Opportunities like this for staffing and planning are rare indeed.

There is no doubt that many in the industry are glad 2009 is over. At the EMS companies I’ve spoken with, business trends began improving in the second half. While 2010 may show a slow recovery, it should represent improvement. Human nature what it is, it can be difficult to mentally change gears when one has been in survival mode that long, which inspired this list of “gut check” questions that managers should ask themselves.

Does my team have the resources it takes to do their jobs? Budgets have been tight; teams have been downsized, and it is highly probable that the 2010 budget was planned when business was flat or in decline. As business picks up, workload will increase, and if contingency plans don’t exist for increasing internal resources, your team may start dropping the ball.

Am I appropriately recognizing my best employees? Chances are your corporate culture has been focused on self-sacrifice and a theme of doing more with less for over a year now. As workloads increase and your competitors start hiring, top performers may decide to make a career move if they feel underappreciated. Now is the time to review top performer compensation, overall employee contributions and workload, because if you wait until a strong recovery is in place, corrective action will cost far more than it does now.

Am I making the best hiring decisions? If increasing team size, focus on individual candidate qualifications rather than the companies they have worked for. Outstanding people are looking for work, and some may interview poorly because they’ve never had to look for work before. There also were a lot of people focused on “looking busy or doing face time” rather than producing results, and were likely laid off justifiably. Not surprisingly, their “interview” skills may be quite good. Consider your requirements and look for candidates with the appropriate track record. People who have spent the bulk of their careers in mid-tier EMS companies may have more hands-on experience implementing processes and organizational change than candidates who have done a short stint at a Tier I provider. Ask candidates how they would execute their new responsibilities and choose those with the best understanding of the challenges and ways to address them. Look for track records of dealing with challenges of similar size and scope, and test that knowledge in the interview. Take your time, because you will likely never again have such a good pool of candidates.

Am I capitalizing on the right emerging opportunities? By the time something is recognized as a trend, it is likely winding down and the next big unrecognized trend is in development. Over the short term, cash for aging appliances may drive increases in “smart” appliance demand, but only for companies already serving this market. Energy and defense seem to be exciting industries today, but China is developing a lot of production capacity focused on alternative energy, and defense may be a shrinking market in today’s political environment. Aerospace is another sector with cyclical demand, and passenger traffic isn’t showing the increases likely to spur demand for planes in the near term. Companies already positioned in these sectors may do well, but they may not be the best choices for companies wishing to expand their market focus. Comparatively, medical products that link to data collection or cost control may be a better expansion choice because that should be a long-term growth market. Home health care products and prosthetic devices also may continue to be a growth market given an aging population and more focus on minimization of third-party care provider costs. A weak dollar makes US manufacturing more cost-competitive, so this also may be an opportunity to increase marketing to European customers looking for North American sources across a range of industries. There also may be pockets of growth in the automotive sector in more energy efficient vehicles and accessories/infrastructure designed to support them. Spend time reviewing business targets against the patterns you see developing in the current economy, rather than simply accepting the current business mix as unchangeable or gravitating to the emerging industries based on a follow-the-pack mentality.

Has the recession driven strategic business decisions that need to change? Strategic decisions made in survival mode are often tradeoffs, rather than the best long-term plan. Review the major strategic decisions made in 2009 and determine whether or not a change in business conditions should drive a significant course correction in strategy.

Bonus question: Are you happy in your present position? One challenge of survival mode is that it can be easy to develop resentments and toxic relationships. Sometimes those conflicts disappear as conditions improve, but other times the attitude damage is too significant to change. Recoveries tend to open the door to job change opportunities. An added plus is that improving economic conditions tend to make getting great results in the new job fairly easy. If you dread going into the office, a job change may be both good for you and your current employer.

We’ve finished a year that tested the mettle of everyone in the EMS industry. We are beginning a year that will provide opportunities for the best and brightest to shine. Enjoy the ride!

Susan Mucha is president of Powell-Mucha Consulting Inc. (smucha@powell-muchaconsulting.com), and author of Find It. Book It. Grow It. A Robust Process for Account Acquisition in Electronics Manufacturing Services. Her column runs bimonthly.

As it recovers from the tragic death of its founder, the vision OEM is ready for anything.

Given that founder and chairman Steve Case’s name is synonymous with CyberOptics, it’s hard to believe someone else has been running the company for the past seven years.

