higher rate because of economies of scale inherent within the outsourcing value proposition. To date, EMS assembly accounts for approximately 23% of the total available market for industrial electronics in terms of revenue, but this percentage is increasing dramatically as the outsourcing is demonstrated. The largest industrial product market to date is Test & Measurement equipment sector, which is also the most electronic-intensive (Table 2).

Industrial process control is comprised of 13 leading product segments according to our field research and includes automation/programmable logic control, construction/agricultural/mining, electric motors, electrical distribution/smart grid, elevator systems, environmental management, fluid control/hydraulics, marine/waste water, oil/gas, power supplies, robotics, smart meters, and UPS/batteries. The leading application by far is automation/PLC, which is embedded in nearly every aspect of this market. The leading region for the assembly of these devices is the Americas followed by Asia Pacific (APAC), as most Asian OEMs prefer to manufacture in-house. The electronics content of process control equipment varies considerably by individual product, with automation/logic (primarily PLCs) and smart meters having the highest concentration.

Our research has identified approximately 52 leading industrial OEMs that are estimated to account for approximately 80% of all process control products. Leading suppliers include GE Industrial, Siemens, ABB, Hitachi, Yokogawa, Schlumberger, Mitsubishi, Emerson, Fujitsu, Bosch and many others. Most market leaders have internal low-cost manufacturing operations in all geographic regions, yet employ a variety of EMS subcontractors in areas where it makes economic sense in terms of supply and demand. The majority of subcontracting involves printed circuit boards (PCBs), and in some cases, the final integration or box assembly of the industrial product.

The test and measurement industry is challenging to segment given the wide range of high technology products, but we have profiled this by equipment size, applications and customer base. We have identified four distinct T&M equipment sectors, which include inspection equipment, metrology/instrumentation, semiconductor capital equipment, and general test and measurement hardware found in the home and industry. The leading region for manufacturing and consuming these devices, by a very wide margin, is the APAC region. While semiconductor manufacturing exists extensively in the Amercias and Europe/Middle East (EMEA), Asia has become the dominant region for most testing of semiconductor products because of the many end-products such as mobile phones and PCs.

Our survey profiled 24 leading industrial OEMs that currently manufacture test and measurement equipment. Major suppliers include Applied Materials, Tokyo Electron, Thermo Fisher, Agilent, Lam Research, Rohde & Schwartz, Parker Hannifin, ASML and Yokogawa, among others. Most large companies have transferred their manufacturing facilities to low-cost manufacturing operations in the APAC region, and their subcontractors have followed this trend in support. In most cases, the OEM is responsible for the final integration or box assembly of the industrial product, while the EMS manufactures the complex PCBs that account for the highest proportion of semiconductor electronics assembly. In certain cases, such as with small handheld test equipment, the EMS company will assemble and ship the entire product (PCB and box assembly).

“Other” industrial products comprise applications that do not fit neatly into a clear sector, sometimes defying classification altogether, including ATM/gaming equipment, HVAC, laundry/home appliances, lighting/LEDs, security/safety products, tools, and material handling/specialty equipment/other industrial hardware. Many of the sectors are quite large, such as LED lighting systems, while others are composed of multiple companies and derivative products, such as HVAC and home appliances, which nevertheless constitute significant markets, albeit minor ones for electronics assembly overall. (That is, the electronic content is less than 10% of the overall COGS.) As we have uncovered, the range of products is very extensive, but they are rich in electronics assembly potential.

Our survey identified 42 leading industrial OEMs that manufacture “other” industrial equipment. Setting aside for the moment the LED lighting industry (which includes OSRAM, Philips Lumileds, Nichia, Panasonic and Samsung), leading suppliers include Siemens, Cooper Industries, NCR, Electrolux, and United Technologies, among others. In many cases, the large OEMs maintain low-cost manufacturing facilities or employ subcontractors for PCB production. In some cases (such as with ATMs/gaming/vending machines), EMS companies play a vital role, given the complexity of semiconductor electronics on the PCB. For other products, such as tools and security products, the PCB assembly is not significant, given the overall assembly of the product.

While there is no standard definition of clean energy technology, we have defined it as a diverse range of products, interfaces and processes that harness renewable materials and energy sources, and thereby reduce the use of natural resources, and cut or eliminate emissions and wastes. We have focused on renewable technologies such as wind power, solar power, tidal, wind and fuel cells (and the necessary inverters), and the demand by consumers to manufacture these products cost-effectively.

Our survey of the clean industry sector includes market leaders such as LDK Solar, First Solar, SunTech Power, Q-Cells, SunPower, Trina Solar, Canadian Solar, and Solar World, among many others. The size of the solar energy sector far exceeds the current market size of the wind, tidal and fuel cell sectors. Inverters naturally apply to all of these product sectors and remain the primary product application for outsourcing.

