Rogue distributors sell massive amounts of fakes. One company is fighting back.

The Government Accounting Office revealed to the US Senate on Nov. 8 that it had carried out a sting operation this year, targeting electronics parts counterfeiters.

A real Law and Order thriller, with great import to the electronics industry, hides beneath clinical governmental prose submitted as testimony by the Office to the recent Senate Armed Services Committee hearings.

Thrilling perhaps, but a cautionary tale if ever there were one. The operation demonstrates a steadily increasing level of efficiency in the global electronics counterfeiting black market. The counterfeiters are fast on the draw, and getting smarter.

First the background: The recent Senate Armed Services Committee hearings exposed to the public in a big way what industry and government have known for some time. The unspeakable has been spoken: There is a flood of counterfeit microchips into the military, including in critical weapons systems. Even to a company like ours, which has been working with an agency of the US Department of Defense since June on a pilot to address the problem, it is enough to take one’s breath away. Upwards of one million counterfeit parts have been identified by the Committee, and that is probably just the tip of the iceberg.

“It is,” warned Sen. Carl Levin (D-MI), co-chair of the committee, “putting our military men at risk and costing us a fortune.” And he went on: “According to the semiconductor industry, each year counterfeiting costs $7.5 billion in revenue and a loss of 11,000 jobs.”

But the GAO, not satisfied with stats, went a very convincing step further. Its operation went like this:

- A fictitious company was created, complete with a fictitious owner, imaginary employees, mailing and email addresses, a website, and a listing on the Central Contractor Registration.

- The fictitious company (we’d love to know its name) then successfully joined two Internet sites claiming to vend military-grade electronic parts.

The “company” then requested quotes on three kinds of part numbers:

- Authentic part numbers for obsolete and rare parts;

- Authentic part numbers with postproduction date codes (date codes after the last date the part was manufactured; and,

- Totally bogus part numbers. Yes, they made them up. (The GAO had checked with the Defense Logistics Agency of the DoD to verify that the numbers never did in fact identify any electronic parts.)

Quotes accepted, the vendors dutifully delivered 13 components, which were then submitted by the GOA to SMT Corp., an independent distributor known for rigorous verification testing of electronics. SMT was able to complete testing on seven by the time of the Senate hearings.

The result?

None of the seven was authentic. Not one. As for the bogus parts, those that never actually existed, well, they do now. They were delivered by the distributor, replete with the imaginary codes requested by the GAO.

The parts included two voltage regulators and one operational amplifier, which, in the event of failure, according to the GAO, “could pose risks to the functioning of the electronic system where the parts reside.” Let’s look more closely at one of those parts: The operational amplifier of the sort that failed its tests may be commonly found in the Army and Air Force’s Joint Surveillance and Target Attack Radar System (JSTARS); the Air Force’s F-15 Eagle fighter plane; and the Air Force, Navy, and Marine Corps’ Maverick AGM-65A missile. Risks indeed.

The counterfeiters, in short, are utterly ruthless, nimble, and getting increasingly better at their copies. They have enabled rogue distributors to get away with selling massive amounts of counterfeits into the military supply chain – the recent sentencing in the VisionTech case comes to mind. (Ed.: In that case, one company employee was convicted and sentenced to 38 months in prison, and the owner committed suicide.)

As is well known in the industry, several initiatives are under way to confront the crisis. Our company’s DNA-marking technology, now in pilot together with the DLA and a major chip manufacturer, is of one of them. Integrated with the best of existing tests, we believe DNA marking has the potential to strongly mitigate the risk of counterfeit chip infiltration.

The GAO sting shows that any solution must be more than administrative, more than a change in procedures. It must be technical – measurable, cost-effective, noninvasive if possible, and utterly reliable. A technical solution is not only urgent, it is possible.

Dr. James A. Hayward is president and CEO of Applied DNA Sciences (adnas.com); james.hayward@adnas.com.

Nothing revealed shook the industry, but after a year of natural disasters, that was a good thing.

If Productronica is, as many believe, the bellwether for the printed circuit board industry’s health, 2012 should shape up better than most prognosticators are currently forecasting. Although the annual Internepcon and JPCA Show in Tokyo are larger, at least in attendance, Productronica remains the de facto prism through which the industry is observed.

Traffic at the biennial trade show in Munich was busier than in 2009, with event organizer Messe reporting attendance up 34% to about 34,000. That’s still below 2007, when it was a reported 40,000, but welcome news nevertheless. Traffic was slow on the first day, but very busy the next two, before tapering on the final day.