So when Case tragically died in a plane crash last year, much attention turned to Kathleen (Kitty) Iverson, the company’s president and chief executive. Yet, while the task of replacing Case’s vision is unenviable, in fact Iverson has been in charge since January 2003. That’s a detail not lost upon many of the inspection and sensor OEM’s customers, who in several discussions at Productronica in November emphasized Iverson’s intelligence and skill to this reporter. Iverson spoke with Editor-in-Chief Mike Buetow in November.

CA: Steve Case was a legendary inventor. How do you replace his R&D vision?

KI: Steve had a lot of vision. He had big ideas. He was always an inventor. You just don’t replace Steve Case. [But] he wasn’t very involved in the day-to-day business. We’ve been working through what we want to do. The thing about Steve was, he [saw] the customers we don’t [yet] have. I see the customers we do have. Insofar as building an organization that got the work done, he left that to me. He had more fun talking to customers. We do have a very solid engineering team and will count on the vision coming from that team.

CA: How has Steve’s death affected the management of the company?

KI: Day to day, there hasn’t been much change. Steve was more interested in the next big thing, the outside world. Not too many of the current products came solely from Steve. The sensors’ improvements came from the R&D base, for example.

CA: How important is it for a tech company to have an engineer at the top?

KI: In my experience, top engineers don’t run companies very well. It’s very important to have a top engineer, but they sometimes don’t enjoy the people management as much as the invention.

We are structured in small, dedicated R&D teams devoted to customers. They work with OEM teams to come up with new products.

Tim Skunes, our director of business development and technology, is a technical genius. He doesn’t have Steve Case’s pizzazz, but he’s a top engineer. For me, coming from an accounting background, it’s important to have that person. We have reorganized so that Tim has more of the technologists in the organization. Then there’s Brendan Hinnenkamp, an electrical engineer with 20 years’ experience at CyberOptics. He opened our Singapore operations, and now heads product development. He’s a “crack the whip; get it done” type of personality. Also, Chuanqi Chen (Chen) has 5 years of CyberOptics R&D experience and he has recently moved to Singapore to run our Systems group. We have a lot of solid engineering talent and are well positioned moving forward.

CA: What have been your customers’ primary questions?

KI: Customer interfaces have been with me, Tim Skunes, and others. We’ve managed those relationships. There was concern – can you continue to bring us technology and innovate? They [customers] said, “Do you have concerns, because we’ve mainly dealt with you.” They were pretty short conversations, and I think that’s because Steve hadn’t been heavily involved with our current customers.

CA: Who will be the face of CyberOptics now?

KI: I will be. Steve and I shared very strong values, and great companies succeed because of their value systems. Ours are “Creativity, innovation, fairness and honesty. Work hard, play hard.” As a founder, Steve gave the company the gift of a very sound value system. I am very proud of how Steve and I managed the company together.

CA: Will the board makeup change?

KI: We will add to the board. I’ll look for a heavy R&D type to support me. I came from Emerson. I have experience mixing business and engineering.

CA: What are your strengths as a leader?

KI: I’m a good team builder. I’m not egotistical. I get good people. I’m achievement-oriented.

CA: Does a tech organization need a face?

KI: In CyberOptics’ case, I need to be that face, because Steve was such a strong leader. You don’t expect someone that smart to be that down-to-earth. In our case, I think it’s important. And in reality, a lot of the company is how the customers feel about [the leader].

CA: How is morale?

KI: Morale is extremely high, which surprises me some because we have had to take some tough actions during the recent downturn. We’ve had continuity of leadership, which is extremely important to get a company through a downturn and we have so many new products in the pipeline that you can’t help but to be excited.

We had a vision of where we wanted the company to go and we are focusing on what made us a leading-edge company. The restructuring we did was strategic in nature. The guys in Minneapolis are good at optical sensing. Our Singapore team is good at system integration. R&D is now catering to what they do best. Now we have more focused R&D, which should help us grow more profitably in the future.

In the so-called Democratic Republic of Congo, the war between various government and rebel armies has raged for 10 years, fueled by monies derived from the country’s vast mines. In the West, the war over the output of those mines is heating up.

In December, a group of OEMs called the Electronic Industry Citizenship Coalition met with the International Tin Research Institute and a representative from the IPC Solder Products Value Council in Paris to discuss elimination of so-called conflict metals by the electronics industry. Among the topics discussed was an audit program for the supply chain, the cost of which would be shared by OEMs and solder manufacturers, among others.