The Worldwide Industrial Electronics Assembly Markets—2012 Edition is based on an in-depth examination of the top 100 industrial OEM companies and their outsourcing partners. Our forecasts conform to the research described in our sister publication, The Worldwide Electronics Manufacturing Services Markets – 2012 Edition.

Randall Sherman is president and principal analyst of New Venture Research (newventureresearch.com), a market research and consulting firm specializing in the electronics manufacturing industry; rsherman@newventureresearch.com.

A March earthquake. September floods. Social unrest. Throughout 2011, upheaval was in the air.

Acquisitions, bankruptcies and Mother Nature were the name of the game in 2011, as topsy-turvy market conditions coupled with inexplicable environmental disasters and unprecedented social backlash led to what were in some cases previously inconceivable opportunities.

In what will remain a year for the books, an earthquake and subsequent tsunami hit northeastern Japan, wiping out scores of manufacturing plants and other business, and leaving painful images of the dead. But in what turned out to be Japan’s finest hour, the nation recovered quickly, with most multinational business back to normal within two quarters. Thailand wasn’t so fortunate. Plants there took such a drubbing that it could be a year before they are usable again. Worse, the repeat disasters had decision-makers rethinking their supply-chain plans.

Had it not been for the weather, the story of the year would have been Elcoteq. Once a top 5 EMS company, the onetime main supplier to Nokia found the competition from Foxconn too much to overcome. It saw sales and profits spiral down over a five-year span, then finally declared bankruptcy last fall, shuttering or selling all but four of its 13 manufacturing sites.

Watching, and perhaps learning from, Elcoteq’s mistakes, No. 2 Flextronics bailed from the price-sensitive PC assembly space in 2011. Having just formally entered the PC production business in 2008, Flextronics quickly grew that segment to $4 billion in annual revenue, only to see margin erosion threaten to wipe out the company’s profits. Competing in a commodity space works only for the largest player, it seems.

Speaking of the largest player, Foxconn (who else?) in 2011 continued its long reign at the top of the pile. It seems hard to imagine, but 10 years ago, Foxconn trailed Flextronics, Solectron, Sanmina-SCI and Celestica in annual revenues. Still, cracks in its formidable armor began to show. Dinged by government-mandated wage hikes, Foxconn has moved much of its reportedly 800,000-man workforce inland, leaving its Shenzhen campus to Apple (more on that in a moment). Worldwide social pressures shone an uncomfortable spotlight on Foxconn, where a blitzkrieg of worker suicides, plant explosions, inflammatory statements (and, perhaps, just a little bit of Apple fatigue) put the firm squarely in the crosshairs of the mainstream media, not to mention several workers’ rights NGOs. In response, Foxconn intimated plans to automate a number of its operations with robots.

Upheaval. An army of robots would have made no difference in Thailand, which was turned upside down when fall floods like none seen in the country in 50 years soaked the nation for the better part of two months. No EMS company was decimated more than Fabrinet, No. 19 on the 2010 list and headed for an even higher ranking. High waters breached two of its facilities, rendering one permanently closed and taking the other offline for months. Others that felt the impact in Thailand included No. 6 Cal-Comp, No. 7 Benchmark, No. 42 Hana Microelectronics and No. 47 SVI Public Co.

No. 14 Beyonics also was hit hard by the Thailand floods. Having seen sales fall about 15% over the past two years, and in the midst of five straight unprofitable quarters, the Singapore-based firm in October announced plans to go private. (The company should know something about going private; its founders came from Flextronics, which did the same thing in 1987 before relisting in 1991.)

[Ed.: To enlarge the table, right-click on it, then click View Image, then left-click on the table.)

In the aftermath of Japan and Thailand, certain OEMs and EMS companies are rethinking their supply chains. No. 3 Jabil already has made clear it wants to navigate away from the all-in-one industrial parks – where suppliers sit almost on top of each other – so characteristic of the Pacific Rim. Moreover, as companies become more aware of time-to-market and the amounts of capital tied up in product in transit from distant lands, a trend is emerging toward positioning production closer to the point of end-use, a phenomenon known in the US as “reshoring.” Social pressures, accented by the long and loud protests over alleged worker exploitation that have landed Foxconn (and its leading customer, Apple) on the front page of The Wall Street Journal for all the wrong reasons, are also leading assemblers to contemplate not just higher but politically safer ground.

As usual, major mergers and acquisitions changed the face of the CIRCUITS ASSEMBLY Top 50 list. No. 21 OnCore Manufacturing, a major defense and aerospace supplier, acquired Victron in what was essentially a merger of financial equals. No. 31 Ducommun made the biggest splash in its 157-year history, acquiring LaBarge in June to form a defense electronics powerhouse. No. 16 AsteelFlash bought Catalyst EMS. (Just after the year ended, No. 8 Plexus announced a deal to acquire Kontron Design Manufacturing Services in Penang.)