Compared to 2009, the physical show itself seemed smaller – and this is relative, as it remains bigger than almost all the other major electronics assembly trade shows combined – with traditional powerhouses like Siemens, Universal Instruments and other placement companies occupying booths that, while they would still qualify as monstrous at any other show, no longer fill entire halls on their own. (This is a good thing.)

For its part, Messe reported the total exhibit space was larger, but we think it was dissembling; several large lounges on the show floor were there to fill holes. Plus, we recall when the U-Bahn stopped at both entrances of the massive New Munich Trade Fair Center; this year, the East entrance to the hall was no longer needed.

Productronica is shaping up primarily as an assembly and test show, with roughly one of its halls devoted to fabrication and bits and pieces of other industries (backend packaging, plastics, solar, EMS) mixed in. Most equipment advances seen were evolutionary, with incremental improvements in speed and accuracy. There were perhaps a dozen EMS companies, mostly Germany-based. Most are heavy into serving the industrial end-markets. All but one suggested that 2012 would be flat. For additional color, we were looking forward to the CEO roundtable late Tuesday morning, but as it turned out, the event was held in German. Verflucht!

Material Issues

Comments regarding low-Ag solders were cheap and plentiful. Most solder vendors agree that, despite the lower cost, assemblers find having to perform yet another round of alloy testing a turnoff. Moreover, there are questions over the applications for which they are best suited. Europe is pushing for nonflammable alternatives to freezer sprays. Europe and the US are not in sync when it comes to MSDS standards. Europe has standardized on a form, while the US is coming under fire for failing to do the same. AIM showed its NC258 no-clean solder paste, which debuted earlier last year. Electrolube displayed an array of new sprays and coatings, many driven by REACH requirements. Likewise, Henkel had a new paste and flux, the Pb- and halogen-free Multicore HF200 solder and halogen-free, no-clean MF390HR flux, and two new adhesives: Ablestik ICP-3535M1, a single-component electrically conductive adhesive and ICP-400, a conductive silicone. Senju rolled out the M40 line of low-Ag paste, but a representative said its industry outlook for 2012 is poor.

DEK president Michael Brianda said the company continues to develop dispensing technology that supports the printer for customers that do not need a dedicated high-volume dispenser. (See the full interview at http://www.circuitsassembly.com/cms/component/content/article/5-current-columns/12108-brianda.) Speedprint added a glue and paste dispenser to its SP 710 printer.

Asymtek named as president Peter Bierhuis, formerly president of March Plasma. PVA showed a pneumatic pump, DPCC, said to reduce air pressure on the conformal coating fluid reservoir and thereby prevent bubbles from forming. It can be installed on the new PVA6000 coater and dispenser. They also mentioned a trend toward solvent-based conformal coatings and higher flow underfill. Ersa debuted the F1 screen and stencil printer.

Placement OEMs are always the highlight of Productronica, and none of them would consider skipping this show. Juki showed several new machines, including the KE-3010, a high-speed placement machine capable of 80,500 cph per IPC-9850, and the KE-3020V, which handles everything from 01005 to 50 x 150mm and 75 sq. mm parts. Assembléon debuted a multifunctional platform called the iFlex, which potentially would compete with the Yamaha lines it has for years distributed. For its part, Yamaha has been gearing up to establish a direct US and Europe sales and service presence, hiring staff (including GM Scott Zerkle, formerly of

Assembléon) and developing a new North America channel with one of its longtime Asian distributors, Transtech. Samsung showed its new SLM 110 Smart LED mounter, a dual-head machine with a patent-pending feeder. Universal debuted its latest Genesis pick-and-place machine, GC-120Q.

Ersa released two soldering lines, including the small-sized EcoSelect 1 selective soldering machine, and a hybrid rework system, the HR600. IBL showed several vapor phase machines, including a new inline model, the CX600. SMT-Wertheim showed its QP-L-Plus reflow oven. Vitronics has sorted out its production; wave machines are being made in China, reflow in US, and selective in Netherlands.

There was at least one potentially significant cleaning advancement: Speedline Technologies introduced its first batch cleaner, the Aquastorm 50, which uses patent-pending technologies common to the Aquastorm 100 and 200 inline cleaners to deliver dynamic energy to the board. The system’s rinse control reportedly guarantees desired board conductivity, and the drying technologies dry product to 0.1g of prewash weight. It is expected to be introduced in the US this quarter and elsewhere in the June quarter. Aqueous Technologies CEO Mike Konrad revealed 85% of its customers are cleaning no-clean flux. Zestron introduced Vigon N, a flux residue cleaner. After attending graduate school and spending several years running its US operations, Zestron CEO Harald Wack has settled back in Germany with no issues. Kyzen debuted the E5321 alkaline cleaner for pallets and general maintenance.