Solder manufacturers purchase thousands of tons of raw materials from Congo mines. Because the revenues are used to arm renegades, some in the press have taken to calling the ores “conflict metals.” Although press attention to the matter has been nominal at best, more than five million people have died, making this one of history’s worst tragedies.

Mined ores are brought to large refineries, some in the Congo, some outside, where they are melted together. From there, the shipments are sold by distributors of the refineries, primarily via contracts on the London Metals Exchange. The material received by the solder manufacturers bears no thumbprint, no genetic markings.

Any company that purchases directly from exchanges – which is more or less all of them* – stands to be affected by this nonsense. The major bar solder companies, including Cookson, Kester and AIM, could really be in for a treat. As they get a significant amount of their material from reclaimed metal, tracing the “ores” would be like trying to deduce the origin of oxygen. As a spokesman for one of the major solder suppliers told me, “It is possible for us to ask for certificates, but we would have no way to validate.” Since the refineries are closest to the mines, they should be the ones asked to audit their supply chain, he added.

But while tin has no DNA, BS certainly does, and some media outposts are shoveling it by the truckload.

In the US, legislators are working up a bill (the Conflict Minerals Trade Act of 2009) requiring companies to disclose – and prove – the origins of the minerals they buy. The Huffington Post, an influential blog cum news and opinion site visited by some 8.5 million visitors a month, has taken up the cause, recently asserting that a process is available for tracing solder materials back to the mines. (The link is http://www.huffingtonpost.com/john-prendergast/new-legislative-action-ta_b_363020.html.)

Audits, be it driven by legislation or third parties, are a misguided and untenable response. As the solder spokesman noted, “Electronics companies would never buy directly from the mines; thus, good auditing at the refineries would do the trick without pushing it upstream to companies that are a minimum of three tiers away from the conflict zone.”

As WEEE and RoHS has aptly demonstrated, the electronics industry has had it up to here with its trade groups taking expensive but politically expedient ways out. In the end, such movements have emptied manufacturers’ pockets at no benefit to the end-customer. It’s refreshing to see IPC, through its solder supplier members, fighting back this time.

The next meeting is planned for Vancouver in May. (If nothing else, one has to appreciate the places they choose to convene.) Make it your New Year’s resolution to pressure the EICC (which includes, among others, that noted worker-friendly enterprise Foxconn) and ITRI (not to mention any legislator caught advocating for such regulation) to back off on what would certainly be another hefty tax with no demonstrable return.

Selling low. A friend of mine who works in finance at a Wall Street company says an acquisition opportunity for a leading process equipment OEM came across his desk a few months back. While the improvement in the economy may spur the parent company to take this business unit off the block, what’s more likely is that the continued commoditization of electronics manufacturing will lead many investors to look elsewhere, where the potential of larger returns is greater. If a market-leading OEM with long history of profitability isn’t an attractive piece of one’s portfolio, what does that portend for those companies more prone to the industry’s rollercoaster ways? And especially now, why doesn’t Wall Street find well-run and stable conglomerates like Nordson and Dover, for instance, more appealing?

One magazine? As many readers noted, last month we co-published PCD&F and Circuits Assembly. This is not intended to be a permanent arrangement, but rather a nod to the current economic world in which we live. Either way, we’re glad you’re reading.

Speaking of last month, I wrote in this space that the TTM-Meadville deal would make high-ranking Hong Kong government official Henry Tang a 33% owner of TTM. In fact, Tang’s father would be the top shareholder.

Finally, we welcome our newest columnist, Andy Murrietta. Andy, who is a second-generation PCB veteran with experience in design, fabrication and assembly (and management), will contribute to our Better Manufacturing column.

*"More or less" may be true, but not all of them. Cookson, for one, buys direct, not through exchanges.

Optimizing x-ray tube parameters is essential to facilitate yield improvement.

The ability of x-ray inspection to nondestructively inspect components for various imperfections such as cracks and voids serves as an ongoing quality control methodology to assess materials and optimize assembly processes. Existing x-ray systems can be used for inspecting Pb-free assemblies without modification. However, because of the density variation between tin, copper and silver predominant in Pb-free alloys, it is recommended that certain x-ray tube parameters be adjusted when inspecting Pb-free BGA and chip-scale package devices to ensure optimal image contrast and enhanced analysis.