Falling off the list was EPIQ, which sold a total of five plants in Bulgaria, Czech Republic and Mexico to No. 25 Integrated Microelectronics Inc. Also departing was Surface Mount Technology Holdings (No. 45 in 2010), the Hong Kong-based EMS firm that endured a painful reorganization in 2011. Revenue plunged 38% year-over-year to about $177.6 million. Suffering a similar fate is former Top 50 mainstay Simclar, which has seen sales fall from a high of $400 million in 2006.

Joining the list were several large flex circuit companies whose EMS revenues were previously not properly accounted for. Most flex PCB fabricators also perform assembly, and it is difficult to get an accurate reading of the value of the bare board from the finished assembly. However, based on data from IPC and others, bare flex circuits comprise roughly 40% of the shipment value. Based on such estimates, No. 12 Nippon Mektron (which has at least 11 plants that perform SMT assembly) and No. 28 MFLEX are now represented in the Top 50.

Whither Kaifa? Not making the list: Sichuan Changhong Electric, a huge Chinese entity (35,000 employees) that makes TVs, white goods and other components. While it builds product for several brand name Japanese OEMs, it was impossible to determine just what its EMS/ODM sales were in 2011. Same goes for Aeroflex. We also left off ODMs such as Qisda, Compal, Wistron, BenQ, and others that are essentially OEMs.

Should Shenzhen Kaifa Technology be included in EMS rankings? It’s not an easy question to answer. On revenue alone, perhaps: Kaifa, as the company is known, had sales of over $4 billion last year. Using that gross number would place it squarely between Sanmina-SCI and Cal-Comp in the Top 10.

But there’s more to it than that. Kaifa generates an extraordinary amount of its revenue from making and selling hard disk drives to Seagate. In fact, under most classifications, Kaifa would rank as an ODM, and not just of printed circuit board assemblies.

Then there’s the confusion of what, exactly, “Kaifa” is. The company, which is supposedly traded under the ticker symbol 00021 on the Shenzhen Exchange, has no current listing. However, it is also apparently a subsidiary of China Electronics Corp.

CEC is giant. The conglomerate says its annual revenues topped $8 billion back in 2006, and it employs more than 70,000 workers across some 61 subsidiaries, including 13 listed holding companies. Among them are cellphone and datacom OEM Panda Electronics, computer and TV manufacturer Greatwall Technology, and yes, Kaifa.

It also is state-owned, and operates directly under the administration of China’s central government. Forget, for the moment, how strange it is for what is essentially a government entity to be publicly traded. Consider instead whether a government business can be considered a contract manufacturer, especially in China, where the Communist Party still holds sway over most economic policy and can pick the winners and losers at the drop of a hat. Want to get a government contract? Use a government provider. It becomes hard to distinguish between what is competitive bidding and what is political.

Then there’s the matter of CEC’s financials. They are dense, to be sure. It’s hard to tell what revenue comes from external customers and what is just “padding” from its own pyramid. Among those that can be discerned, Greatwall alone made up $1.6 billion in revenue in 2010. Read the fine print and you’ll see the company has several “deals” in place to buy components and services from other CEC subsidiaries.

So should Kaifa be listed on the CIRCUITS ASSEMBLY Top 50? Because it is next to impossible to know what its true revenue from EMS-related activities is, we say no, while respecting the decision of others to disagree.

EMS is a lopsided business. The CIRCUITS ASSEMBLY Top 50 make up about 87% of the total revenues of the entire electronics outsourcing industry, although that figure admittedly includes a fair percentage of revenue that would properly be classified as ODM work. The industry as a whole reached about $205 billion in sales last year, according to IHS iSuppli.1 (The research firm predicts industry revenue to be flat in 2012.)

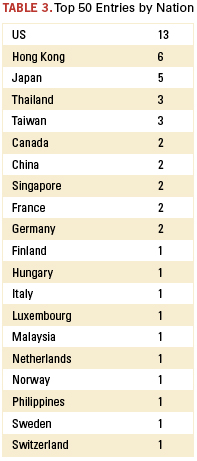

The US continues to dominate the Top 10 list, with five of the top eight entries, although we are seeing some minor shifts take place (Table 3). Regionally, the Top 50 remain intact, led by Southeast Asia (16 entries), North America (15) and Europe (12). Japan gained two entries, a reflection of heretofore unacknowledged EMS work. Notable for its lack of entries is Russia, which almost certainly has domestic firms that would qualify, and whose electronics assembly industry was forecast to reach $14 billion in 2010 (55% of which was industrial or military).2 While changes in the rankings have been most common in the middle to lower half of the list, a few firms are threatening to shake up the top. Given their organic growth and acquisition strategy, respectively, Zollner and AsteelFlash look like good bets to break into the Top 10, should any of the current leaders falter.