BPM Microsystems’ Model 4800 automated device programmer line can now program 36 devices concurrently, including all types of flash memory. Data I/O had its RoadRunner 3 automated inline chip programmer, which connects to MES or other shop-floor control and ERP software, including Aegis, with whom Data I/O just inked an agreement.

Goepel’s Opticon 3D x-ray offered real-time multi-angle image recording at test speeds of 40cm²/s. Meanwhile, the Opticon AOI can handle up to 32 devices under test simultaneously using a top camera and bottom-side scanner. Viscom mentioned its Europe and North America markets have been strong. The company is marketing Viscom as the sole inspection company that covers all test gates, from wirebond to assembled component. Mirtec exhibited its latest benchtop enhancement, the MV-3 AOI, featuring one top-down and four angled 10 MP cameras. Vitrox showed the 510XL x-ray, which handles maximum board sizes of 610 by 610mm (24 x 24"). Dage debuted X Plane technology, a software tool that mixes certain component adjustments, retrofits and new software in order to separate the component package, wirebond and board layers to reveal voids and other hidden defects. While solder volume characterizations are not possible, it was suggested they are potentially not far away. A rumor began, then subsided, over Koh Young’s patents on dual lighting. The patents have been challenged in several nations as being overly broad. Koh Young reports courts in Korea and China have upheld the patents, however. DJ Tech, the Japanese AOI company, showed a 2D/3D SPI. Acculogic had the Flying Scorpion FLS980 DXi double-sided probe tester.

Etek Europe has moved into its new $1 million headquarters. The Scotland-based distributor has added 14 staff in the past 18 months and is adding a demo room and possibly IPC training. It also has registered Etek USA. Managing director Mike Nelson did not sound like Etek will come to the US in the near term, but it could be on the horizon.

Rise of the Robots

The PCB fabrication exhibits have shrunk over the years and are now down to about one hall (although exhibitors were spread over two, intermingled with large lounge areas and contract assemblers). Like the (much bigger) assembly sections, exhibitors felt Tuesday’s traffic was slow, but Wednesday and Thursday were strong. Ten years ago, Productronica featured lots of large plating and develop/etch/strip lines and lamination equipment designed for large and heavy backplanes. Meanwhile, machines shown at the CPCA Show in Shanghai could fit in a shoebox. That equation has completely flipped: Productronica is now characterized by ample models of small-scale prototype and batch production equipment. Still, the number and quality of lines far outpaces that of all other Western shows (namely IPC Apex/Expo). Notable for its absence was Hitachi, the world’s largest PCB drill supplier. Nor did we see any laser drills onsite.

In the fabrication halls, robotics were the rage. Around 2000, sensors seemingly overnight showed up in almost all equipment. We witnessed perhaps the beginning of a similar surge in robotics: Several systems had robotic arms or handlers, including Kuttler’s Cleanline loader.

Most major laminate and material vendors were there, including Kingboard, Isola, Nelco, Rogers, ITEQ, OMG, Uyemura, Dow and others. There was a difference of opinion as to how important halogen-free materials are today, with some vendors asserting they are of low priority and others (Shengyi Tech, for one) indicating high demand, especially in Japan and Europe. Many echoed Arlon, which said it saw plenty of demand for high-temperature materials. ITEQ sees business flattening, while others willing to comment were slightly-to-somewhat more positive. Most felt the next two or three quarters would be bumpy, and there were complaints of Chinese knockoffs of raw materials and finished laminate. The good news is that shortages of glass and other raw materials brought about by the March earthquake in Japan have receded.

Isola said its high-speed digital business is growing, and the company is adding capacity in Taiwan. Rogers was busy, with customers mainly from Germany and Europe. Shengyi Tech said lead times are stable. Kingboard noted higher interest in Pb-free laminate materials. CCI Eurolam shared a booth with Isola, whom it distributes in Europe. It showed its Zetalam base materials.

Italian OEM Chemplate showed its Indubond 130N inductive bonding machine, said to facilitate pin registration for printed circuit board innerlayers. Bungard showed new lamination, UV exposure and drill and route machines. Dave Howard said 2011 was a record year for Bürkle, buoyed by a strong first half in photovoltaic and other non-PCB equipment sales, but he did not seem as optimistic about 2012. CA Picard agreed that after 18 strong months, the market has been quieting down since September. Dynachem has introduced two new machines in the past two years, including a new cut-sheet laminator, the SmartLam 5000. Activity was hopping at Kuttler Automation, which displayed a new Mylar peeler (P650), featuring an optical-based off-center adjustment. It also reported on, but did not have at the show, a new copper recovery system.