Understanding these material density variations helps explain the role that adjusting and optimizing x-ray tube parameters and test routines plays in providing a vital and sound method of investigating all aspects of device and PCB processing with respect to identifying defects in a production environment.

Any object or material within an analyzed sample that has a higher density than its surroundings will absorb more of the x-rays in that specific location. As a result, fewer x-rays will pass through the sample at that location, resulting in less x-rays hitting the capture device at that point, thus casting a darker shadow on the detector. A typical x-ray image produced by an x-ray inspection system has solder locations, device terminations and copper tracks appearing darker compared with the laminated circuit board or substrate material. The greater the density difference between the materials in question, the more clearly the contrast will appear on the x-ray image.1

The quality of the x-ray radiation produced by an x-ray tube, and its effectiveness in discriminating the different materials within a sample to produce a useful analytical image, depends on the particular x-ray tube settings used. These settings are referred to as the x-ray tube accelerating voltage, or kilo volts (kV), and the tube power, or watts (W) used to set the tube at appropriate levels to obtain an image with optimal contrast at the detector.

The accelerating potential is the applied voltage between the anode and cathode of the x-ray tube. Electrons are produced at the cathode and accelerated striking the target anode creating x-rays. The tube power is calculated from the product of the accelerating potential and the electron current hitting the target, which is usually made of tungsten. The more power used, the brighter the x-ray source; however, there are technical limitations on the maximum power that tubes can achieve.

The kV setting is also a measure of the penetrating power of the x-rays. The higher the kV used, the more penetrating are the resulting x-rays. This means higher kV levels need to be used to image dense or thicker objects. Conversely, at lower kV levels only thin or less dense samples are inspected.

The interaction between penetrating radiation and matter, such as x-rays passing through a sample under test, is a complex relationship based on a number of factors. An important consideration is that absorption of the radiation increases with the atomic number and density of the material that is present.

Material Properties

Historically, the most common SnPb solders have consisted of 63% tin and 37% lead. The most prevalent Pb-free solder alloy in use today is the SAC alloy, which contains a mixture of tin, silver and copper. Although different alloys available from various suppliers have varying elemental ratios, the majority of SAC alloys contain approximately 97% tin.

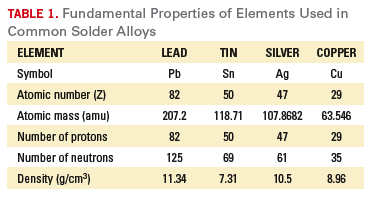

Table 1 shows the differences in the atomic number (Z) and density between the different elements contained in SnPb and Pb-free solders. Lead has a very high Z value and has been replaced in Pb-free solder alloys with an increased quantity of tin, which has a much lower Z value, as well as a lower density. Therefore, the effect of imaging Pb-free solders using the same x-ray tube parameters used for SnPb solders may result in the image being overexposed. This is because the lower Z value and less dense materials contained in Pb-free alloys will absorb fewer x-rays, permitting more to pass through to the detector, potentially saturating it.

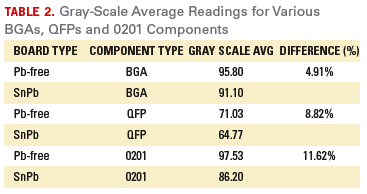

This difference in Z value and density between Pb-free and SnPb solders can be noticeably observed when imaging the solder joints for a variety of components with different mass and thickness (Table 2). The measurement data consist of average gray-scale readings obtained from 30 readings of each type of component with background variations accounted for, as well as the calculated differences between Pb-free and SnPb images.2 The x-ray parameters kV and power level were kept the same for Pb-free and SnPb components for these readings.

To compensate for this effect, it is generally necessary to decrease the tube kV and/or the power values that have been used for x-ray inspection of SnPb solder when inspecting assemblies produced with Pb-free alloys. This will ensure suitably contrasted images are available for analysis. However, these changes are very small in quantity with decreased values of 5-20 kV for accelerating voltage and/or 0.1-0.25 for power. This also depends on the x-ray system being used, due to variations in tube efficiency, capability and brightness from manufacturer to manufacturer.