References

1. Mike Buetow, "iSuppli: EMS in for Flat Year," circuitsassembly.com, Feb. 7, 2012.

2. Ivan Pokrovsky, "Electronics Manufacturing in Russia," New Russian Electronics, Business Industry Yearbook, 2008.

Mike Buetow is editor in chief of CIRCUITS ASSEMBLY; mbuetow@upmediagroup.com.

Ed: For the 2010 Top 50, click here.

For the 2009 Top 50, click here.

OSATs are facing off with foundries over next-gen packages.

Two poker games occurred at the IMAPS Global Business Council and International Device Packaging Conference held in Ft. McDowell, AZ, in early March. One was a game of Texas Hold’em for attendees; the other had much bigger stakes.

Time was, companies were vertically integrated, and large semiconductor companies established and maintained assembly operations to produce packages. While a few companies, including IBM, Intel, Samsung, Texas Instruments and others, maintain strategic assembly operations, many companies shifted to the “asset light” model, and the era of the fabless semiconductor emerged. The industry is potentially entering a new stage with the move to 2.5D (chips mounted on silicon interposers) and 3D with through silicon vias (TSVs). Will the fabless model still produce the high margins of the past? Is the industry moving back to its past with a new vertical integration infrastructure?

TSMC has announced that it plans to cut the outsource service assembly and test (OSAT) suppliers out of the assembly of silicon interposers it produces – and eventually 3D TSV assembly. The growing concern over that infrastructure model was evident at one panel session. The panel included representatives from TSMC, GlobalFoundries, UMC, Qualcomm, Hynix, Amkor and ASE. The argument is that the thin, delicate wafers cannot be shipped from the foundry to the OSAT for assembly without potential damage, and that responsibility for a defective finished product would be difficult to determine. TSMC describes the 3D TSV process as extremely complex, and says it should handle an assembly process with equal complexity, including everything from substrate design to dicing the micro-bumped wafers and assembling the finished stack into the package. TSMC already provides bumping and wafer level packaging services, but the new proposal is a step into territory typically reserved for the OSATs. This play would cut OSATs out of the high-value segment of the market. (Of course, TSMC will leave assembly of the lower value package types to OSATs.) With IBM, and now Intel, offering foundry services, as well as having internal assembly operations, the stakes are high in the game to dominate the market. Samsung, a vertically integrated OEM that also offers foundry services, is maintaining a low profile and not showing its hand. Other foundry service providers such as GlobalFoundries have announced they will not provide assembly services and will work in conjunction with OSAT partners. UMC will make silicon interposers and supply them for use by OSATs. The silver lining, as ASE notes, may be if the foundries get into the assembly business, margins for packaging – and assembly may increase.

Commercialization of 2.5D and 3D technology will be enabled by continued process improvements. Papers and panel sessions at the conference highlighted areas in the 3D TSV process that would benefit from new developments. The materials panel highlighted many new developments in underfills, dielectrics and materials for wafer bond/debond. The panel indicated materials for the bond/debond process used in wafer thinning for the 3D TSV process are an area that could use the most improvement. Equipment makers EV Group and Suss Microtec described new system developments. Much progress has been made by individual

companies and consortia to improve the debonding process.

While technical issues still need to be resolved, supply chain and business issues are of increasing concern. With supply chain disruptions such as the earthquake and tsunami in Japan and flooding in Thailand in 2011, some companies are not happy with the model that does not permit second sources for interposers and assembly.

The complexity of silicon interposers and 3D TSV assembly is not being debated. The difficulty of dicing thin wafers fabricated with ultra low-k dielectrics, and bonding the die with micro bumps using new materials and processes, is not in question. Stresses during the assembly process must be carefully managed to prevent delamination of the silicon itself. Selecting materials, developing the assembly process, and executing the turnkey operation to produce a finished package with high yield will be challenging, and it is not clear to everyone which group has all the necessary skills. TSMC has clearly demonstrated successful completion of various 3D TSV process steps. However, the first product samples of die assembly on interposers were a joint effort involving die design by Xilinx, fabricated by TSMC, with Amkor providing assembly on an organic substrate manufactured by Ibiden.

Which strategy will provide the best results and move these new technologies into high-volume manufacturing is an open question. With all players holding their cards close to their vests, the industry is moving into a new era with ramifications for the future infrastructure.

[Sidebar] What’s a Silicon Interposer with TSVs?

A silicon interposer acts as a transposer between the silicon die and package substrate. Communication between the die are possible by routing signals down through the interposer and up to the next chip. The advantages of silicon substrates result from the combination of the silicon material properties and multichip packaging, including:

- High wiring density due to the very flat substrate.