It is remarkable how many Germany-based equipment manufacturers remain, even though the continent has seen its bare board industry decimated. (It’s more or less AT&S and then everyone else.) Walter Lemmen, another of the miniature line makers, had a UV LED maskless lithography machine and a compact final finish line (named, appropriately, Compacta). Posalux sold a drill to HMP. Lenz had a CNC drill and router. LPKF said the show was busy, with interest from both the fabrication and assembly side.

Orbotech’s booth was busy, in part because of its success in the LDI market. Miva has a new photoplotter and direct imager aimed at low-volume and prototype markets. Apollon-DI had a UV-LED direct imager.

Known for its continuous plating lines, PAL had no equipment to show because most US and European fabricators use batch plating. Pola e Massa had some robotic advancements to its wet processing and handling equipment.

Atotech shows several new products ranging from via fill to photoresist adhesion materials to the Touchless Transport System, which offers lateral guided transport of touch-sensitive surface, such as embedded circuits for its Uniplate systems. FujiFilm is expected to announce Multiline as its distributor in Europe. Interest in white solder mask is growing, especially for LEDs.

Polymer Ag had a slick new cross-sectioning system for laser-drilled holes. The aptly named Micro Hole Cross Sectioning sections holes down to 0.003" starting from the center of the via, and can lop a two-hours-long manual process down to about 4 min. Luther+Maelzer showed the A5 flying probe tester. Lloyd Doyle is a shell of its former self.

Unlike PCB assembly, Eastern Europe has been slow to adopt or attract fabrication. When asked, most exhibitors pointed to the region’s lack of process knowledge.

2011 likely will go down as a transitory year. Business dropped from the big rebound in 2010, but not so much as to call it a recession. By and large, the electronics design and manufacturing industry outpaced the broader economies, a testament to tighter business and process management. Yet the supply chain had to deal with multiple significant disruptions, and all these vectors will influence changes in the years to come. News out of Bangkok was that the waters rose so high, some factories were soaked on their second floors. Expect a big wave of new machines to replace the thousands lost in the flood. This should help give the equipment industry a bit of a reprieve from a slowdown that is expected to last at least three quarters. Some placement companies reported receiving more than 100 orders to date.

Also, the big drop in the solar market will claim many victims. Some think, once the bloodletting is over, there will be only a handful of companies left. Others aren’t so dire, but the clear consensus is that there is tremendous overcapacity in solar (estimates run north of 35%), and that it will be two to three years before demand and supply reach equilibrium again. In the meantime, expect companies as varied as DEK, BTU and Bürkle, plus a host of materials vendors, to spend more time concentrating on SMT again.

Mike Buetow is Editor in Chief of PCD&F/CIRCUITS ASSEMBLY; mbuetow@upmediagroup.com.

AOI reliability suffers from bad data.

Memories of a less-automated environment, where quality was occasionally “inspected in” a product, are difficult to banish. Along with quality improvements that resulted from higher levels of automation in process manufacturing, emerging automated inspection technologies, now with decades of development behind them, are striving to eliminate the potential for human error.

The ideal manufacturing setting would have an SMT (or through-hole) line dedicated to a single product, and first-article inspection (FAI) would be performed on the first-off assembly. Then the line would run for the next 12 months building nothing but exact copies of that same rev level of that very first article. Under such a scenario, we might even have a flawless parts verification system that couldn’t be circumvented by reel replacements or splicing. Add closed-loop SPI to this equation to ensure no paste printing problems materialize, and perhaps an AOI machine that produces no false calls or escapes. To round out that awesome configuration, let’s add AXI at the backend to reveal those nasty hidden joints!

Despite high levels of technology and automation applied in high-volume scenarios, many users still likely require an intensive first-article inspection before confidently releasing the line to run.

In fact, those in most need of FAI are companies that perform large numbers of changeovers, given the greater number of opportunities for error. A significant proportion of assembly facilities, including many with AOI, continue to involve personnel in the FAI process. Even those dependent on AOI tend to use human oversight on the first board, relying on a combination of AOI data and operator or inspector input to decide to release the line to production. While higher volume, repeat products can often be successful with this approach, for most manufacturers some level of visual inspection is mandated on the first-offs.

The FAI process is detailed and compares BoM and CAD data to the first-off PCB, with cross-references to some subset of drawings, checklists or inspection process documents. This detailed inspection process ensures that every part number on the BoM has been placed in its preordained position on the board, according to the CAD data. Often, this is done by a two-person inspection team, to maintain the focus of the inspector operating the microscope. This is a time-consuming process, and human inspectors bear the burden of responsibility for ensuring that all upstream programming, machine loading and placement activity is correct. Despite the overhead of such an inspection process, many do it, as the costs of rework and lost business are far higher than the long changeover penalty of performing manual FAI.