Optimizing X-Ray Parameters

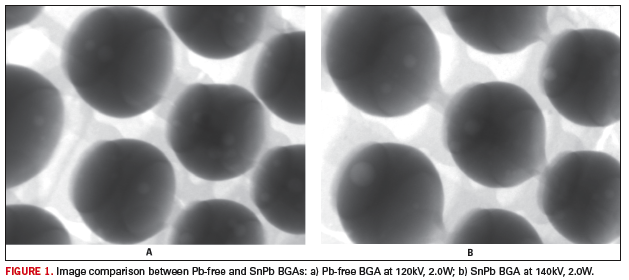

When optimizing x-ray tube parameters, the actual adjustments are to a great extent dependent on the thickness and mass of the solder joint for various components. In the case of BGA components, it is suggested to lower the kV value when inspecting a Pb-free solder joint (Figure 1).

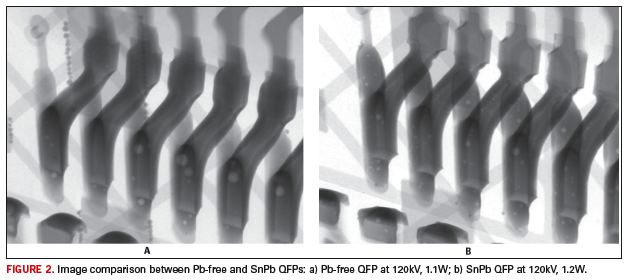

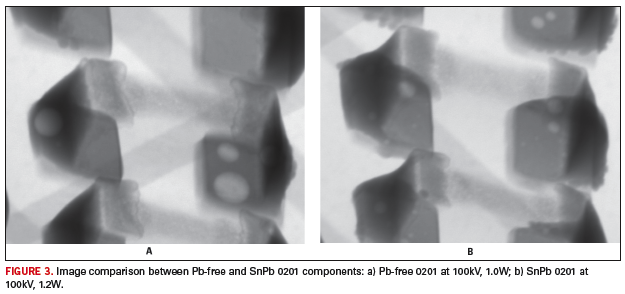

For Pb-free components that have thinner solder joints, such as a quad flat package or an 0201 discrete component, a slight lowering of the power setting and/or the kV will achieve an optimal image (Figure 2 and Figure 3).

As can be observed from the figures, adjusting the x-ray tube parameters with a lower kV or power level optimizes the image quality of Pb-free solder joints and facilitates a complete analysis of potential defects such as cracks or voids, as well as other manufacturing anomalies.

The key requirement of x-ray inspection is that hidden defects such as cracks, opens, bridges, shorts, voids, etc. can be seen so that process and quality control can be maintained throughout the assembly process. Inspecting Pb-free solder joints requires consideration be given to the implications of the material differences exhibited by the elements present to ensure that optimal image quality is maintained to enhance manufacturing process yields.

References

1. David Bernard, “An A-to-Z Guide to X-Ray Inspection,” Circuits Assembly, December 2007.

2. Evstatin Krastev, “X-Ray Image Comparison, Lead-Free and Tin-Lead Boards,” IPC/JEDEC Lead-Free Reliability Conference, December 2007.

Dr. Evstatin Krastev is applications manager for semiconductor packaging and printed circuit board inspection at Dage Precision Industries, a Nordson Co. (dage-group.com); ekrastev@dage-group.com.

How the CAM engineer can make the difference.

Embedded in fabrication planning is calculating panel size, checking layer stackup information, reviewing expected yields, reviewing board construction and verifying impedance control calculations.

Typical panel sizes are 9 x 12˝, 12 x 18˝, 18 x 24˝, or 18 x 36˝. A number of factors need to be considered when calculating panel size. For instance, consider a small board of 25˝2. A relatively high number of this small board can be panelized in an 18 x 24˝ panel. But board complexity and density, or such factors as high-speed signals, trace thicknesses, or controlled impedance, could favor a 9 x 12˝ panel.

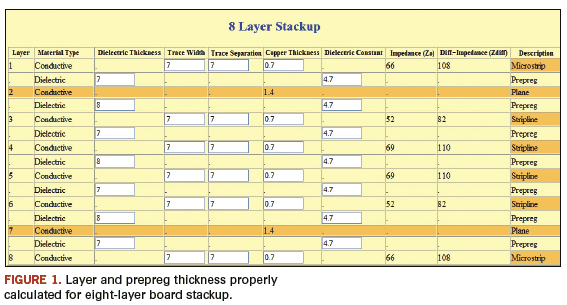

Stackup calculation is another planning aspect. Figure 1 shows the construction of an eight-layer board stackup with properly calculated layer and prepreg thickness. Stackup depends on the number of layers, the construction design, and the prepregs. It’s important to understand how a PCB’s layers and prepregs are constructed because they come in different amounts of copper. They also come in different thicknesses, and depending on the number of layers, board construction can change, thereby either increasing or decreasing yield.