- TCE matched to the silicon die.

- Excellent electrical and thermal performance.

- Lower laminate substrate cost due to reduced wiring density.

- Lower cost of active devices due to partitioning large die with minimal effect on performance.

- Lower cost of active devices due to smaller flip-chip bump pitch.

- Lower power requirements than equivalent single-chip packages due to multiple chips combined on one substrate.

- Possibility of integrating passives into the substrate.

E. Jan Vardaman is president of TechSearch International (techsearchinc.com); jan@techsearchinc.com. Her column appears bimonthly.

After a week in San Diego, Las Vegas seemed a strange old world.

A new location, a new lease on life.

Three tepid years in Las Vegas left many observers wondering if, when it came to the IPC Apex Expo trade show, Elvis had left the building.

But the move to the San Diego Convention Center was a revelation. It was as if all it took was a little sunshine (and a few fewer slot machines) to breathe new life into the doddering show.

From the opening bell, attendees swarmed keynote speaker William Shatner, some sporting Trekkie gear and other paraphernalia as they lined up by the hundreds to get photos and autographs from the famed Star Trek actor.

On the show floor, the vibe carried over, with attendance and attitudes perked up. Was it the improving economy, a different mix of attendees, or the new site? Hard to say, but exhibitors weren’t complaining.

Attendance seemed strongest the first day, and the momentum carried over through the middle of the second day. Things slowed a bit that afternoon, but picked up at the show-floor reception. Day 3, as usual, crawled.

We noticed the show itself was not as well organized as in the past. Previous shows grouped fabrication suppliers more or less in one place and assembly suppliers in another. That all changed this year. While industries (fabrication, assembly) were delineated (sort of) by the color of carpet in the various exhibitors’ booths, there was a nearly random nature that made trying to visit all the suppliers of a certain product inconvenient. Having the show split across two floors didn’t help either.

Most of the products shown at Apex Expo were introduced at Productronica and have already been covered by this magazine both in print and online; we will focus here only on new releases, with a couple exceptions as noted.

The most interesting developments included a new inline printed circuit board assembly cleaner from Aqueous Technologies. Named Typhoon, the short (12' linear length) machine is considered safer than many traditional models, thanks to magnetically conductive pumps that permit it to run (at reduced cleaning performance, of course) up to 36 hr. without water, whereas most models’ pumps freeze up after a few minutes under such conditions. The machine features rotating air knives, a 24" wide conveyor, and zero or filter discharge.

Speaking of cleaning, we also viewed our first full demo of Speedline’s new Aquastorm batch cleaner. Speedline’s engineers came up with the novel idea of firing water at the board straight from the rack’s spindles, providing ample power, always the bane of batch systems.

Two companies (SMT and A-Tec) are now supplying inline convection reflow ovens containing vacuums, which are said to help reduce voiding. Matt Holzmann at Christopher Associates proudly displayed the MEK S1 SPI, reportedly with 50µm resolution and 5D vision, claimed to be the fastest SPI on the market.

At Juki, the biggest news came just ahead of the show opening, when the placement company inked a deal to distribute JT’s reflow soldering equipment in the Americas. Now armed with a printer (courtesy of January’s deal with GKG), and a complete line of soldering machines, Juki seems armed to do battle in the full-line fight. (Heller, with which Juki had previously teamed on an informal basis, seems the odd man out.) CEO Bob Black also privately showed a startling development that, while we cannot yet reveal, is likely to shake up the process equipment market down the road.

Yamaha made for an interesting presence, with a large booth and several machines, not all of which were for placement. The company, which is slowly separating from its longtime Americas distributor Assembléon, also had an AXI machine on display. (Assembléon, we should note, did pick up an NPI Award for its new iFlex placement platform, debuted at Productronica, as well as a Service Excellence Award – its tenth in a row.)

Several AOI OEMs, Koh Young, Mirtec, CyberOptics and Viscom among them, are doing a much improved job of tying SPI and post-reflow inspection data to the screen printer. The efforts in this area to make the data captured during inspection meaningful for in-process production were noticeable.

Fears of a lingering slowdown seemed overstated: Soldering oven manufacturers such as BTU and Speedline Technologies, as well as CyberOptics and BPM Microsystems, indicated strong demand, especially since January. Automotive seems to be driving much of the recovery. BTU is planning an expansion at its Shanghai-based campus.

Aegis Industrial Software has a slick new tool called inForce, a touchscreen and I/O unit that monitors and controls boards as they proceed down the conveyor, and feeds the data back to the Aegis MES factory software, aiding traceability.