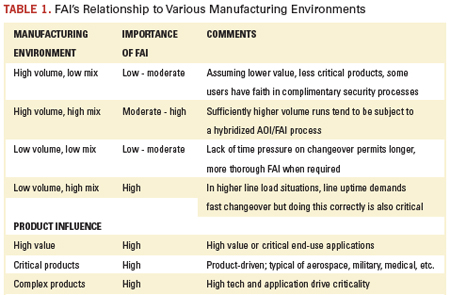

A growing number of equipment providers, as many as eight to 10 currently active in North America, now offer automated FAI systems. Table 1 shows an outline of the potential relative importance of FAI across a variety of assembly and product environments.

How FAI Works

Isn’t FAI just another name for AOI? Not quite. The whole idea of AOI is to help ensure that what’s coming off the line is exactly the same as the sample with which it is compared. Say, for instance, you’ve completed the first production run of 5,000 boards for a new customer. The PCBs passed QA, were shipped on time and fit in the customer’s new product. Then the worst possible thing happens: a failure, possibly due to an incorrect component that was placed on the line. What’s the reason? Every unit passed AOI with flying colors against the program, or the AOI version of the golden board.

While the AOI might have done its job as programmed, we are occasionally subject to the cliché “garbage in, garbage out.” Moreover, there is a known or expected false call and escape rate with AOI, which makes it a poor choice for FAI.

In contrast, first-article inspection is used to ensure that the first board off the line is populated and assembled perfectly and provides a master to benchmark against. As a discipline, it has been around as long as the PCB, and typically works like this: 1) set up SMT machine, 2) load feeders, 3) load program, 4) build first board, 5) get two trusted people to inspect board using bill of materials, drawing and microscope or magnifier lamp, 6) get same two trusted people to complete detailed documentation correctly for traceability purposes.

Apart from chronic inaccuracy, the primary issues with conventional first-article inspection are that it’s slow, laborious and expensive. Two dozen parts on the board are not a problem, but a 12 x 14" PCB with 1200 components or, in the case of a smartphone, a 4 x 2" board with a similar number of parts would take many hours to conduct a thorough inspection against the BoM and drawing, with two people trying to communicate with each other and fill in the paperwork at the same time.

Modern FAI is a computerized method of inspecting that first board. It is a logically validated, semiautomatic system that integrates visual inspection with document or data file control and traceability reporting. Boards are checked for errors against a platform of strictly controlled procedures to eliminate risk of failure. Here’s how:

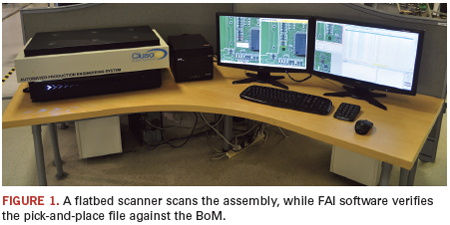

CAD and placement machine and BoM data are loaded into the Windows 7-based system as ASCII files. The system automatically verifies the pick-and-place file against the BoM to ensure no extra, missing or changed parts. The first-off, completed PCB is loaded into the system’s camera-based image scanner, and the digital image file is displayed on a monitor, ready for inspection (Figure 1). That’s the first practical benefit – time saved because FAI doesn’t require manual programming.

All BoM data are reviewed relative to the image on the monitor, which brings up an expanded view of the part under inspection. There’s no need to check off parts in the system because the BoM data are 100% accurate, having come from the placement machine, or further upstream if validation of the placement program is also required. The location of individual parts on the PCB is automated too, as the coordinates also are from the pick-and-place files or original CAD data set. Combining all the data and the image file into a unified, digital system makes the first-article inspection task efficient and effective, while the operator is free to focus on visual inspection of the parts in a systematic, unpressured way.

Once inspected, the first board is saved as a master. Any boards from subsequent production runs may be compared to ensure no parts have been added, deleted, rotated or moved. This way, the system can be used for first-article inspection and production audits, for ECO implementation, and as a diagnostic tool to verify components on boards that fail at test. The data set is then saved for future production runs. The system interfaces with common Windows-based programs to provide traceability reports in a format of the user’s choice.

Interestingly, AOI users occasionally modify the functionality of their equipment to give a sometimes-adequate version of FAI. More often though, due to the pressures of delivery deadlines, the inspection process is harassed and hurried to the point of occasional failure, while the difficult task of educating users on alternative FAI strategies remains in the hands of the small equipment manufacturers that are developing solutions for these problems.