When impedance control calculations are involved, the CAM engineer should work closely with design engineers.

Innerlayer registration. Buried capacitance (or buried resistance) is a technique sometimes applied when there is no available surface real estate to place passive components or when placing them creates noise that cannot be suppressed. In such instances, innerlayer registration requires special attention. Extremely thin prepregs (in the range of 0.002˝) demand careful handling. It is very hard to align such thin prepreg material during internal layer lamination process.

CAM engineers must ensure internal layers are properly registered, taking into account potential shifts occurring in layer construction. Fine-pitch devices require careful attention because they use extremely thin traces, thus posing impedance calculation issues. AOI is a solution here. AOI can check for internal shorts or opens before or even after boards are laminated, although changes after the latter are expensive.

If mechanical drills are used for holes in the range of 0.006˝ to 0.009˝, extra-fine drill bits with extremely tight tolerances are required. Also, routing issues come into play when components are stacked toward the board edge. If the tolerances are not tight, the drilled holes can encroach into other areas, possibly damaging traces or pads.

A word of caution. It’s not a good idea to stretch the technology. Put another way, a fabricator may not have the most advanced technology in-house. If outdated equipment is pushed beyond its limits, fabrication yields may decrease. For example, an older mechanical drill may be designed to form 0.008˝ holes, but the design calls for 0.005˝ holes. The situation may call for a laser drill, as mechanical drills lack the precise tolerance needed, which could result in overly large or wide drilled holes. Cutting into other traces or creating opens or shorts jeopardizes board integrity. It’s better to match the technology to the level of board fabrication complexity.

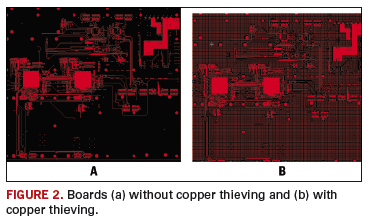

Manufacturing practices. In board fabrication, good manufacturing practices go hand-in-hand with advanced technologies. Those preventive maintenance practices are synonymous with maintaining and properly and frequently calibrating fabrication equipment and systems. Precise calibrations are critical for ensuring proper drilling, routing, etching, and maintaining plating and etching chemistries. Another best practice to increase fabrication yield is copper thieving. It is used to balance the copper on the PCB surface, making the etching uniform and thereby reducing the chances of board warpage (Figure 2).

First-article creation and inspection represents yet another important aspect that can tremendously improve fabrication yields. At the beginning stage, after CAM planning is done, the fabricator should create a first article by aligning all the drill holes with through-hole pads, creating drilling and routing files, and checking power and ground planes for opens and shorts. A first-article board is then built to make sure all the critical factors are properly addressed.

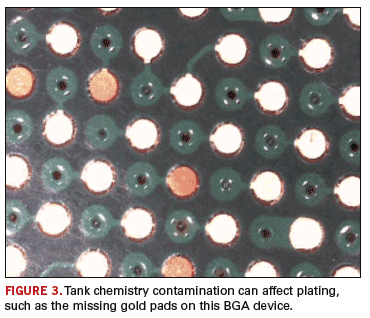

Chemistries. A fabricator has an assortment of chemical tanks. Maintaining effective chemistry balance is vital in etching tanks and plating lines. It is always a good idea for a fabricator to maintain an in-house chemical laboratory that can frequently monitor the chemistry in each bath. Some types of chemistry require checking every day – others every two to three days, depending on their processes and critical elements constituting those chemistries. Maintaining proper chemistries can boost board yield. If tank chemistries are not monitored properly, it can cause contamination, thereby creating uneven plating (Figure 3).

Finally, advanced fabrication equipment technology and preventive maintenance are inextricably intertwined; one isn’t effective without the other. Proper calibrations and maintenance are demanded when fabricators perform special builds such as countersink holes, back or stub drilling, or sequential laminations.

Zulki Khan is president and founder of Nexlogic Technologies (nexlogic.com); zk@nexlogic.com.

Could a show full of new products and a rising sun be a good omen for the industry?

We saw the sun in Munich.