We spent considerable time with the materials vendors. AIM noted sales were up 41% year-over-year in 2011, while Cookson saw sales at its Alpha unit rise about 18%. (Raw metals price inflation contributed strongly to the increases.) AIM will open a plant in Poland for blending powder, liquid flux and bar solder, and plans to expand its Montreal and Juarez operations as well. Henkel rolled out four products, including underfill brands for jetting (seeing more of that, too) and traditional dispensing. Many materials companies noted the huge potential in the LED market, although one suggested some lower-energy, higher-brightness alternatives such as ITO should not be ruled out.

There’s some disagreement as to how much the conversation over low-silver solders will translate into actual use, however. Some vendors said that low-silver is starting to transition from the discussion phase into actual production. However, other vendors say it’s mostly hype, adding that the cost-savings tradeoff versus the amount of process development work that needs to go into characterizing each alloy makes change questionable at best. We also are hearing SAC 305 is losing popularity. An iNEMI project team led by Dr. Greg Henshall of HP is evaluating 16 different alternate solder materials; it could be that once that group has completed its work, the picture will become clearer for users.

The EMS companies exhibiting, including STI Electronics and Divsys, were generally bullish in 2012, saying most of the pain from military spending delays should be worked through by the second quarter.

Apex Expo is a misnomer: The “Expo” part is a throwback to when the show was aimed at board fabricators. Those days went the way of Gene Roddenberry. Finding fabrication equipment on the show floor is unusual, and vendors said new sales are going to replace old machines, not to add capacity. Dow, Oak-Mitsui, RBP Chemical, Ventec, Park Electrochemical and Rogers were among the materials companies with new or soon-to-be released products. Isola revealed it completed the beta testing and internal qualification for I-Speed, a Pb-free compatible, low-loss, high-speed digital laminate. The company has also teamed with Circuit Foil on Ultrathin, a 40µm glass-reinforced laminate said to eliminate the thermo-mechanical mismatch issues commonly associated with unreinforced films. The Tg tops 170⁰C, and Young’s modulus and CTE are said to be similar to high-Tg systems.

LPKF has a new, versatile UV laser (Protolaser U3) said to be for depaneling, drilling, marking and surface etching on FR-4, ceramic or other high-frequency RF substrates. PCB cleaning equipment OEM Teknek will double its headcount in Asia and has added a small number of staff in Germany as well.

We had a nice long talk (for the show) with iNEMI president Bill Bader, who provided a rundown on the consortium’s programs – and there are a lot of them. iNEMI officially launched three new projects in medical in January, with three more in “definition.” UL Research is leading a project to update its standards and specifications methodology. Also, a white paper on harmonization of environmental data management is underway.

On the move. At Universal Instruments, George Westby has semi-retired from the UIC Consortium, and Dave Vicara has been named to run the lab. Also, Jeff Mogensen, last seen with Speedline, has joined Parmi, and his former colleague Greg Lefevbre has joined Cardinal Circuit. And another Speedline alum, Shean Dalton, has launched his own rep firm.

Brian O’Leary, formerly of KIC, has joined Trans-Tec (Yamaha’s distributor in the Americas) as general manager, and Lino D’Andretti has joined him in sales. Seho appointed Alexander Riedel director of customer service, and Europlacer named Chris Round global marketing manager. Rogers named Jeffrey Grudzien vice president of its Advanced Circuit Materials division, replacing Michael Bessette, who is retiring after 37 years with the company.

IPC has narrowed its search for a new president to three candidates, none of whom is reportedly from the IPC staff. All have association backgrounds, but some are said to have various degrees of indirect industry experience. A decision is expected in the next few weeks. (Ed: Update: http://www.circuitsassembly.com/cms/news/12678-ipc-names-mitchell-president-and-ceo)

Longtime MacDermid engineer Denny Fritz was inducted to the IPC Hall of Fame, and Dr. William Coleman of PhotoStencil and Mike Bixenman of Kyzen received the President’s Award for their contributions to the organization.

Overheard. Spokesmen from Nordson Dage and OK International acknowledged their respective companies are seeking acquisitions in the coming quarters.

A bid has been made for a major ($500 million-plus) publicly traded US-based EMS company, but so far the company’s asking price is higher than market value.

There was some chatter that the US Department of Defense is considering lifting the ITAR ban on PCBs, which would dramatically shake up (read: eviscerate) the US PCB market. TTM, the largest PCB supplier to the Pentagon, and others are said to be pushing back on the DoD.

All in all, a good week. The show remains in San Diego next year, then back to Las Vegas. So much for boldly going where no one has gone before.

Mike Buetow is editor in chief of PCD&F and CIRCUITS ASSEMBLY; mbuetow@upmediagroup.com.