Alternatives offer the potential to be significantly faster and more accurate than traditional techniques. New FAI systems enable those assemblers already engaged in full first-off inspection to recover significant changeover time, with the corresponding improvement in asset utilization. These lower-cost FAI systems provide a complementary process to AOI and are not designed to be a substitute.

Production versions of some FAI platforms are in use at some of the world’s Top 10 EMS companies, along with a host of smaller OEMs and EMS companies. One such firm is MicroArt Services, an electronics manufacturing and design services company based in Toronto, Canada. MicroArt operates five SMT lines 24 hours a day, 6 days a week, building as many as 400 unique part numbers every month. Director of operations Mark Wood says some larger boards that were taking four hours through first-off inspection are now being done in 30 minutes. Over a month’s time, Wood expects to recover some 400 hr. of SMT line uptime across the plant.

Acknowledgments

With grateful appreciation for the contributions of Mark Wood of MicroArt Services Inc.

Paul F. Walsh is general manager of Brock Electronics (brockelectronics.com), a distributor of FAI systems; paul@brockelectronics.com.

The tsunami in Japan shook more than just a nation; the shock waves were felt across the entire supply chain. Coupled with the overwhelming floods in Thailand, companies have been forced to look harder at their channels than at any time since the great tech meltdown of 2001-02. Alex Iuorio, senior vice president, supplier management at Avnet Electronics Marketing Americas, spoke with CIRCUITS ASSEMBLY Editor-in-Chief Mike Buetow about the after-effects and the overall muting of the supply chain cycles.

CA: As we approach the nine-month anniversary of the Japan tsunami, has Avnet EM noted any changes in the way customers are managing their supply chains?

AI: What happened was 21% of frontend development and 85% of BT resin was taken offline. Obviously, the frontend concerns were fantastic. But whether it was Japan’s ability to respond to the disaster, coupled with significant raw materials and finished goods inventories – that is, Japan’s intense treatment of the problem, plus what was already in the pipeline – on a tactical level, there probably wasn’t near the perceived impact.

On a macro effect, two things showed through: One, bookings that were probably going to reside in the June quarter were moved into the March quarter. The clear effect was inordinately higher book-to-bill rates at end of May and into April. Then it fell off the table, and industry now sits at one or below one.

The second big effect is the real scrutiny of the supply chain as it existed in Japan leading up to the tragedy and beyond. What was discerned is that Japan had hyper-efficient but fragile supply chains. It was a compilation of so many small companies within those supply chains. All you need is to be [missing] one part and you can’t build. We’ve seen shifts to Taiwan and China, depending on need and expertise.

So in short, we saw bookings accelerated into the March quarter and a real reckoning in the supply chain in Japan to achieve objectives of efficiency without being so fragile.

CA: Are manufacturers stocking more to ensure supplies of key components? If so, any particular parts?

AI: We don’t have great visibility into the top tier manufacturers. Our sweet spot is the secondary account base. There, we have not seen changes in buying patterns, but big changes in behavior. In Americas, we generate more than $5 billion in revenue. Of that, over half is supply chain services. That means, at some level, we take a customer forecast and reaction and look at the pipeline, and customers draw off those as a form of inventory management.

People are realizing we are past the worst of it. People want to know what is going on with specific suppliers, where we expect shortages to occur. Nothing different, but we see a substantial leveraging of Avnet as a supplier and quicker information gathering.

CA: Is Avnet itself changing its ordering or stocking practices in light of the Japan tsunami or any other external events?

AI: Our response can be described in four ways: 1. We implemented controlled manual release programs, for all products with country of origin = Japan. 2. Where we didn’t have control, we took certain products off the Internet [catalog]. 3. Where we thought lead times were extending, we used our tools to try to service their manufacturing needs. 4. We sent out “Light the Target” notifications to Avnet’s customers. This follows the same practice we conduct for end-of-life. We pulled SKUs, and account managers notified customers of shortages and optional cross-reference parts.

We wanted to take a proactive approach. Avnet has in place a doomsday scenario. From experience, cycles many times yield specific allocations from suppliers. We followed that protection process to build a model for Japan.

CA: Are manufacturers stocking more to ensure supplies of key components? If so, any particular parts?

AI: Not particularly. I don’t see that happening. What we do see is a much higher degree of analysis of what we have in inventory.

CA: Is that changes in software? Or more phone calls?

AI: Since 2000, we’ve seen substantial investment in the supplier community to discern visibility. But nothing stops the voice-to-voice communication.

CA: Are manufacturers maintaining the JIT/Lean types of practices as adopted following the 2001 tech downturn?