For the first time in 10 years, I saw the distinct yellow rays of that giant orb in the sky break through the ubiquitous gray of the November German sky. Was it a sign? An omen? Global warming?

No, it was just good timing. But for once, scheduling the world’s largest electronics manufacturing trade show in a cold climate and on the cusp of the holiday season turned out to be a wise move.

Amid tepid expectations, Productronica turned out stronger than expected, with attendance lower than past years, but solid nonetheless. And while it clearly has become a regional (read: European) event, and several big-name suppliers opted out, and the fab side is a shell of its former self, Productronica defied gravity and the pundits to remain the mother of all trade shows.

In general, almost all the 80-plus companies we spoke to during the Nov. 10-13 show felt the corner has been turned. The capital equipment companies generally felt the bottom was last January, and reported September and October were to that point the strongest months of the year.

Across the board, the sentiment is that this year will be financially better, though there is disagreement on just how much so. Few companies reported equipment buys for capacity outside China. Perhaps more important, after a year of malaise, there is a noticeable improvement in the general outlook for 2010. The optimists far outnumbered the pessimists.

What follows are comments beyond what could be found in the company press releases leading up to the show. To review the product releases – and there were many – please visit our special web sections at http://www.circuitsassembly.com/productronica2009 and http://www.pcdandf.com/productronica2009.

Time was, Productronica was equal parts assembly and fabrication. No more. While assembly commands four-plus halls, the fab side has been reduced to a single hall. Laminate makers Isola, Arlon, Kingboard, Ventec and others were on hand, many in booths more in tune with the current market conditions and expectations for the show. Precious few machines were shown. Gone are the days when visitors could see 40 to 60 ft. plating lines in action.

David Rund, president of Taiyo America, called the show “excellent,” adding that with 80% market share in the US, Europe was the next big market for the soldermask supplier to target. He added that many attendees appeared concerned about the supply chain, and were attempting to assess their supplier’s financial viability before ordering product.

We did see a few sales made. Teknek sold a CM8 clean machine to Graphic. David Westwood will become GM of Teknek US and, with marketing manager (and wife) Jenni Westwood, will be moving to Charlotte, NC, to launch the company’s operations.

LPKF was drawing a crowd to gawk at the sharp BMW motorcycle on display, a vehicle (get it?) to highlight LPKF’s micromachining and LDS laser process that the automaker uses in a number of its products, mostly for steering control boards.

Holmüller is quickly coalescing with parent company Rena. It was a little odd not seeing Joe Kresky there, however.

Kodak rolled out Accumax, a new red-sensitive film. The company agreed that not many visitors were from outside Europe.

Staff I spoke with at Ventec, Isola and others remarked the show was smaller than in the past. Rogers added that the show was “smaller than usual, but not too bad,” estimating perhaps 20% of the attendees were from outside Europe. Interestingly, the attendees were almost all PCB manufacturers, not the OEM designers the company typically targets. John Hendricks says it could be because the visitors want to see the company’s tech support staff, and because they are now offering more high temperature products that would appeal to fabricators. The company is ending its polyimide lines because, as Hendricks said, that is “a dogfight we don’t want to be in.”

Meanwhile, Arlon was showing EP-2, its enhanced polyimide for high-speed digital applications, which features a Tg of 250°C, lower moisture absorption and lower electrical loss.

Productronica today is primarily an assembly show. The large placement companies continue to one-up each other with booths that, although toned down from previous years, still dazzled.

ASYS’s Markus Wilkens was among the many who observed the lack of attendees from Asia, although he saw several buyers from Brazil and a few from US and Mexico. The company showed the upgraded ADS automated depaneling system. It also increased the speed on its X3 printer.

Henkel Electronics global marketing manager Doug Dixon noted plenty of industry blowback to proposed legislation over so-called conflict metals (tin and other ores mined in the Congo). The industry, under the auspices of the IPC Solder Products Value Council, is readying a response. Henkel was showing a series of new die attach and Pb-free pastes.

Balver-Zinn launched the Aquasol water-soluble flux paste. Aimed at US market, it is in beta and is said to handle all alloys. Also new: a VOC flux (3960RX). The company also is working on a new no-clean paste, which will come in SnPb and Pb-free versions for pin-in-paste applications. Conductive adhesives remain on the company’s roadmap, but next up are low-VOC fluxes for Asia.