SEA, NPI 2012 Winners

By Chelsey Drysdale

In San Diego last month, CIRCUITS ASSEMBLY revealed the winners of its 20th annual Service Excellence Awards at IPC Apex Expo. Electronics manufacturing services providers and electronics assembly equipment, materials and software suppliers were recognized for top-notch customer service. Each firm’s own customers rated them in an online survey process during the months leading up to the trade show.

EMS winners with the highest overall ratings included EPIC Technologies in the large company category (revenues between $101 million and $500 million), Applied Technical Services in the medium company category (revenues between $20 million and $100 million), and Burton Industries in the small company category (revenues under $20 million).

EMS companies with the highest scores in each of five individual service categories were honored as well. (Overall winners were excluded from winning individual categories.) In the large company category, last year’s overall winner Mack Technologies swept all five individual awards (dependability/timely delivery, manufacturing quality, value for the price, responsiveness, and technology).

Electronics Systems took first place in dependability and value, and tied ACD for responsiveness in the medium company category. ACD also scored the technology award. Western Electronics took home the quality top prize.

In the small company category, Spectrum Assembly took top honors for dependability and responsiveness, and tied Accu-Sembly for first place in quality. Accu-Sembly also won for technology and value.

Electronics assembly equipment award winners were Assembléon America for pick-and-place; DEK International for screen printing; Kyzen Corp. for cleaning/processing materials; Nordson YesTech for test and inspection; Nordson EFD for materials; Nordson Asymtek for dispensing, and KIC for soldering equipment. Aegis Industrial Software received top honors in the automation/manufacturing software category.

CIRCUITS ASSEMBLY and PCD&F also announced the winners of the 2012 New Product Introduction Award for electronics assembly equipment, materials, software, and PCB fabrication at the same event, held on the show floor.

The NPI Award, in its fifth year, recognizes leading new products during the past 12 months. An independent panel of practicing industry engineers selected the recipients.

The winners included Cognex in the process control tools category for the DataMan 500 and Speedprint in the screen/stencil printing equipment category for Speedprint SP700avi. Seika Machinery won the screen/stencil printing peripherals prize for the Sawa Ultrasonic Stencil Cleaner SC-AH100F-LV Low-VOC Model. Aqueous Technologies was honored for cleaning equipment with its Trident XLD, while Data I/O took home an award for device programming with its RoadRunner 3 with FIS.

For dispensing equipment, GPD Global took top honors for PCD Dispensing on MAX series platform. CyberOptics scored the number one spot for AOI test & inspection with the QX100. ICT test & inspection went to Datest for the SPEA 4060 Flying Probe Tester with Goepel Boundary Scan. Test & inspection – functional test was awarded to Agilent Technologies for TS-8900. ViTrox Technologies won for its V810 In-Line 3D AXI in the AXI test & inspection category.

AIM was honored for soldering materials with NC259 solder paste, and LPKF Laser & Electronics was awarded for its LPKF MicroLine 1120 P in the automation tools category. Multifunction component placement went to Assembléon America for iFlex, and Juki snagged the award for high-speed component placement for its Sentry tool. Speedline Technologies’ Closed Loop Nitrogen Control was honored for reflow soldering, and Seho Systems’ AOI system to be embedded in a selective soldering machine was recognized for selective soldering.

Kyzen’s Aquanox A4638 took top prize for cleaning materials, and Cogiscan’s LabelScan Automated Vision System was number one in labeling equipment.

Juki’s second award was for production software for its Juki IS NPI+ Bundle. Microscan was awarded in the process control software category for its AutoVISION machine vision software.

In the soldering – other category, EVS was given a plaque for its EVS 7000LFHS solder recovery system redesign. Nihon Superior was honored in the cored wire category for (SN100C (551CT)) lead-free flux-cored solder wire, while Semblant won for its SPF (Semblant Plasma Finish) in the coatings/encapsulants category.

Christopher Associates took home a plaque for the Magnus HD Trend in the rework & repair tools category, and KIC was honored in wave soldering for its KIC 24/7 Wave.

Finally, for surface treatment, Dow Electronic Materials won for its Circuposit Hole Prep 4126 Sweller.

Congratulations to all of 2012’s honorees. Join us again next year, when IPC Apex Expo returns to San Diego, where we’ll recognize a new batch of industry standouts during our 2013 event. Check back to circuitsassembly.com and pcdandf.com for more details soon.

Chelsey Drysdale is senior editor for PCD&F and CIRCUITS ASSEMBLY; cdrysdale@upmediagroup.com.

Custom formulations have become the norm.