AI: It’s a question of economics. Certainly you don’t want more assets in your supply chain than you need because it costs you money. At the same time, this was a peculiar phenomenon based on a specific event that impacts the world in so many areas. So maybe not more stockpiling, but more scrutiny in the up-and-down supply chain, and not inventory build as a standard process. You had a temporary inventory build at some OEMs because they didn’t know what the situation was going to be. But those behaviors at the very frontend, the easy answer was pull it in and protect yourself. But the fact the supply chain responded as it did probably shows those behaviors will mute over time.

For example, consider that Japan is responsible for 56% of all ceramic chip production. There were spot shortages in those products, but nothing compared to what it could have been.

CA: Does Taiwan have a similar disaster plan in place?

AI: I can’t comment on whether other major manufacturing countries would have these kinds of strategies. Overall, the recovery probably occurred 60 to 90 days earlier than estimates.

CA: How have other macro financial events (debt ceiling, Euro currency crises, etc.) affected inventory and ordering activity, if at all?

AI: That’s really out of my wheelhouse.

CA: How have other specific industry vectors such as the counterfeiting of components affected inventory and ordering activity, if at all?

AI: Avnet is a member of the ECIA (Electronics Components Industry Association), formerly NEDA (The National Electronic Distributors Association). We’re working together to promote the importance of purchasing from an authorized source. Insofar as counterfeiting, we have found when you buy from authorized channels, you don’t end up with the problem. But the moment you go outside the authorized channels, you are leaving yourself wide open.

We are working with our suppliers to ensure that their parts are verifiable. Being a company that deals with franchised manufacturers, I’m already getting certificates from them. But let’s be honest, when we get into a constriction environment, for any reason, Purchasing has to keep its lines open. We have seen much more scrutiny. Anecdotally, customers are taking a more mindful view of whom they are buying from and the traceability of those parts.

CA: Have you seen any indications that original component manufacturers are changing their production strategies beyond what would be considered normal business response to demand cycles?

AI: In a general sense, we’re no longer seeing in the cycles this wholesale addition of capacity – from feast to famine. The cycles are becoming a lot more muted. We have better tools, and as an industry don’t tend to add capacity for the sake of capacity. We add it prudently and consistently.

I think it goes to the information systems we have in the global supply chain. They have a lot of information they are trading in terms of lead times and source of manufacture, whether it’s precious metals or plastics or silicon. We do find when we talk to the major semiconductor manufacturers, they are very wired in upstream and can share that info with us.

Is it safer to leave noncorrosive flux residues on the board following hand soldering?

A large OEM recently commented on IPC’s TechNet forum about topically cleaning ROLO (rosin with no halide activators) flux residues from circuit assemblies. The OEM inferred that spot-cleaning methods are inconsistent and damaging due to the tendency to spread residues over large areas of the board and under low-clearance parts. The OEM, not having access to automated cleaning once the final assembly is complete, strongly advocated leaving RMA flux residues on the assembly, since rosin is an excellent electrical insulator and often results in higher surface insulation resistance (SIR) levels than bare, fully cleaned boards.

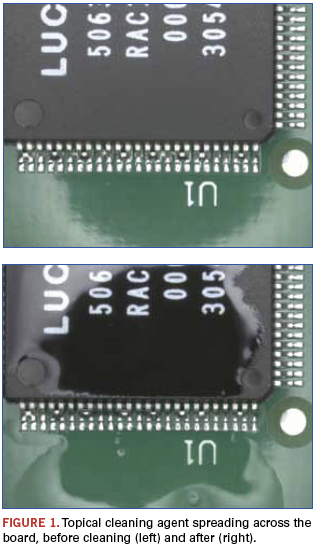

In consideration for the OEM’s argument, topical cleaning agents are formulated with organic-based solvents designed to dissolve the residue. Common topical cleaning solvents include oxygenated solvents such as isopropyl-alcohol (IPA) and halogenated-alcohol blends. As the OEM contends, the dissolved flux residues have a tendency to spread across the board and under components (Figure 1). When the solvent evaporates, non-volatile contaminants may still be present. These non-volatile residues, whether non-ionic or ionic, may create a reliability risk.