Asymtek typically has several new offerings and this year did not disappoint. The firm has upgraded the Spectrum S-920, an inline dual-jetting dispenser aimed at cellphone boards; the SC400, for jetting conformal coating; and the DispenseMate, a batch-style tabletop dispenser for UV-curable materials.

Vice president of sales Greg Wood noted business is improving and the company “can see the ice starting to melt.” Meanwhile, Asymtek parent

Nordson has hit $1 billion in overall sales and now is pushing its corporate identity on top of all the brands, a move that is being met with mixed reviews among the show attendees we spoke with.

Juki’s Heinz Schlup showed the KE-3020RL flexible mounter now in beta and due out this year. The dual head machine uses 25% less power than previous models and is rated at 17,100 cph per IPC-9850. “While the placement equipment market fell by 80% in 2009, it looks like the worst is behind us,” said Jurg Schuepbach, president of Juki Europe. However, he cautioned, large companies are not yet investing, and most won’t do so for another 12 months.

Fuji’s Scott Wischhoffer proudly displayed the NXTII placement machine, which comes with dual placement heads, one of which can be replaced with an inspection head. That head holds a single camera with three light systems, and is for higher reliability product, like pacemakers, where traceability is desired. The company will have two new machines at Apex.

Assembléon announced the integration of its pick-and-place machine interfaces into Valor’s software products. The enhanced machine interfaces now are available for Valor’s process engineering tool vPlan on Assembléon’s A-, M- and X-Series machines. The firms expect to expand the relationship to Valor’s MES tools. The company also said its rep deal with Yamaha remains intact.

Separately, Valor also exhibited DynaMix, its fully integrated MES software. The company reiterated that it will maintain its distribution and rep channel after the company’s acquisition by Mentor goes through.

Siemens’ CEO Guenter Lauber noted that business picked up in the June and July timeframe, primarily in China. Most sales are for replacement machines, although some orders have been for increased capacity, he said.

Europlacer displayed its xpii placement machine. The single- or dual-head machine features linear motors, front and rear feeders, and trolley-style or fixed bases. It can handle up to 92 feeders and places part sizes of 01005 to 50 x 50 mm.

Rehm said vapor phase machines have been outselling the general reflow market. With automotive still lead-heavy, the company feels there is plenty of room to grow. COO Marc Dalderup cited a slow improvement in business, adding 2010 could be up 10-30% from 2009.

Seho showed the PowerSelective selective soldering machine, with dual pots to facilitate changeover time. Christian Ott said the company is “completely loaded” through year-end and called the business outlook good.

KIC is pushing solutions to reduce energy use in ovens. The company has a new shield for real-time profiling of inline vapor phase machines.

Mirtec is adding laser systems to its AOI line to enhance coplanarity and improve paste measurement capability. The company reported 100% growth in 2009.

Koh Young is growing. It has added two engineers in Ireland and now claims a 35% market share in SPI worldwide. It sold its first Aspire 3-D AOI to a consumer electronics OEM in Europe, and reported a second sale was about to close with a US customer.

A somewhat new face in the field was Opro Vision, which took over Orbotech’s assembly inspection business in 2009. With the machines, it brought on several ex Orbotech staffers, including Arnon Tuval as president. It now has 19 staff, half in development, half in support. Production takes place in Italy, some by third parties. Since the buyout, Opro Vision has developed a new tabletop AOI.

Viscom was among those noting a “big” increase in sales in October. Visitors were most interested in the company’s X7056 combination AOI/AXI.

TechCon Systems’ global sales and marketing manager Brian Glass held modest expectations for the show, but said the traffic and quality of leads matched those of two years ago.

Electrolube introduced some 13 products, most of which were non-VOC flavors of conformal coatings. Customer demand is driving its push into that technology, marketing manager Karen Harrison said.

Humiseal now offers gel versions of all its coatings. It has opened a manufacturing 100,000 sq. ft., fully automated facility in Pittsburgh, PA, and noted business has been picking up since May.

Overheard

We encountered several familiar faces on the show floor. One was Keith Favre, the former Electrovert, Speedline and PhotoStencil executive, who has launched his own rep business, FHP LLC (fhpreps.com).

Ovation Products founder (and Grid-Lok inventor) Charlie Moncavage supposedly is working on a new, cheaper board support system.

R&D Technical Services sold a third vapor phase rework machine to IBM.

Mike Buetow is editor-in-chief of Circuits Assembly (circuitsassembly.com); mbuetow@upmediagroup.com.