Conformal coating materials, to an equipment manufacturer, are a vital ingredient to success or failure on many different levels. The marriage of material and the correct application equipment invariably dictates everything from process implementation, line efficiency, quality, and customer satisfaction. This drives chemical companies and equipment suppliers to a unique relationship in that new product or process development is often dictated by the capabilities of the other. For example, new chemistries are always in development, and while performance properties, reworkability, and cure mechanisms all contribute to product marketability, ease of application can often dictate how widely a material is accepted by consumers. Further, does the technology even exist to process a chemistry per its intended application? Similarly, equipment manufacturers work diligently with formulators to assure they have products to meet the demands of material trends throughout the industry.

One of the most prominent examples of this relationship occurred in the early 1990s, as formulators began to heavily market solvent-free, higher viscosity (>100cps) coatings. These materials could not be processed well with non-atomized film coaters, the prevalent technology of that era. This problem quickly turned to opportunity as dispensing companies started to invest in researching atomized application solutions. The atomized spray valve would subsequently fill this niche, while also affording formulators the opportunity to sell these products to a larger potential market of end-users. In the end, equipment manufacturers, chemical formulators, and the customer all benefitted because they were able to access their preferred material and process the chemistry in the most efficient way possible. This type of win-win scenario is indicative of the relationship shared by equipment fabricators and chemical formulators.

As equipment fabricators and material formulators need each other to be successful, each entity often finds itself on the forefront of developing technology for the other. This provides valuable insight into new technology and global trends within the industry. Often, trends in material usage follow not only what is the new technology of the time, but the industries that are investing in new equipment, researching new materials, and using higher volumes of coating. As a result of various physical properties represented in each chemistry, many coatings generally follow the industry they serve. For instance, during the past two years, as the global automotive industry has recovered, we have seen an increase in demand for silicone coating products due to their excellent temperature and moisture resistance. Similarly, as aerospace, home appliance, and consumer electronics products are coated, one tends to see more UV and moisture cure acrylics and urethanes as a result of their overall protection properties and ease of reworkability. That said, it’s not always the newest technology on the market that drives coating material decisions, but also the industry and subsequent environment that the end-product is exposed to as users identify the appropriate chemistry for their protection requirements (Table 1). This translates to frequent fluctuations in what coating materials are being utilized in automated applications based on the profile of the customer.

Another factor that can trigger growth for a specific chemistry is the geography of the application. The type of materials utilized can vary greatly, depending on the regional preferences, environmental regulations, application process and market niche. While silicones have gained traction, solvent-based acrylics and urethanes remain very popular in Europe, where they have historically dominated. Solvent-based chemistries have broad appeal, but are even more popular in pockets of the US that sprout subcontractors that service the aerospace and defense industries. Take a region like Florida, for example, that seemingly has dozens of contract manufacturers, all primarily servicing the same industry. In stark contrast, states such as California or Minnesota that have very tight restrictions on solvent or VOC emissions drive coaters to more environmentally friendly formulations. Restrictions or simply personal preferences such as these have caused many chemical companies to revisit their formulations over the past decade and introduce more environmentally friendly versions of coatings to open new markets for their products.

Silicones and UV products remain strong competitors in Mexico, Pacific Rim, Korea and China, where automotive component production remains strong. In those areas, numerous moisture-cure silicones are popular for their physical properties, but so are UV materials for their speed of cure – a necessity for high-volume production.

All this segmentation in the coating industry has driven chemical companies to the most prominent current trend in the marketplace: customization. No longer is one coating chemistry versatile enough for the changing demands of the consumer. It is no longer unusual to take a longstanding coating material and have eight to 10 versions of the formulation on the market. Viscosity modifications, sometimes from 20cps all the way to a non-slumping gel version, tend to be the most popular. If one is looking to modify the flow characteristics, limit wicking into keep-out areas, produce a dam, or control the solvent-to-resin ratio, there is typically a product tailored to their requirements.

Maybe the appearance of the coating is of greater importance to the end-user. This can be as radical as the physical color of the coating itself or perhaps just the level of fluorescence under black light. Some end-users do specify the coating needs to be visible to the operator from a predetermined distance from the application. Maybe a technology is proprietary to the point that an opaque coating protects the design in lieu of transparent materials. Such requirements may drive an end-user to request a custom formulation with these properties.

No matter the request, from appearance to viscosity, to the cure mechanism or even changing the solvent carrier to a VOC-friendly alternative, custom formulations have become the norm more than the exception, and chemical manufacturers are marketing these products as standard solutions. End-users should always work with formulators to ensure that any modification to the original chemistry does not affect performance properties such as adhesion, protection or curing. From an application standpoint, having a chemistry slightly altered may affect a variety of process parameters, so always consult with the material manufacturer and applications staff prior to a formulation change. In an automated process, the changes may be as simple as modifying the robot speed or adjusting the path spacing to compensate for the new flow characteristics, but these factors can always be prequalified in a test laboratory.

Frank Hart is sales and marketing manager, PVA (pva.net); fhart@pva.net.