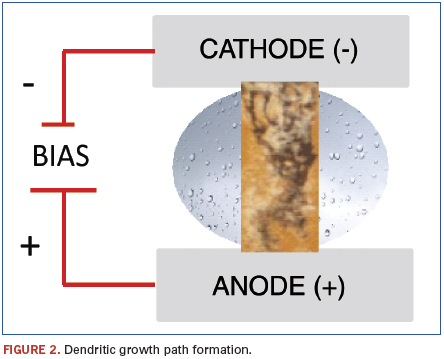

To compound the topical cleaning issue, partially cleaned flux residue exposes organic acids present in the flux. Ionic residues are hydroscopic with the tendency to attract mono-layers of moisture. Moisture in combination with ionic residues dissolved into mono-layers of water becomes an electrolyte that can transfer trace metals across conductors. Metals, being positively charged ions, are attracted to the negative cathode. When the board is powered up, the electrical bias will slowly plate metals present in the electrolyte. Over time, the metals will form a tree-like dendritic path that will eventually short the component (Figure 2).

So, does this mean that the use of topical cleaners is bad? During assembly and joining, soldered assembly reliability is directly related to cleanliness. Topical cleaners provide an effective method for removing flux and handling residues following precleaning, hand soldering, component replacement and rework. Topical cleaning is an intermittent step for removing these harmful residues during the build process. Final board cleanliness becomes the most important metric to achieving a reliable assembly. Once the assembly process is complete, the board should be processed through automated cleaning equipment to remove any remaining residues left on the assembly.

As with other processes used to assemble boards, when best practices are employed, reliability is not compromised. For topical cleaning, IPC- AJ-820, Assembly and Joining Handbook, recommends recognizing that each step in the assembly process has the potential to leave harmful residues, and knowing the characteristics of the residue. Non-polar contaminants include compounds such as rosin, oils, and waxes, which are usually insulators. Ionizable polar contaminants are usually salts introduced to the assembly during production via flux activators, human skin, and fabrication plating chemistry. Topical cleaners should be capable of removing any electrically conductive (ionic residues) and nonconductive (non-ionic or organic) residues.

Finally, per IPC-AJ-820, topical cleaning should occur soon after soldering, and the final assembly should be cleaned using automated equipment.

The fundamental issue that started the TechNet discussion stemmed from an OEM that employs a no-clean assembly process. Since the OEM has no automated cleaning equipment, its past experience found that it was better to leave noncorrosive flux residues following hand soldering, component replacement and rework. The argument was based on the fact that topical cleaners can spread residues over the assembly and under components. In respect to the OEM assembly process, I agree it may be prudent not to use topical cleaning agents when an automated cleaning process is not available to perform a final cleaning step. For assemblers that use topical cleaning agents, a final cleaning step using automated cleaning equipment should be employed to remove non-ionic and ionic residues from the assembly.

Mike Bixenman is chief technology officer at Kyzen (kyzen.com); mikeb@kyzen.com.

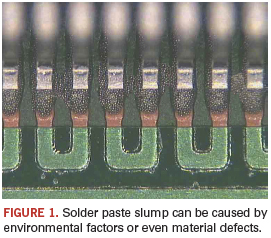

Reflow might resolve paste slump without operator intervention.

Solder paste quality today is very good and consistent thanks to controls put in place by suppliers and users. For printing problems, always go back to basics and check each part of the process and the materials used. If the metal size distribution or material quality does not meet international standards, that could be the root cause of stencil blockage problems, but also the reason for paste slump (Figure 1).

Solder paste slump can, in some instances, lead to solder shorts. Any cold or hot slump of solder paste is not ideal, but if the material volume is correct for the pad and component combination, and the pad surface solderability and pin are satisfactory, these small wet paste shorts will disappear during reflow, even more so when reflowed in nitrogen or vapor phase due to the better solder coverage. (The solder volume is spread over a larger area.)

Run some simple trials to look at hot and cold hot paste slump with reference to the test methods in J-STD-005 or the IPC-TM-650, Test Methods Manual. Look at the environment controls in your manufacturing area to see if this is a contributor. Finally, look at the placement process; Figure 1 may be simply paste displacement, rather than a paste problem.

These are typical defects shown in the National Physical Laboratory’s interactive assembly and soldering defects database. The database (http://defectsdatabase.npl.co.uk), available to all this publication’s readers, allows engineers to search and view countless defects and solutions, or to submit defects online. To complement the defect of the month is the “Defect Video of the Month,” presented online by Bob Willis. This describes over 20 different failure modes, many with video examples of the defect occurring in real time.

Chris Hunt is with the National Physical Laboratory Industry and Innovation division (npl.co.uk); chris.hunt@npl.co.uk. His column appears monthly.

Press Releases

- Altus Group Expands Aftersales Team to Its Largest Size to Date

- Incap Estonia Invests in New Flying robe System to Advance Production Performance

- Critical Manufacturing Partners with Canonical to Expand Cloud-Native Deployment Options for Manufacturers

- Heller Industries Becomes the Latest Partner to Join THE SMT FUTURE EXPERIENCE